ETF Trading Research 3/20/2017

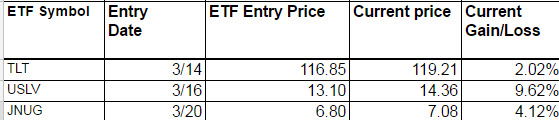

Today’s Trades

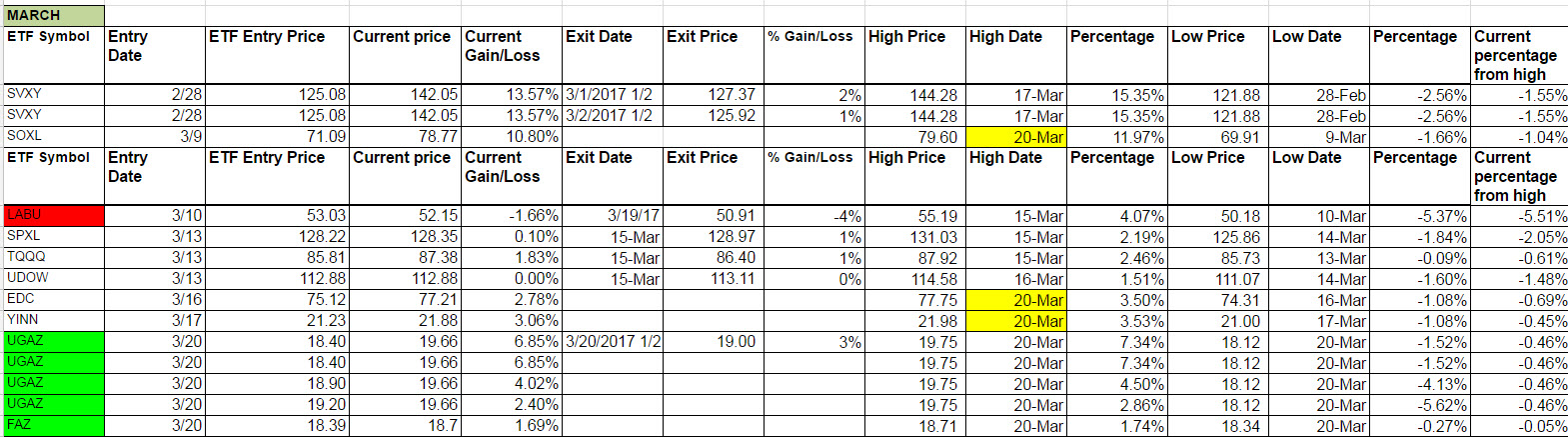

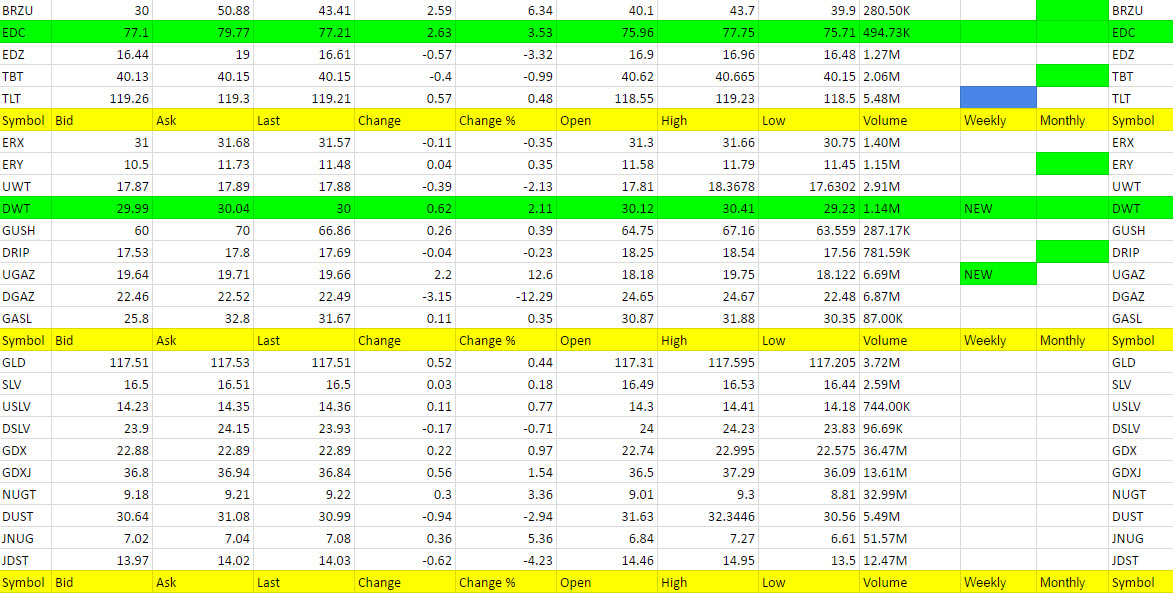

We stopped out of JNUG and tried a scalp in JDST but not much to gain. JDST only gave the scalpers a good show (it was called a scalp only as I am still very bullish gold). Got long JNUG again at 6.80 and still holding. I said the real show was in UGAZ which we got long at 17.40, sold 1/2 at 19, got long and stayed long for any new traders at 18.90 1/2 shares and 19.20 other half shares (everyone else still holding 1/2 shares from 18.40). Still holding all shares at current price of 19.70.

Tried a quick trade of DWT in the morning and stopped out for small loss of -1.05%.

Got long FAZ at 18.39 closed 18.70.

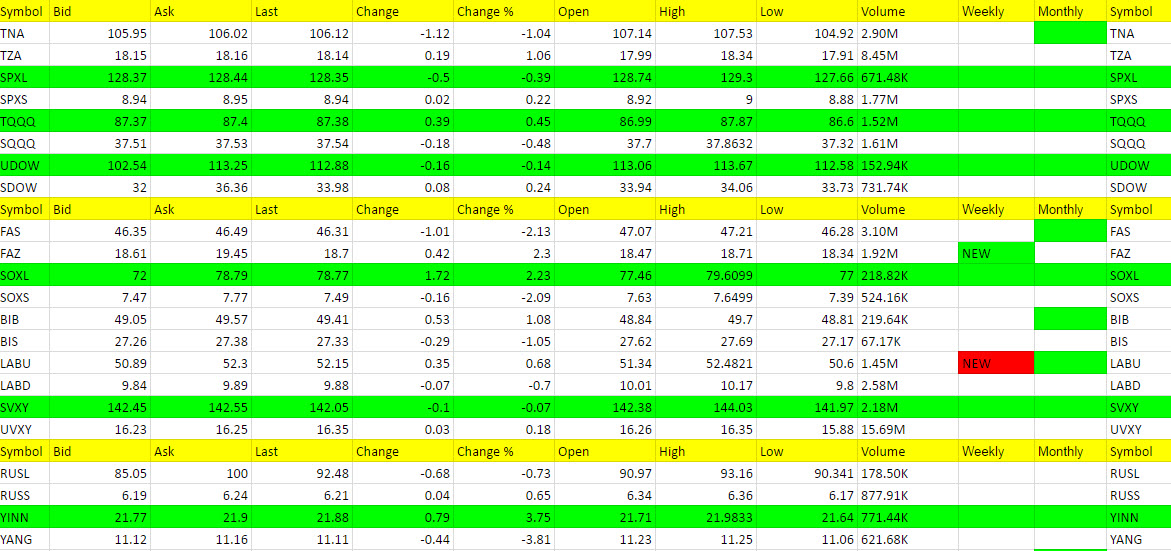

Still holding the green weekly’s below which were up nicely like EDC and YINN and holding the following which are not green weekly’s but doing well for us.

Dollar needs to break 100.03 now then 99.48 for JNUG and gold to take off. Same with USLV.

Market makers started off the day playing some leftover St. Patrick’s day Lucky Charm tricks on us but we fought through it and came out well. Gold just needs to get its act together and the dollar take a bit more of a tumble and we’ll get JNUG to a swing trade. It’s not there yet but I definitely can feel something brewing except for that darn dollar. Overnight action might get us there finally.

On a side note, the Trump Effect seems to be dwindling. Ratings are lower and I think the Trump trade is hanging on by a thread, or a tweet. Because FAZ triggered today it gave me what I need to have more confidence as it now is in alignment with TLT moving higher. Lower rates and weak financials. What’s up Ms. Yellen?

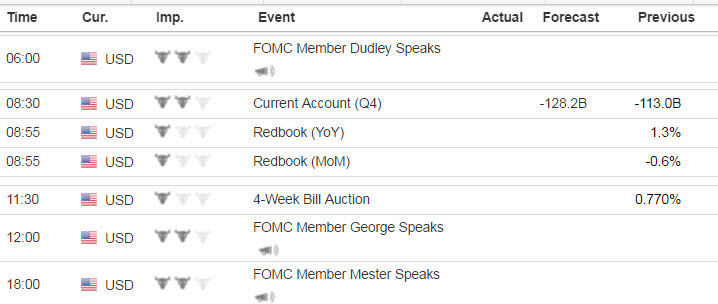

Economic Data for Tomorrow

Nothing important for data tomorrow but 3 Fed members speaking and they can move the markets a bit like one did today.

http://www.investing.com/economic-calendar/

Stock Market

We had a big spike down but a big spike back up in futures but overall the DOW didn’t do much today. Whether it was Comey talking about Russia and Trump, or the fact Trumps approval ratings came in low, it doesn’t matter. This market has a good ways to fall and FAZ triggering along with TLT rising is giving me more and more reason to get short the market. That and 2 days in a row our green ETFs that are long the market have hit lower highs, except for SOXL which hit a new high. Also, having got 10% from SOXL, I would be exiting the trade if for some reason you stuck through it.

Foreign Markets

EDC and YINN finally got going today. We’ll keep moving our stops up on them but look to be taking profit on 1/2 shares at the levels listed in the Trading Rules.

Interest Rates

TLT looking good and over 119 now.

Energy

DWT gapped up too high and we did try a stab at it but it pulled back and never took off again. This move higher did trigger it long on the weekly but I will caution you on this long since we are getting both sides of the oil trade on OPEC comments and I view this trade a a bit higher risk. That said, we will attempt a buy at the open tomorrow because a trend has once again been established after a one day hiatus. I will keep a closer eye on it.

Yesterday I had this to say about Nat Gas; “Something should change here soon and get us a trade and I’ll pay closer attention to them tomorrow now that oil is a tougher call.” Today we got our answer in UGAZ taking off for us. We’ll look at getting to our profit goals now for taking 1/2 off per the Trading Rules.

Precious Metals and Mining Stocks

Today I had us add 3 cents below what turned out to be the morning high and we stopped out on those 1/2 shares -5% and got out flat on our original shares. But we got back in JNUG and rode it from 6.80 to 7.23 or 6.32% and settled at the close up 4.11%. We can expect some volatility until we turn green on the weekly but I like the fact that gold did move up a bit at the end of the day with JNUG considering the dollar was up a bit. We still have the dollar up 2 cents to 100.16 in Asian trading with gold +.30 to 1234.40 and silver +.01 to 17.43. Perhaps we get a move higher overnight for once that sticks and we’re off to “green” pasture’s.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UGAZ, JNUG, BRZU, EDC, YINN, NUGT (UGAZ and FAZ turned green on the weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, JDST, YANG, EDZ, DUST (LABU turned red on the weekly)

Green Weekly’s

UGAZ and FAZ are 2 new green weekly’s we bought today. I have 4 different entries for UGAZ because we were already long from 18.40 and had scalped some by 19 so some of you were still carrying shares from 18.40. Then I made the call to hold at 18.90 for 1/2 shares and 19.20 for the remaining half as a long green weekly had triggered.