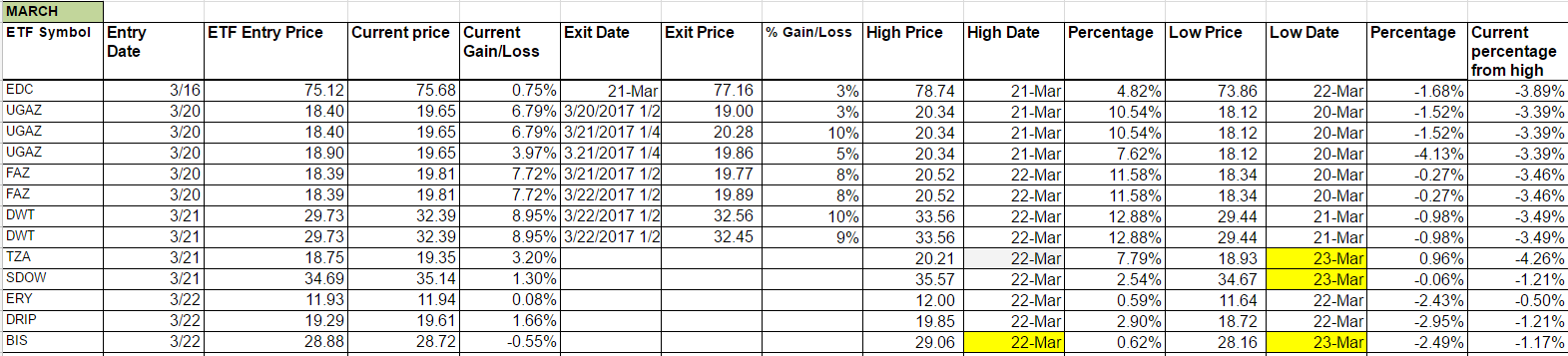

ETF Trading Research 3/23/2017

Today’s Trades

Won’t be a full analysis today as I am traveling and having internet issues overall but today’s alerts I had plenty of time to give you some good insight. Frustrating but in reality nothing has changed from yesterday. No new green or reds. Called the markets and metals overall good today considering the oddity of JNUG. We kept stops. Scalped the opposite with JDST. Tried a few other trades and got some from LABD. DWT flat. Sold some short the market ETFs for profit and bought them back lower and are up (TZA, FAZ and SDOW). Congress never gets it right and that I used to our favor as I didn’t believe the run up for the market (futures). Also I didn’t believe the move down in JNUG and we stopped out but are now long lower and up. Unfortunately jury still out with metals. Feel good overall still. When I do that we are on cue for profits and some good ones. When I don’t, then I have to fight for profits and I dig deep and fight hard.

I take any losses on bad calls personally and continually challenge myself as to why I acted the way I did. You should too.

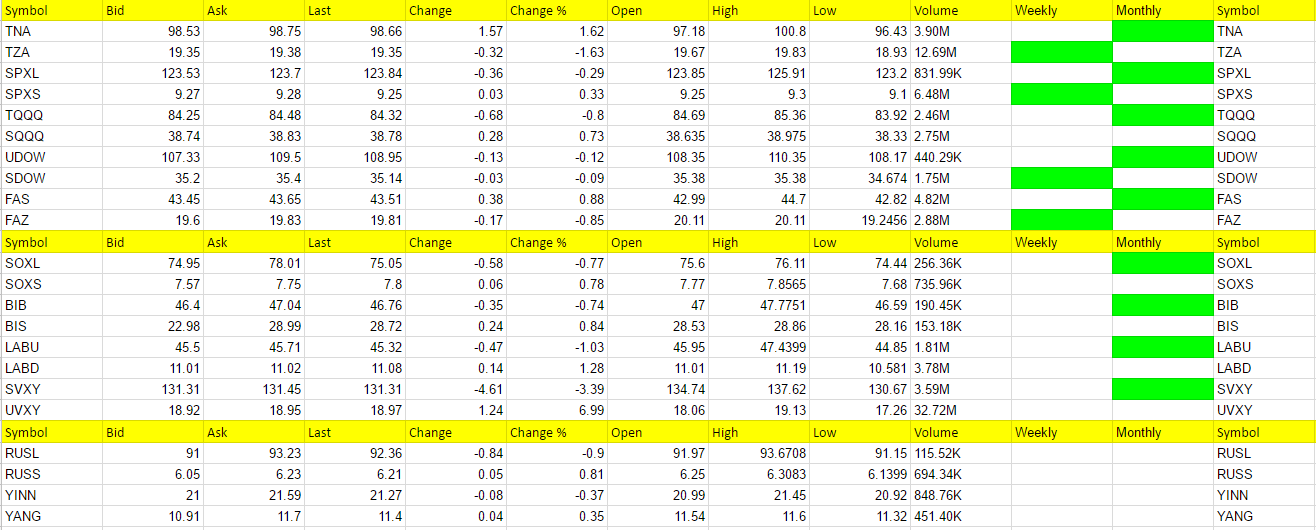

But I will say, as one subscriber wrote me today to tell new subscribers. Pay attention to the Green Weekly’s. And take profit and control the losses which are FEWER with Green Weekly’s. Simple as that.

If you are trading JNUG and JDST then you are gambling more than trend trading and you accept the good with the bad. When JNUG finally hits green on the weekly, hold on tight as it will be a fun ride. Which leads me to the question, why do I concentrate on JNUG/JDST so much? It’s because most of you trade it. That’s why. We are one sided with our thinking sometimes and I am VERY happy to see some of you open up to other trades on the Green Weekly. You’ll be happy when you expand your horizons, but I will still try and micro mange JNUG/JDST the best I can.

We stopped out of FAZ, TZA, SDOW, TLT all with profit. We got back in FAZ, TZA, SDOW and are sitting in profit. I can’t figure out BIS and any other green weekly’s from yesterday but suffice to say we didn’t get hurt much.

You may notice my aggressiveness a bit more today. I don’t normally buy dips like I did in JNUG, but I have seen enough charts and price moves with spikes to know when I feel comfortable with a buy. Today’s drop in JNUG, again, was uncalled for. Doesn’t mean we will make money with the trade but the risk/reward I think is with us.

Economic Data for Tomorrow

Housing data came in way better than expected and that is why I got us out of the remaining short the market trades. You will recall yesterday and before we got out of some with decent profit. The Trading Rules work. We hit our goals and lock in profit, like with FAZ, and then wait for a better entry if we get a pullback and it is still green, which we did. I truly believe I am getting this service to be better because of the extra research involved, and more of you are seeing the green weekly’s as the key, but once we turn green and profit, like we did with DWT in the last week a few times, you also notice that a trade gets tired and the profit is harder to come by. Hence getting out flat in DWT today. I do think UWT will be the call here soon. We’ll see.

Economic Data For Tomorrow

No real news on Yellen, but we did see the failure of Congress to agree on healthcare and we took advantage of it. Tomorrow nothing big but a couple Fed members and Oil Rig Count later along with PMI.

http://www.investing.com/economic-calendar/

Stock Market

After a churn day we saw the markets shoot higher with the good housing data. Don’t believe the data one bit. Consumers, as I said in an alert, are the last to know what’s going on and will always follow the crowd. We trade ahead of the crowd. We may scalp a move higher but as one subscriber wrote me today, I have to explain something here. I do not always lean lower. I know I have in the past but we are more and more following price action. I can make some micro assumptions based on what I read (and I constantly read a lot) and that is what helps me cut out the “noisy” stuff as Yellen put it, but she gets it wrong. She says GDP is “noisy” and I say we are on the cusp of a serious downturn and no one at the Fed or CNBC has a clue. We’ll see what tomorrow brings since Congress couldn’t get their act together and do anything today but push off the vote.

Feel free on your own, always, to lock in your own profit. I don’t need to tell you to do that. Know your own personal goals. Always be locking in profit and know you can start a new trade and let go of the EMOTION.

Foreign Markets

Holding off on calls here because of the volatility. These are some of the best trades to profit from quickly once they turn green on the weekly. Always have them on your radar. VERY predictable once they turn green on the weekly.

Interest Rates

Stopped out of TLT with decent profit and will be buying again.

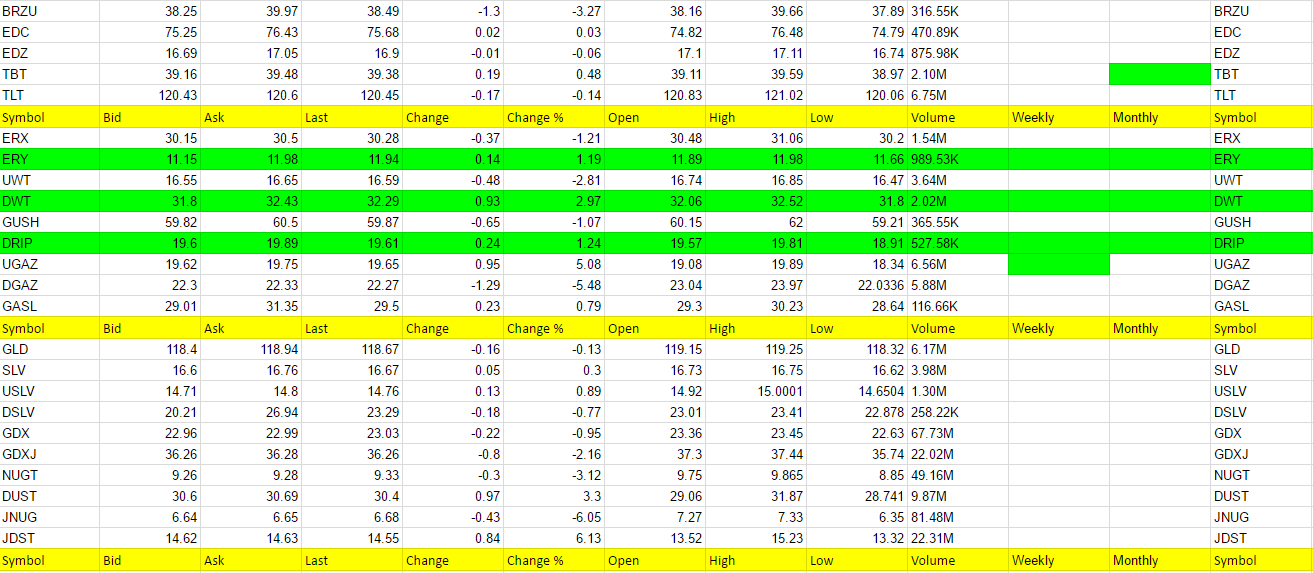

Energy

Flat trade on DWT and we very well might be turning to UWT soon.

Nat Gas data was flat and no trades in these today.

Precious Metals and Mining Stocks

Very frustrating to us what happened today in JNUG. I wish more of you would tell me you sold JNUG at 7 and bought some of the JDST trades, and then bout JNUG at 6.50. Right or wrong, I like JNUG but unless we get the dollar to fall below and stay below 99.48, then we are simply gambling because there is no green weekly indicator. When it comes, as I said above, be ready to load up. And I mean that in a BIG way.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UGAZ, DUST, JDST, UVXY

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, JNUG, BRZU, SVZY, NUGT

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too.

We got out of all but JNUG, TZA, FAZ, SDOW, USLV. Might have missed a good trade in UVXY today.