ETF Trading Research 3/27/2017

Interesting story for gold bugs; https://mobile.nytimes.com/2017/03/27/world/europe/gold-coin-berlin-stolen.html?emc=edit_tnt_20170327&nlid=59528101&tntemail0=y&_r=0&referer=android-app://com.google.android.gm

221 pounds isn’t easy to maneuver I’m guessing.

Today’s Trades

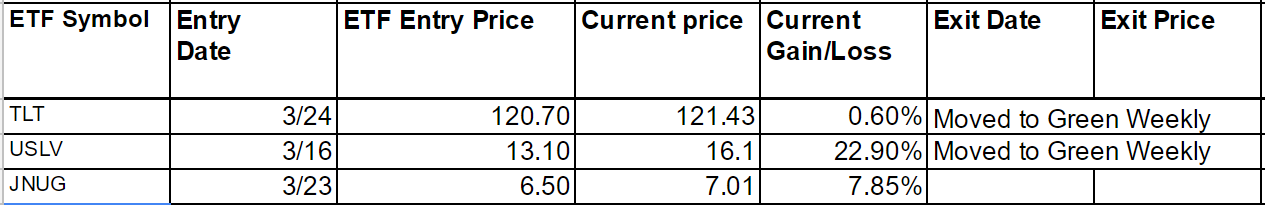

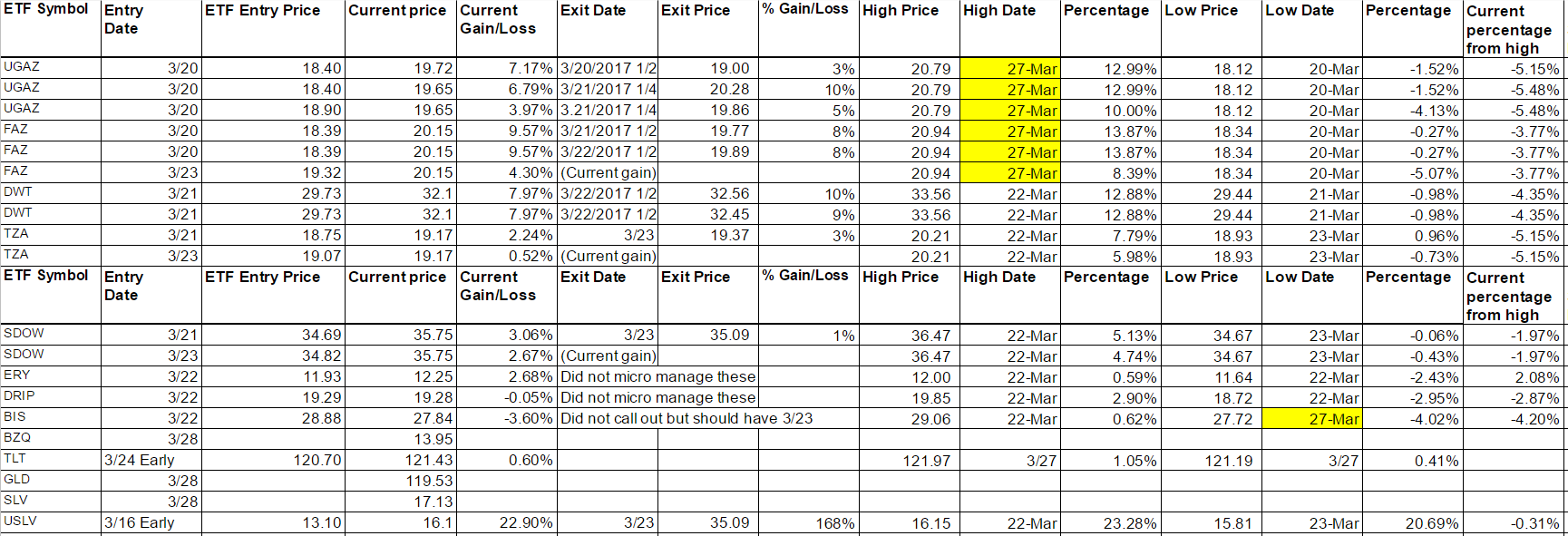

The day started out with everything in a “too good to be true mode” and I tried early and often to say we don’t move in straight lines and for Conservative traders to sell if your personal goals are met. The tendency for many of us though is to hold through thick and thin. But I will warn you in advance, at some point gold will reverse again and so will JNUG and it will be wicked. If we turn green on JNUG and we alreday have on USLV, please be out completely of all your longs if we go red again after we move past $1,300 in gold. Before that we first have to of course hit green on the weekly for JNUG. Last time up was a lot faster and smoother. This time we are working for our profits, but we are still profitable on our last entry. It went lower and bounced back to 7 which is nice too.

We had a couple failed attempts at UVXY and got long UWT which we are up. In fact, it is up to 16.72 after hours. We may have turned the corner.

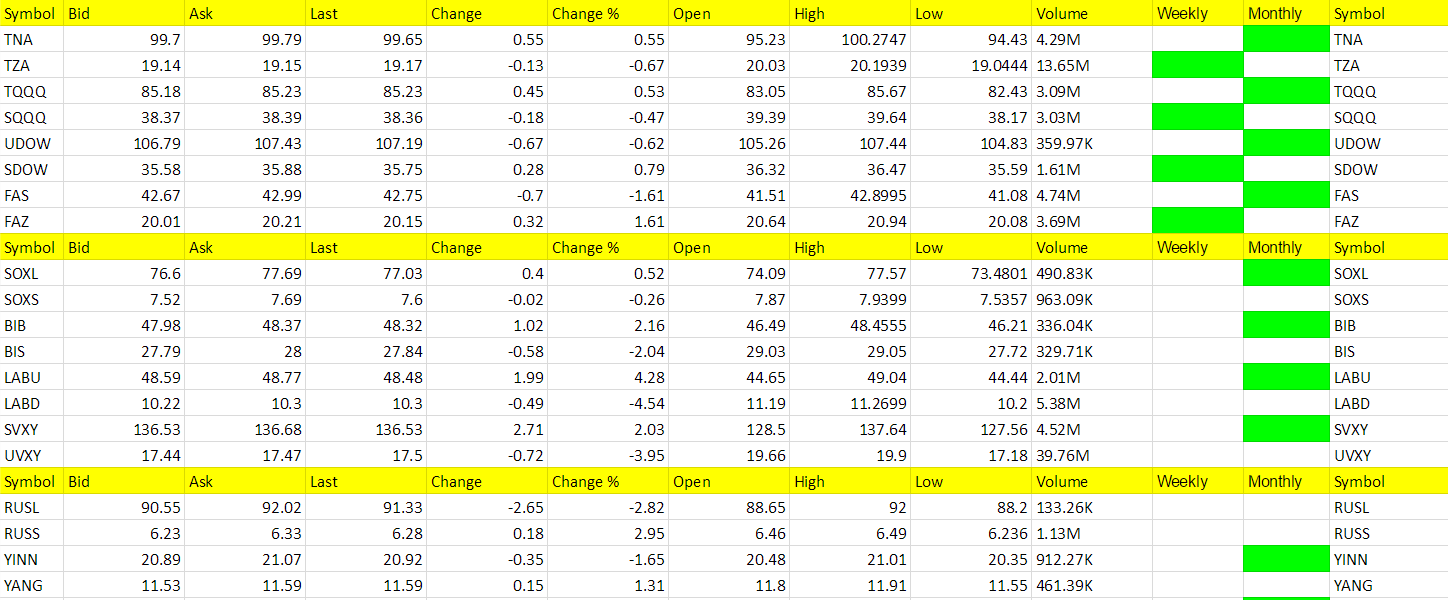

I called a couple longs in YANG and RUSS that were more risky not having hit green on the weekly yet, but they can pay off big for us if the markets continue south.

I added a new trade in UGLD as GLD has triggered green on the weekly and I wanted conservative traders to have some exposure to a slow moving positive trade in gold that was leveraged, assuming green weekly’s do what they are supposed to.

I have added a new ETF to the list besides UGLD and that is a 2X BZQ short Brazil since there is not active 3X. The volume on it is a little more than DSLV and you should use limit orders only to trade it.

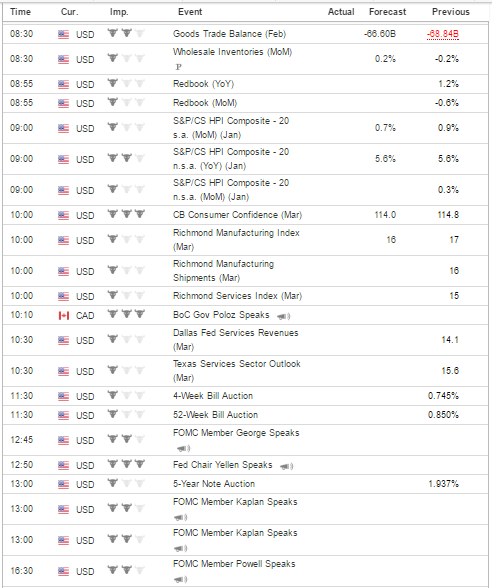

Economic Data For Tomorrow

Tomorrow there is a lot of data and capped off by many Fed members speaking including Chairwoman Janet Yellen.

http://www.investing.com/economic-calendar/

Stock Market

Markets are weak and the DOW is 8 days into a losing streak, the longest in almost 6 years. Nothing goes straight down and I tried to emphasize this in holding onto some profitable trades, but I am a little greedy in that the trend is still with us. I decided to go to UWT and was patient in making a call and finally did.

Foreign Markets

Got a little aggressive with YANG and RUSS. I prefer you wait until green weekly’s on these for a better opportunity but I have hit these early before. YANG was 17 not too long ago and ready for a breakout. The fact that YINN is no longer green makes me want to own YANG more.

Interest Rates

Still long TLT which was up again today knocking on 122.

Energy

Oil is a long and I know I am a bit early, and with that we might see some volatility. But with the dollar falling I think we can get a good trade in. Maybe we had good timing but technically we will scalp.

Precious Metals and Mining Stocks

I did continue to have confidence in JNUG which so far has paid off. We didn’t look at JDST once. I personally didn’t even look at it. USLV or silver is leading gold higher at this point. Love the price action in silver. Dollar is lower. Gold and silver higher. What’s not to like? We are just getting started I think here. But we will still take 10% off on USLV now that it has turned green on the weekly. The profit of 22% or so we have had is just gravy for us and we’ll take it since we took the risk early and got rewarded now.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

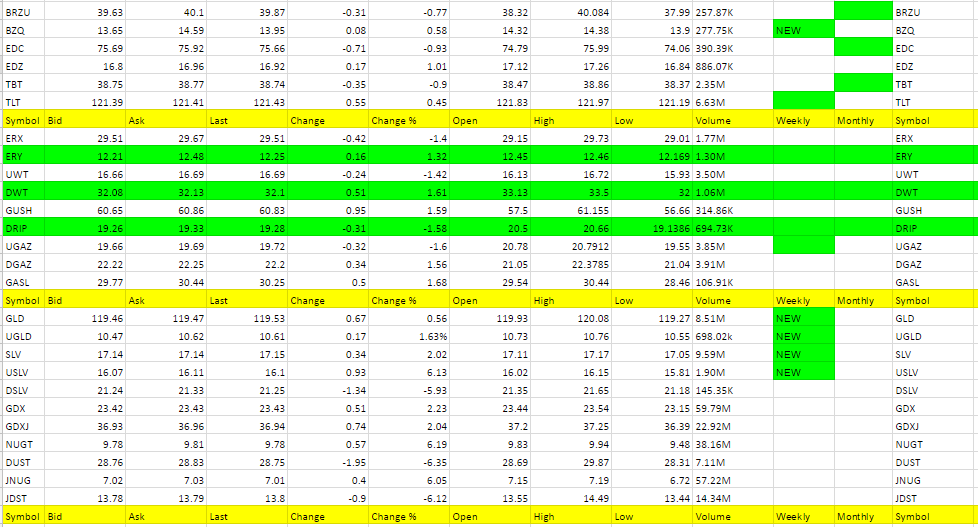

NUGT, USLV, JNUG, LABU (GLD, UGLD, SLV and BZQ turned green on the weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UVXY, LABD, DSLV, JDST, DUST

Current Non-Weekly Green Trades We Are In

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

The following table includes the re-entry into FAZ, TZA and SDOW last Thursday and TLT again last Friday.