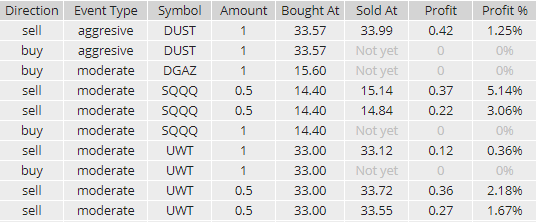

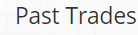

Got some good trades in UWT, SQQQ and DUST and missed a home run in TVIX because of a technical glitch where I put the trade on and it didn’t connect. That said, SQQQ was a good mover and I did say TVIX over 53 short the market and under 53 long the market. Could have got more out of today but overall we have a 4 day winning streak going of taking profit with minimal risk.

News is what they say killed the market today. U.S. plans more China tariffs if Trump-Xi meeting fails: Bloomberg

Many times with news it is blown over quickly, so some longs may be on the horizon tomorrow. If you are able to swing trade this kind of market and sit through the moves up to get more on the downside, more power to you. The news helped the shorts today. I still see 2880 break for us in /ES on the horizon and would rather swing trade that coming up here soon, if I had to swing trade anything.

Economic Data For Tomorrow

Consumer spending was flat and personal income lower. Tomorrow we have consumer confidence. My guess is it is declining.

http://www.investing.com/economic-calendar/

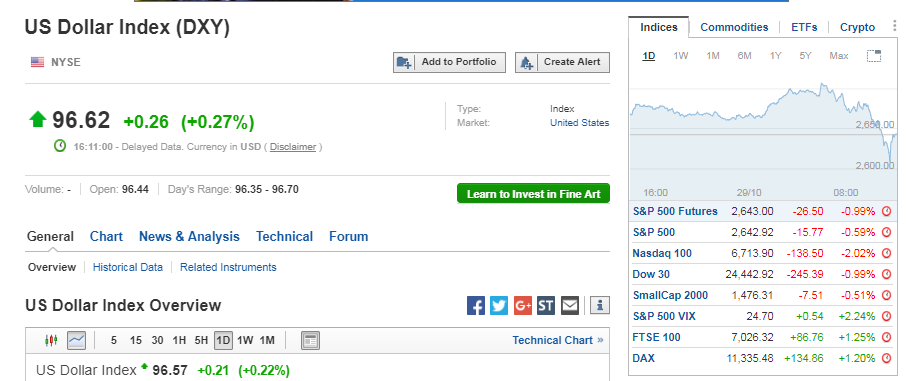

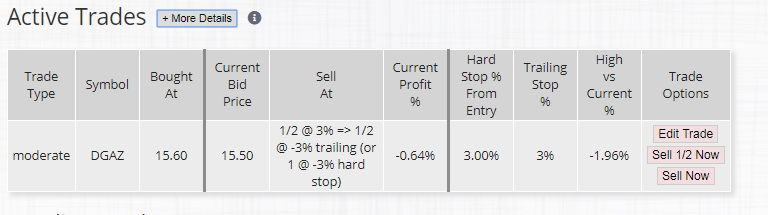

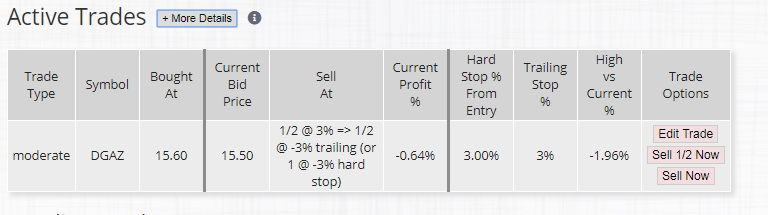

Today started out with the big move up and trapped all the bulls and the rug was pulled and at one point we were down 500 point in the DOW to complete an 800 point swing. That’s pretty amazing in and of itself. We saw /ES fall below the support area of the morning and then continue to fall all the way until just before the close. While we did catch some of it I missed the entry for TVIX at 51.20 and sure wish my system caught it. Still, SQQQ gave us some nice profit and I got conservative and went to DUST which we got 1% from and DGAZ we bought the dip on it and just under flat after hours here at 15.50 bid.

We have to see how overnight selling comes in and one way or another find a spot to flip to long when it presents itself. I prefer we break 2600 and test lower but that 2600 level is a pretty powerful support level it seems. TVIX fell 5.5 points from the high on that bounce.

Foreign Markets

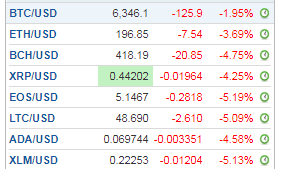

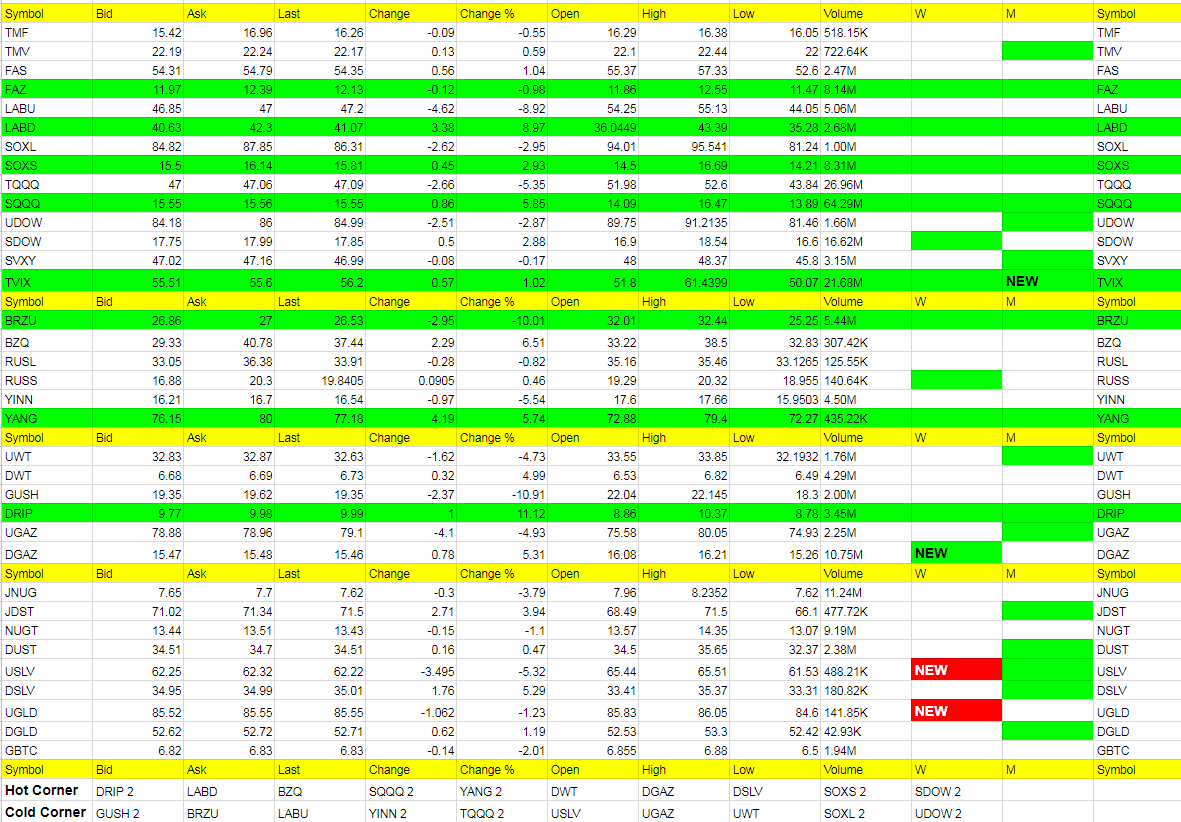

Last night I said about Foreign ETFs, “any moves up then YANG and RUSS and BZQ come into play. If/when U.S. futures move south, these will benefit.” BRZU was up 15% pre-market and fell 25% to end up -10.01%. Now that’s a move. Once any of these 3 short the market ETFs went positive, they would have been worth a shot. BZQ ended up 6.51%, YANG 5.74% and RUSS barely positive. YINN had a nice pop with the U.S. markets after 2603 was hit in /ES. These are all trading with U.S. markets and offer a little more bang for your buck. That said, I wouldn’t take them home as the volatility is too great.

Interest Rates

On a day where markets got hit hard, TMF couldn’t find a bid and was flat today. That tells me real money wasn’t shorting this market but just market makers whipping things around. Real money goes to TMF if there was a real bloodbath going on. Something to think about tomorrow. Look over to see what TMF is doing and then if the market is selling off and TMF rising to see if the sell off is real. If not, then we may buy the market on a downturn.

Before we started popping higher in DGAZ, last night I said; “DGAZ may be the trade of the day tomorrow.” It was early on but most of the move came pre-market. We did wait for a pullback and got long as it signaled us to do so. 3.20 is a resistance area now for nat gas and we’ll see if we can push towards 3.10 again. Through 3.20 though, and 3.32 is next stop. We are getting a little bounce to our buy price after hours. Current bid is 15.51 a penny under.

For oil, here is what I wrote yesterday on UWT; “UWT we should be in buy the dip mode now. GUSH hasn’t triggered yet but we should be getting long UWT again on Monday. But if the market does want to go south, we will have to keep a tight stop if oil goes south with it. That has been the pattern. But first long signal in awhile.” We did get two positive trades out of UWT today and then the stock market fell apart. Could have jumped on DWT as we saw UWT end up the day down about -5%.

Precious Metals and Mining Stocks

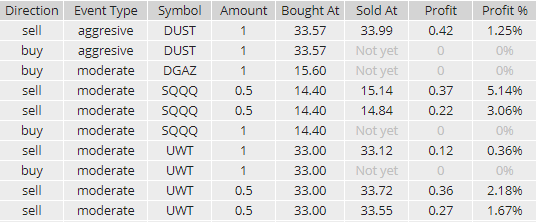

Last night I said; “DUST is still looking like the way to go here. We should see USLV and UGLD turn south here soon as well.” We got the sell signal on USLV and UGLD today and I posted it and we got in DUST for a trade and profited. We are going to keep trading these south for now but look for a spot to buy JNUG and NUGT at some point. Still looking at the dollar to get to 97/98 and possibly higher. 1219 is support on gold. Might get a long around there but below there, south we go.

![]()