IMPORTANT: Cold Corner 3 Day List

TVIX, SOXS, YANG, RUSS, SQQQ, SDOW.

All of these we will concentrate on longs tomorrow. It is RARE for these to go 4 days but TVIX sometimes does. GUSH and BRZU are the only two others that have gone 4, 5 and 6 days in the Cold Corner which is ultra rare.

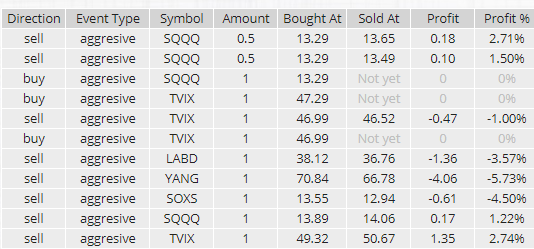

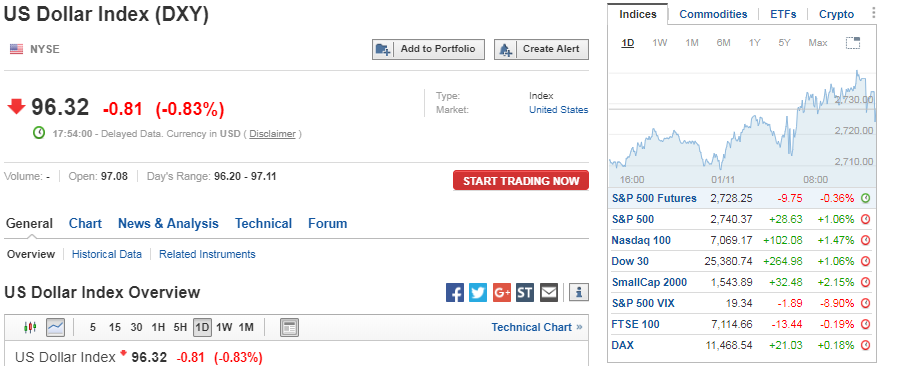

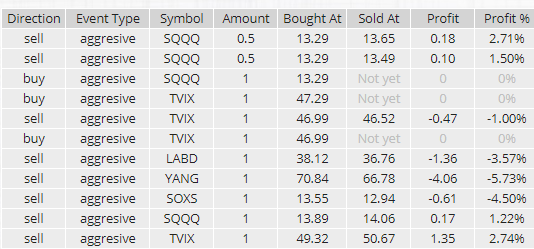

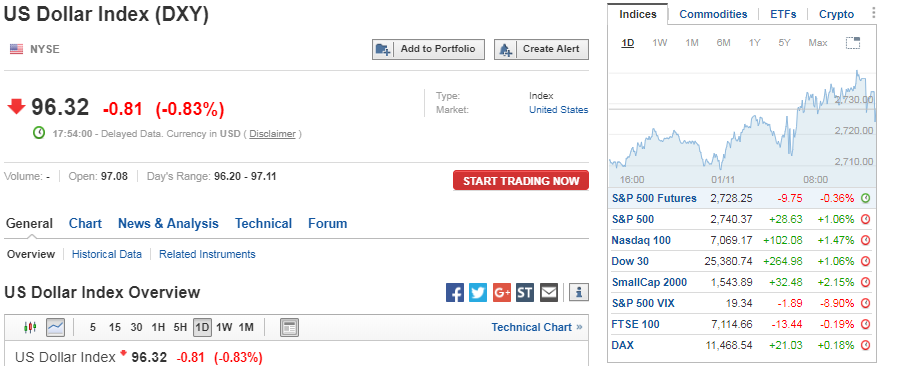

Today I will take full responsibility for as I should have been calling longs all day yesterday, not shorts with the new signals that came in. The one thing that I do to calculate those signals I did not do and that’s on me. Once Trump Tweeted and ruined the run below 2700 we got a big move up and I said I would short that and gave the limits I thought that /ES would go for anyone long to be 2735 double top to 2750. We hit 2741.25.

We then took a chance with TVIX before the market closed and added SQQQ right before the market closed and salvaged a decent trade in it.

I have confidence that this is a one off trade in miners moving higher with gold with a dollar reprieve so stuck with DUST with the bad entry at the open. It has moved off a 31 base now. Watch the dollar tomorrow and if positive and gold down will add JDST to the mix AFTER the open.

I tweak my system constantly and have now put up a checklist of tasks each morning to keep me in check.

The good news for tomorrow, is we will aggressively go after our 7 Cold Corner ETFs and make up for today.

Also, I am tweaking already with my system as for some reason my IT people were instructed to keep stops at a maximum of -5% and they have gone past that. It is supposed to automatically sell at -5%. I have decided that -5% is too much and takes away from our profit when wrong and have lowered it to -3%. Also, most likely, I will be taking the profit automatically on +3% or greater half shares which is what we had on TVIX yesterday. I get caught up with those who want to swing trade and try and get more out of a trade and each time I do it I don’t like the results. I have to trade what I see and let the system I created automatically dictate profit and losses. I created it to take the human emotions out of the equation; Do I hold out a little longer to see if it comes back. The answer to that is no! Get the heck out of it and move on to what is moving IN YOUR FAVOR.

Simple as that.

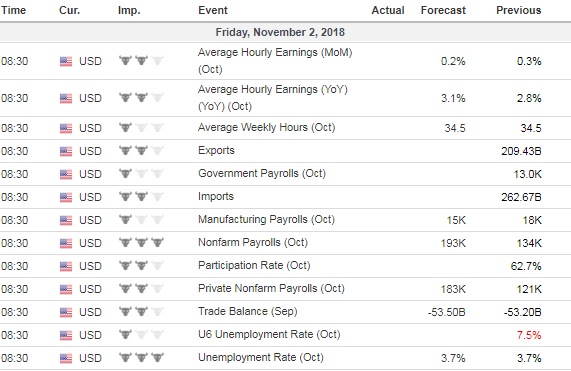

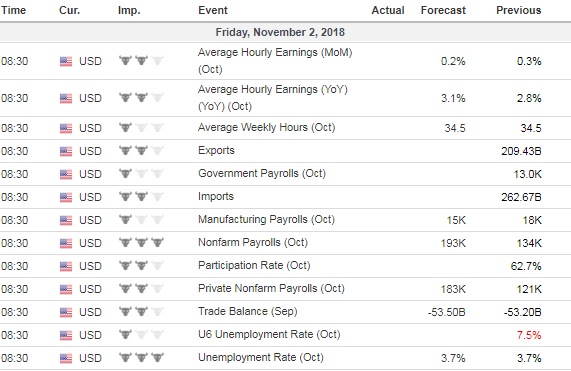

Economic Data For Tomorrow

Today’s data all missed and market went up 264 points. Does data matter? Yes, it does. And the market will eventually figure this out.

http://www.investing.com/economic-calendar/

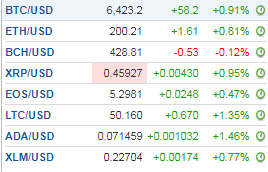

We fell short of 2750 and outside chance we still test it tomorrow morning after data if it’s good, but under 2700 should be next stop. Apple revenue miss and the fact they are starting to hide things on unit sales is very suspicious. My macro view is this market is hanging on a thread and the Fed is clueless to what the heck they are doing to the markets. But markets are driven by other forces that are alive and well when big money pushes little money around. We fell short of following the big money the last 24 hours but will get back on track I assure you. We will look to trade the Cold Corner ETFs tomorrow after the open. I won’t make any new calls pre-market tomorrow most likely. Want to see real money come in after 10pm. We have a good short already if data is bad and we have support on it at 45.50 area. 47.28 as I type. Will let it ride hopefully to 55 and grab some more shorts along the way. You fall off a horse you get back on.

Foreign Markets

Took a chance on YANG and if you work up early and had IB Brokers you would have got a 2 point scalp from it. After that it fell quickly. 3 days in the Cold Corner though and look for it to move up here soon. Someone asked about Brazil and it was up today, but it will fall with the markets. If you see us get a buy signal for BZQ, take it. Foreign ETFs will lead U.S. ETFs south, especially if we get a dollar boost back up.

Interest Rates

TMF took over for TMV by a hair only today. Higher rates with TMV moving higher didn’t stop this 3 day bull run.

UGAZ had a good afternoon run. I thought about calling it but was concentrating on U.S. markets. No signals here but I did say the top in DGAZ was 3.35. We only got to 3.304.

UWT got hammered today with the markets moving up. The correlation here is toast for now. It was suspect yesterday as I wrote about the manipulation. Today even more so. We will look to buy UWT tomorrow most likely from an oversold perspective.

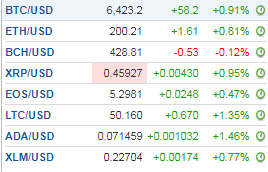

Precious Metals and Mining Stocks

Yesterday I said we might be getting long JNUG here soon. But we missed the bigger run up with the overnight move up in gold and dollar lower. Dollar was at 95 DSI (Daily Sentiment Index) as I wrote about and due for a bounce. We should have taken a position yesterday out of speculation. There were no signs but there are now. However, as I wrote yesterday, metals and miners still have a leg down. 1250 is still resistance area. Doubt we get that far but will trade ourselves out of DUST with profit or take the loss and get back in and add JDST here if necessary on any weakness. Watch that dollar tomorrow.