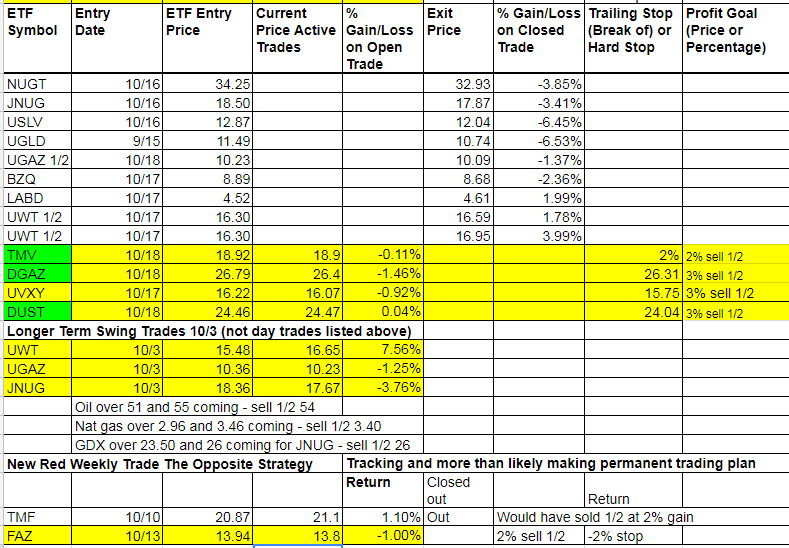

ETF Trading Research 10/18/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

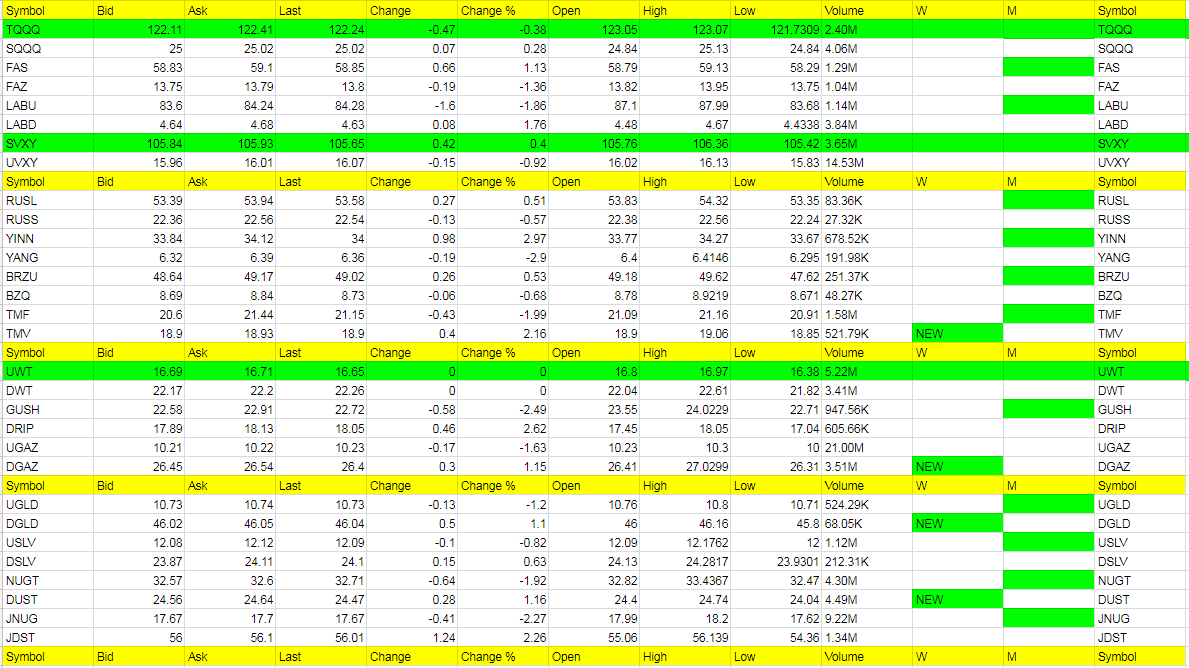

Today’s Trades and Current Positions (highlighted in yellow):

When I saw that DUST had triggered green on the weekly, unlike last time, I took that as a signal to get out rather than the potential of riding metals and miners lower.

There is some confusion on keeping the Swing Trades going though, especially when I am calling us for day trades the opposite. JNUG for example, is still green on the monthly and I still think 26 is in play along with gold to over +1400. I also said we may have one more smack down to the 1240/1250 level and am clear now that I think this will be the last smack down before we blast off. Swing trades take a little more patience and the goal in putting these on the alerts is to help the many who ask for swing trades for profit. The thing is, all 3 of the current swing trades were up 5% and two of them 9% at one point. No one is stopping a swing trader from locking in that kind of profit. Because this is a new way of tracking these trades, based on my longer term goals of higher gold, oil, nat gas, I don’t say to take the profit. At least I didn’t do that. Day trades and we are up that much, and I almost always say to take the profit. And that’s the dilemma I have, trying to satisfy day traders and swing traders both and I am trying to get to those much higher returns for swing traders than 9%. To do so, we are seeing that leveraged ETFs have some wild swing and that’s why my preference is to day trade them. My calls in metals and miners have been affected by my overall bullishness, but today DUST going green told me to take the other side. Being that the move up never got JNUG or NUGT green, means that we didn’t have the early signal to get out on them turning red (since they never went green). This is the tough part when you get reversals before the colors hit. It’s also why it make more sense to keep tighter profit goals and stops until we get to some bigger moves in metals and miners. The moves higher will come. Seeking Alpha finally put my last article out there and nothing has changed. Gold to +1400 is the call. Very little downside to a very nice upside. Let’s see if we can bounce though before we get to the 1240-1250 level on some North Korea news or something. Of course bringing some fear in the market would help and the last 3 days the VIX overall has perked up.

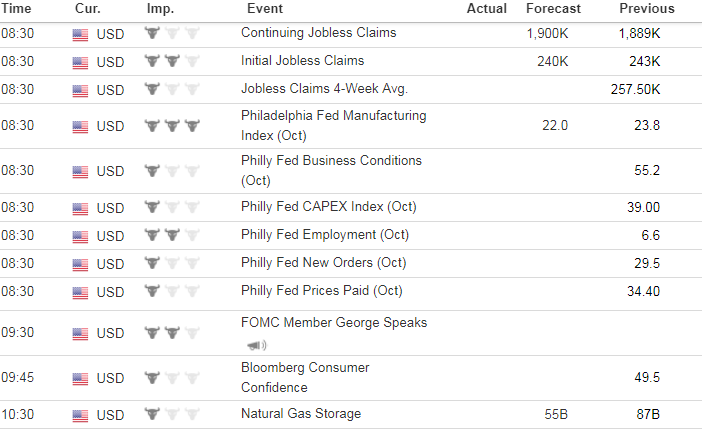

Economic Data For Tomorrow

Initial Jobless Claims and Philly Fed Manufacturing the big one tomorrow. Nat Gas storage at 10:30.

http://www.investing.com/economic-calendar/

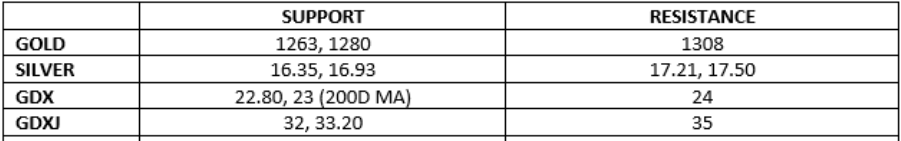

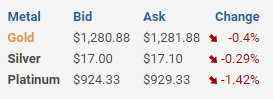

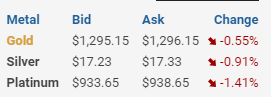

Precious Metals and Mining Stocks

USD/JPY spiked up early and we finally bailed on the trade and took a position in DUST. Will be a scalp for the most part unless gold can show us lower prices and silver get under 17.

Want to know when to be fully bullish metals and miners? Above these resistance levels. Bottom feeding won’t be easy until then, but if we are confident we can break these resistance levels, which I am on all of them, then we welcome the opportunity to buy lower. If we do move to the 1263 level in gold and 16.35 in silver, we would have profited nicely with DUST and maybe a JDST trigger, and be comfortable getting in the opposite a bit early knowing our downside is limited. And gosh darn it, this time will be the ride we have waited patiently for. Until these levels are broken, expect some volatility and tougher trading and we’ll go with the signals of green and red weekly to look for entries long, or just go all in if we hit those secondary support areas.

Wednesday Price

Tuesday Price

Monday Price

Friday Afternoon Price

Thursday Afternoon Price

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

No ETFs in the hot corner today. Only one yesterday. Tough to trade these kind of day. (DUST, TMV, DGAZ and DGLD new green weekly’s today)

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

YANG the only ETF in the cold corner. Rather pathetic day for trading.

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!