ETF Trading Research 3/21/2017

Today’s Trades

Today was another one for the ages like last Thursday Fed day, but not as much for JNUG as for our profits in UVXY (10% and 4.91%) and LABD 10% and 11.05%) each half shares.

We were long FAZ from the entry yesterday and sold half for 7.5%, got long DWT at open for a good run and still in it, as well as TZA, SDOW, USLV and TLT.

Bought JNUG yesterday 6.80 and sold have at 7.60 today for 11.6%. Still holding half. Will buy on the dip in the morning. My reasoning for selling before the close was because dollar could not get through the 99.48 level and stay there and gold/silver fell back a bit with no follow through. It was almost a gift that JNUG stayed up at 7.60 as long as it did as I spend a good 5 minutes writing that alert out and debating on whether to lock in profit. Then I remembered my Trading Rules, haha.

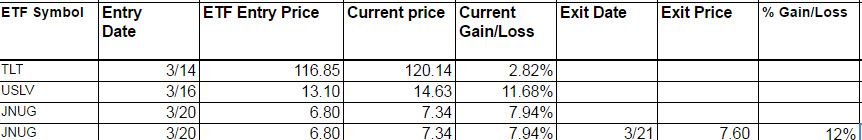

Current position entries and closing prices;

TLT 116.86 – 120.14

USLV 13.10 – 14.63

JNUG 1/2 6.80 – 7.37

FAZ 1/2 18.39 – 19.93

DWT 29.73 – 31.35

TZA 18.75 – 19.65

SDOW 34.69 – 35.10

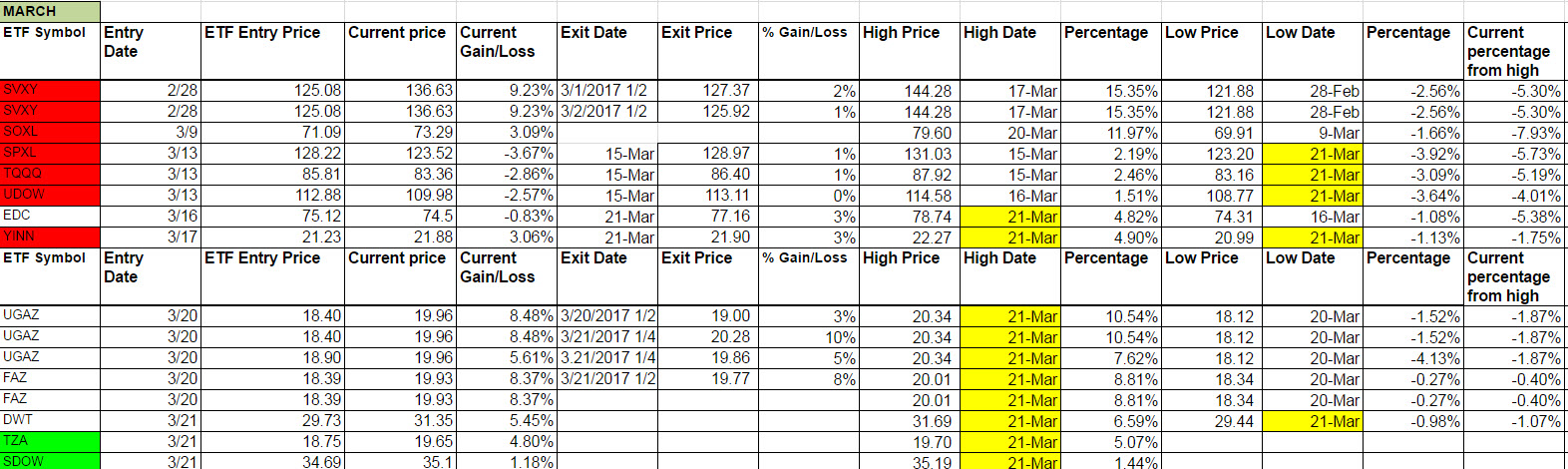

Current non-green weekly positions and gain/loss – profit taken:

Stopped out of the following with profit;

EDC 75.12 sold 77.16

YINN 21.23 sold 21.90

UGAZ we entered yesterday 18.40 and 18.90 and out 20.28 and 19.86 this morning.

Love gold and miners overall still. Dollar under 99.48 is what’s needed for the run.

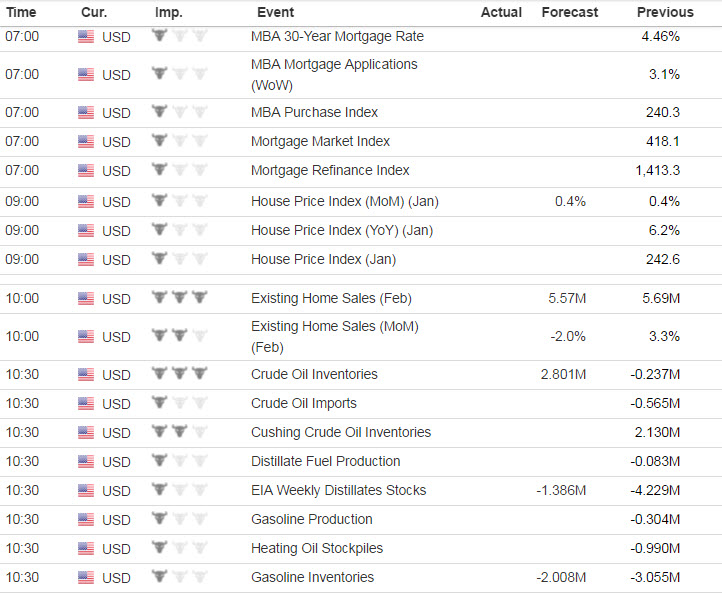

Economic Data for Tomorrow

Tomorrow we have Existing Home Sales and Crude Oil Inventories as the major data. Interesting how the forecasts are even negative for MoM Existing Home Sales. No matter how you slice it, if we do get bad data now this market is ripe for a big fall.

http://www.investing.com/economic-calendar/

Stock Market

Yesterday I said the following; “This market has a good ways to fall and FAZ triggering along with TLT rising is giving me more and more reason to get short the market. That and 2 days in a row our green ETFs that are long the market have hit lower highs.” Today we got the follow through and we may be just getting started. That said, part of the reasoning was what looks to be the new healthcare and the repeal of Obamacare having issues and thus delaying even further any planned tax cuts. The markets didn’t like that. But we had to take profit per the rules and we’ll be happy to get back in as well as this fall could still have a ways to go. In taking profit per the rules I am doing a few things here that may or may not make sense to you. Since we have new trades coming all the time when we hit the green weekly’s, I want to look at those as better opportunities for profit so locking in that profit on some that have benefited from a big move and using some of that capital for new trades is what makes sense. We’ll still always look at the higher flyers like LABD and UVXY to go long though, but they have not triggered green on the weekly. UVXY also fell back a bit after we took the profit.

Foreign Markets

EDC and YINN gapped up this morning and before I could look at the Trading Rules for when to take profit, they started to fall and I got us out with 3% profit. They eventually went negative for the day and YINN even turned red on the weekly. That didn’t last long but we did profit. Some of you took the opposite side when I first mentioned them by trading YANG and EDZ. It’s a little more risky but if I am calling us out of one, it typically means the other side is an option. Just so happens today there were many options.

Interest Rates

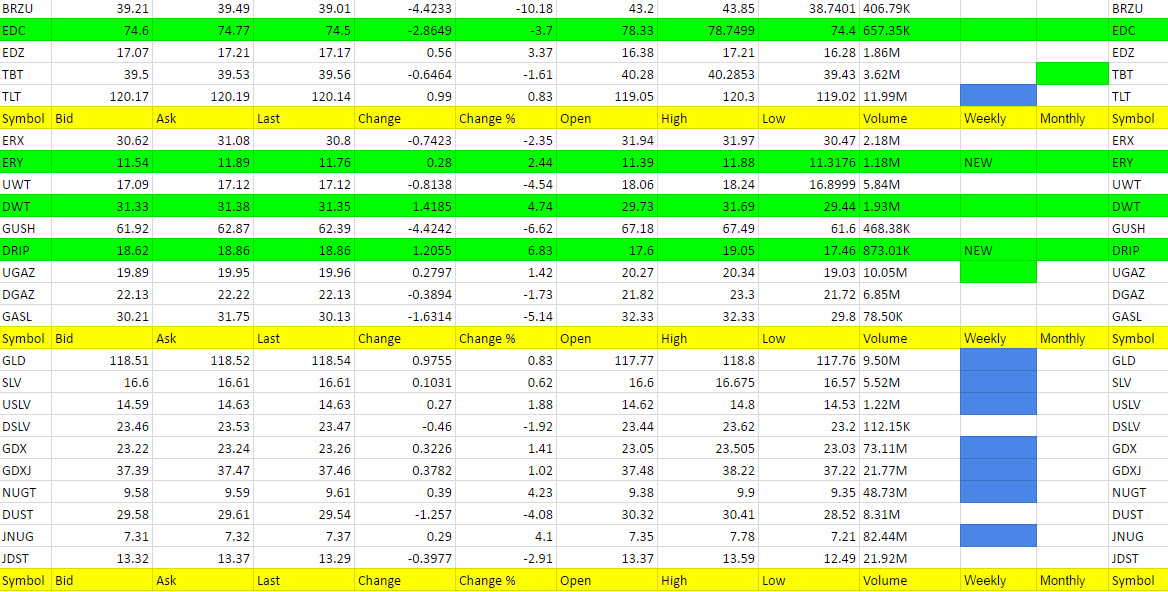

TLT looking good and over 120 now. A point a day isn’t bad but this one is somewhat ignored in favor of the high flyers.

Energy

DWT gapped down and gave us a better entry for the long at the open and we are up presently on the trade. Watch out for the oil report tomorrow though and if you are up on DWT it may make sense to either sell half or all before the data. Why risk?

I was very unhappy with the email alert glitch that didn’t get more of you in UGAZ yesterday, but those who had 1/2 shares came out well. Decided to lock in the profit on it as I saw better opportunities elsewhere.

Precious Metals and Mining Stocks

Loved how JNUG played in the morning but the rest of the day the dollar couldn’t push below the 99.48 level and stay there and that is the reason why I took 1/2 off the profitable JNUG trade. JNUG did fall 3.42% from that level to 7.34 and we’ll look to buy there or lower in the morning the 1/2 shares back. You don’t need me to tell you to do this. Take advantage of the dip but first glance over to that darn dollar and see if it is behaving well (lower).

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

LABD, TZA, UVXY, SOXS, DRIP, FAZ, BIS, JNUG, NUGT, DWT, SQQQ, SPXS, SDOW, EDZ, YANG (TZA and SDOW turned green on the weekly. Late note: BIS did too but I did not add it to the list below. Please include it at the open price tomorrow).

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

LABU, BRZU, TNA, SOXL, FAS, GUSH, BIB, GASL, DUST, TQQQ, UWT, JDST, SVXY, SPXL, EDC, UDOW, YINN

Green Weekly’s

NOTE: I did not include BIS in the green weekly below but should have. Buy at the open tomorrow. TZA and SDOW turned green on the weekly. We are in both of them but I still think can be buys at the open in the morning.