For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

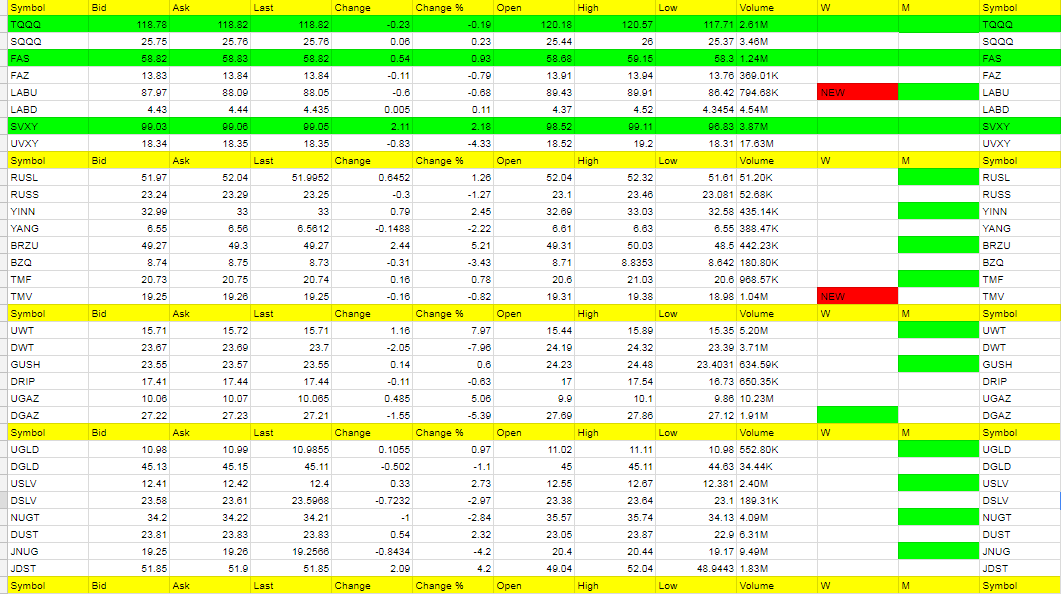

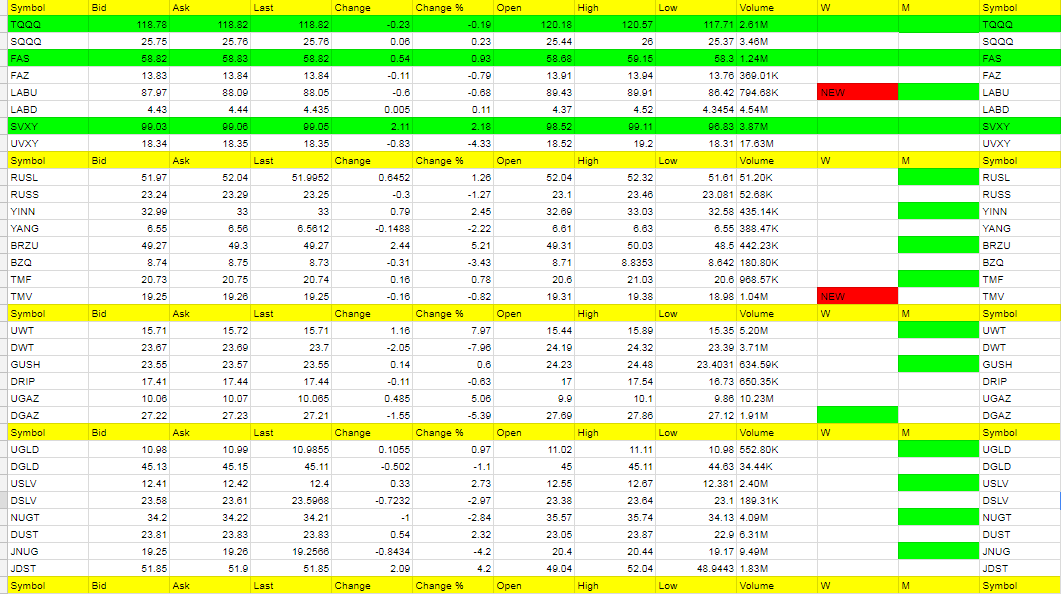

Today’s Trades and Current Positions (highlighted in yellow):

With JNUG and NUGT 2 days in the hot corner, and that move up early in the morning, it wasn’t too much of a surprise that we saw a pullback today. However, to see it when the USD/JPY was actually falling more was somewhat of a surprise. But the USD/JPY bounced off of 112 area and metals never looked back up. UGAZ was nice to see rebound along with UWT although we are not yet long UWT as a day trade. Tomorrow on a dip maybe. UVXY tried to break out and offered us a 3%+ potential scalp, but we held out for more and now down a bit. We had a couple more Red weekly’s hit with LABU and TMV and now looking at what we might get out of LABD and TMF. I am using this strategy live with you all to track it and gain confidence on where to take profit and keep stops. So far, we would have profited from more over 5% than losses (mostly DWT and DRIP). DGAZ we would have sold -3% too, but I never really liked it from the beginning as we are swinging UGAZ. For that matter same with DWT as we are swinging UWT. At least I had the Swing direction correct overall and we should see some good moves in those into the end of the month.

Economic Data For Tomorrow

Important data tomorrow are the JOLDs Jobe Openings and FOMC Meeting Minutes in the afternoon.

http://www.investing.com/economic-calendar/

Markets barely up today ahead of the FOMC minutes. /NQ went red a few times. Tomorrow, post FOMC minutes, I don’t expect a surprise at all. If anything it is sell the news and markets fall and metals/miners rise. Most everyone knows that 75% of the Fed members were looking for a rate hike in December, surpassing any bullishness from the Street by 25% on the bull side. This is baked into the markets and I see limited upside on any more noise about rate hikes in the minutes once released. However, any comments made that can surprise, would be to the bull side of gold, so we could see a pop there. Any pops up in the market I would be looking at taking the other side.

UVXY thye took below yesterday’s low to once again shake out weak hands. Our goal is over 19.60 but today only got to 19.20. So first confirmation of a bottom is over 19.20 tomorrow. No real reason for the knock down that I can see except market makers making money.

Foreign Markets

Tough day for foreign ETFs. But they stopped falling, which is good. Futures fell back and /NQ even went negative for a bit. I think tomorrow we gap up in all 3 of these; RUSS, YANG and BZQ. Either way, the bottom may be in based on the new red weekly signals.

2 days in a row of leaning TMF and TMV finally hit red on the weekly and under the new buy the opposite system, we are tracking it at an entry of 20.87. High today was 21.03 and over that would confirm new trend. Break of 20.60 and we have to get markets to move lower to make any money.

We got the nice pop in Nat Gas today and it just needs to stay above the 10.10 level or 2.90 Nat Gas for some real fun. 3.00 is fist resistance level, then 3.10. Over 3.10 and 3.40 is 100% on the table for our big reward.

Yesterday for UWT I mentioned a break of 14.80 is a key spot and today we gapped over that and never looked back. I thought about chasing but expected a sharp move lower like we seem to always get. It did hit 15.89 and pulled back to 15.60 and tomorrow we’ll look to see if we might get long lower.

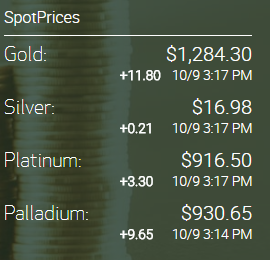

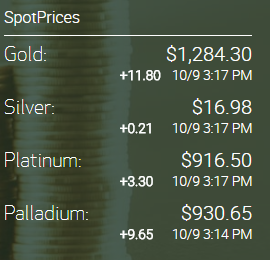

Precious Metals and Mining Stocks

The resistance in GDX and GDXJ played into the fall today, but the USD/JPY bounce off of the 112 support was the nail in the coffin for any fun today in metals, even though for a time gold was up 10, but JNUG was falling all day. I see a turnaround coming tomorrow and zooming out I offer the 10 points below. Hang in there you swing traders!.

A few notes on gold that has me looking more positive, even if we had one more shakeout lower. I’m not that fearful of the downside at all. In fact, everything is lining up for a big move to that 1400 level. Don’t let the day to day or week to week moves scare you too much now.

1. USD/JPY broke to a lower low of 112. While it still has it within itself to move to 114.50 and push gold to 1250 range, that’s it. We ill manage our trade and look to take some profit assuming we can get to that 1300 mark (just below). That’s the ideal situation.

2. We saw the USD/JPY move up from the 112 support, which is to be expected. Now though we have that 112.40 mark as resistance. We are 112.26 as I type. We should break below 112 here soon, maybe after the FOMC minutes tomorrow.

3. US Mint website shows the US coin dealers are having one of the worst years ever, as bad as 2003. In 2003 US Mint sold 315k 1oz coins. 2007 360k oz. 2011 1.2M oz. So far YTD for 2017, 310k oz and most of that was in January. Dealers are saying that not only are people not buying coins, they’re selling them back.

4. I personally can say that it has been awhile since I had a $1 million gold trade, and in fact it was a sell, not a buy. But today for the first time I have seen more buyers. More importantly, so has that of my suppliers as one of them is out of Gold Eagles and the premiums have shot up on the Gold Eagles. First time in awhile.

5. The USD/JPY is also tied to the SPX and not just gold inversely. Every time the S&P gets weak, it is miraculously supported by a rebound in the USD/JPY. BoJ governor Kuroda has pledged to stick with quantitative easing and that should come as no surprise. That’s all they have going for them.

6. North Korea has been silent on missile’s, but I don’t think there is dialogue on the table here. I think this will change.

7. Markets are toppy. UVXY keeps wanting to take off higher and is NOT making new lows like it always does. Something’s up here and a big move in UVXY is imminent I think and thus down in the markets.

8. “People are giving up on precious metals” which means we’re in a bull market – Mike Maloney

9. Eventually, we get through 1300 in gold and 17.50 in silver, we are off and running. How much downside pain you may want to take I think we have already seen the worst of it and if we can live through that, we can live through one more potential test lower.

10. Miners resistance was 24 GDX and today we hit 23.89 and 35 GDXJ and we hit 35+yesterday and now are 34.55 (35.18 high today). Normal resistance areas to push through an that is why you see a retreat at present.

Bottom line, we are just getting warmed up and if we do get one more dip, this will be your termporary all in buy and we will 100% have to get greedy over 1300 gold and 17.50 silver.

Tuesday Afternoon Price

Monday Afternoon Price

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, BRZU, UGAZ, JDST

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DWT, DGAZ, UVXY, JNUG, BZQ, DSLV

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!