ETF Trading Research 3/22/2017

Today’s Trades

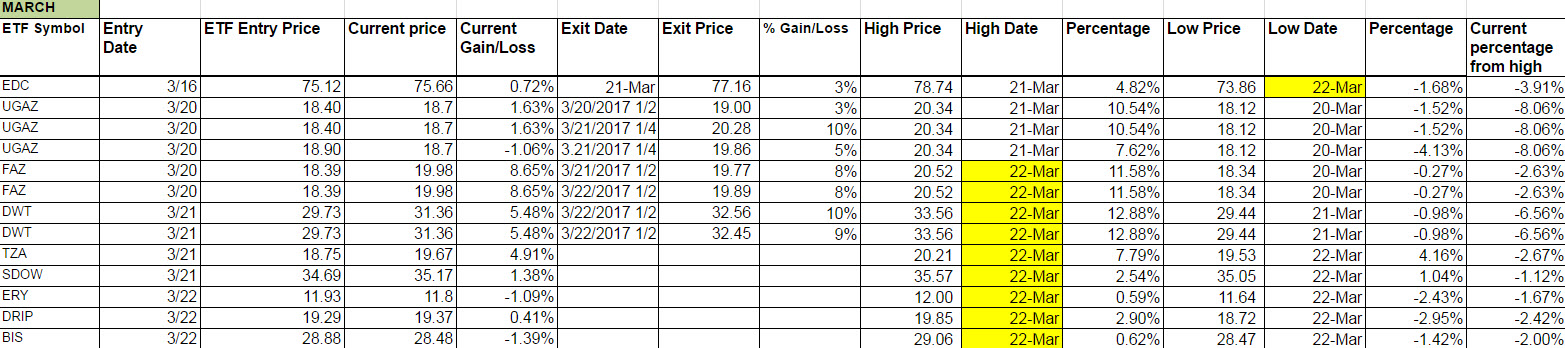

They were nothing like yesterday’s trades. I spent most of the day trying to explain what I saw happening with market makers and in a sense trying to scare you from trading but it should have scared me from making any calls as well. We did close out some profitable trades in FAZ 1/2 shares for 8%, DWT 1/2 shares for 10% and 9% pre-market, but made some other stabs at LABD, DWT and DGAZ that didn’t pan out. Got long JNUG after trying to talk myself out of it in the morning. Missed by a few pennies. And tried JDST a couple times for small losses. I’ll take some small loss days when locking in big profits surrounding it. Tomorrow should definitely be a less choppy trading day. If you made money today as a trader, congratulate yourself. TZA and SDOW actually closed a hair higher. The other new green ETFs I must have had some sort of a slip to not include them in the Green Weekly report or a lucky premonition as none of them were positive today. They were BIS, ERY and DRIP. Perhaps we got lucky there, I don’t know. But tomorrow I would be buying them if they are opening higher. The new DWT attempts after the morning locking in of profit and after the report I thought would do better as we were green weekly and with the build in oil storage, but today was a Seinfeld episode opposite day where nothing went the same direction as yesterday for the most part. Tomorrow we should still look at DWT for an entry. See below for gold.

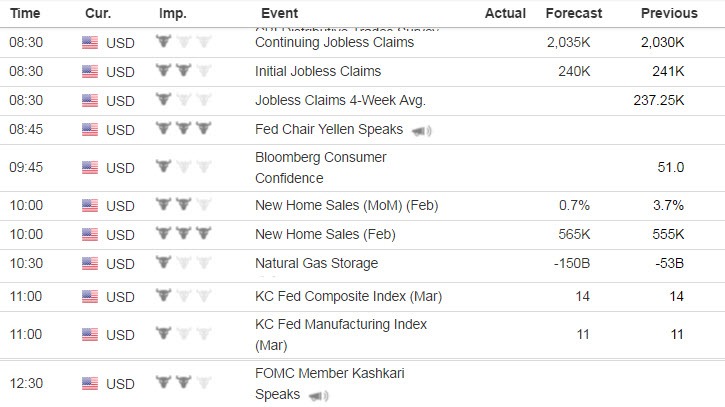

Economic Data for Tomorrow

Housing data came in lousy and market makers had already made up their mind what they were going to do with the market.

Initial Jobless claims tomorrow and New Home Sales but most importantly the Fed’s Yellen is speaking at 8:45. Be on your toes.

http://www.investing.com/economic-calendar/

Stock Market

Today was just a churn day and the data was bad. Nothing more. We are still weak in the market and the trends are still intact as TZA and SDOW showed. We’ll look to get back in FAZ tomorrow.

Foreign Markets

EDC is still green and went a little higher today. Not a lot of faith in it but we should keep an eye on it.

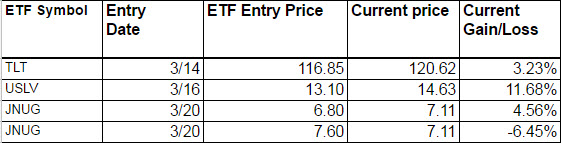

Interest Rates

TLT moved up higher again.

Energy

DWT we took the money and ran on a gap up this morning. Very surprised about the move lower after the report but it was a professional’s day. Opposites.

DGAZ no real follow through and UGAZ still green on the weekly but ignored with DGAZ up.

Precious Metals and Mining Stocks

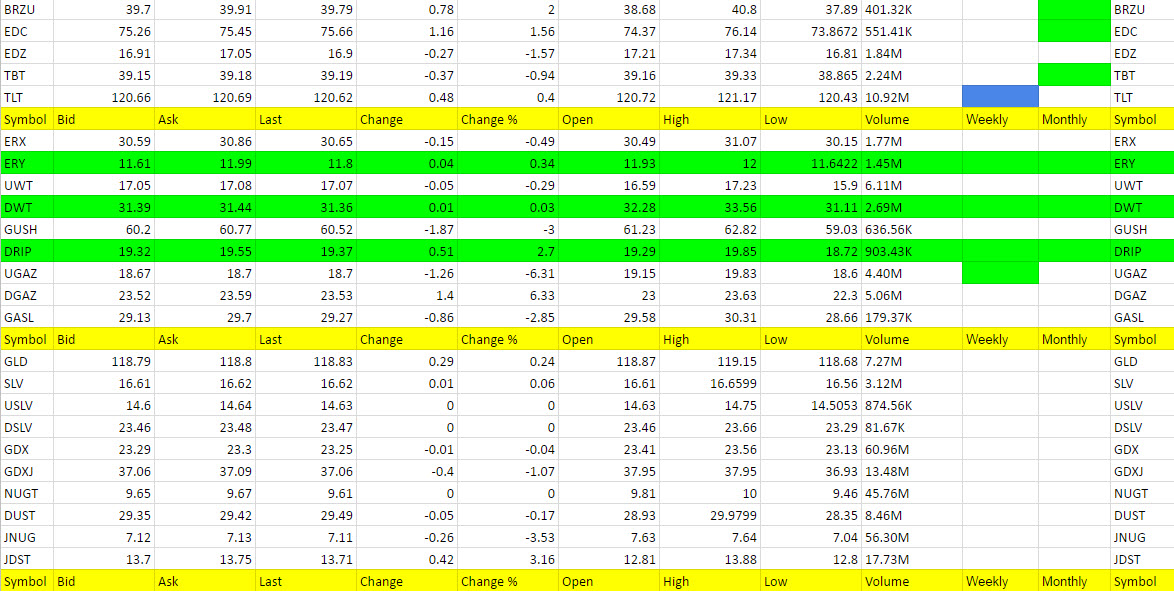

Dollar did what we wanted. Gold did what we wanted. The stars were aligned but JNUG didn’t want to play ball. I think it will here shortly. Might get a dip lower in the morning and then soon I think blast off. Normally I keep a stop and it was a tough decision at the end of the day to hold the additional 1/2 shares which we were down on. I will make note of one thing that we and I should keep a closer eye on. Whenever we have the Hot Corner below show up with a bold highlight as JNUG and NUGT did below, we need to be a little more cautious. I have seen them go bold for a maximum of 3 days and this was only two. But 3 days is rare. These are some new patterns I am noticing to help you make better decisions, so look for them (it also means on the other side that JDST and DUST would have been good potential longs). See yesterday’s report to know what I am talking about.

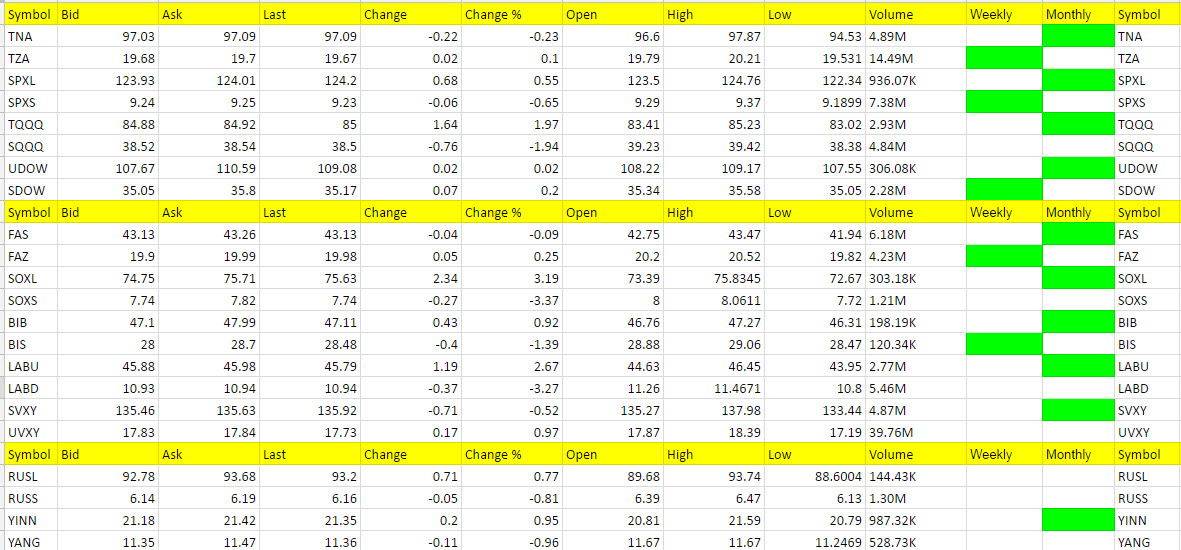

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DGAZ, SOXL

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UGAZ, SOXS, LABD

Today’s Non-Green Positions status including new entry into JNUG (we closed out 1/2 position yesterday for 12%)

Green Weekly’s – These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too.