ETF Trading Research 11/27/2018

Question;

“Don’t you think it’s, at least possible, that they will keep issuing more and more debt, and purchase that debt themselves, if necessary, (and if they are not doing that now, which i am not sure) until they are safely out of harms way?”

Answer: Absolutely. That’s all they know to do. And what some who sell gold for a business don’t get, is they have been good at it. What Ron Paul and some Austrians didn’t get is that the Fed still matters and will do anything to save themselves with the guise of saving us all.

Question;

“My thinking is the two parties in power, both start wars and print money and that is IT. Period. That is what the Dem’s and GOP do. There is little, if any growth in the economy.”

Answer: There is no better way to inflate it all away as Gel suggests and Richard Russel used to constantly say; “inflate or die.” But there has to be a deflationary contraction first IMHO. That’s where Lew Rockwell and company I think miss the boat by always looking at inflation as an only option. They do not include “credit” in their definitions of deflation as they only look at the M2 money printing. One can’t ignore the credit. Even Mises with his crack up boom analysis couldn’t have imagined the amount of credit that has been built up since the 1971 Nixon departure from gold. Warren Buffet’s dad, a Congressman, wrote about what would happen next in the 1940’s if we left the gold standard, and while it hasn’t occurred yet, we have had some wonderful years for many that I wrote about in my article above. But there is an end game. How the Fed reacts to that end game will be the subject of my next article.What I have already written about is how gold will get hit in that “one more decline” pretty hard, but one can’t just look at the U.S. as an isolated economy or monetary system. As gel points out, the worldwide debt is impossible to pay off. It will be the survival of the fittest who at first at least, will be the “perceived safety” and the U.S. is the fittest of a bad bunch. Why? Because they have been for so long. And because they are the world’s largest military power (yes, to me that means something). And still, today, 70% of the world’s economy trades in dollars although alternatives are used. I am not in the camp as some that SDR’s are a future currency like Rickards and have written about that.Only one asset can be considered “honest money” and in times of war is hoarded by those who understand it and in times of peace sold to enjoy the prosperity peace provides, with some government help. But even Keynes said one has to stop the spending and that is something no government is doing or plans to do. There is no fiscal bone in either party and the lust for war to resolve issues is on the table no doubt.But a lot of what is missing is the “when?” I’ll try and dive into that more in my next article.And no, I am not a return to the gold standard guy. Nowhere have I ever recommended that. But it doesn’t mean that individuals from troubled countries can’t make their own gold standard if they see troubles ahead. I write about awareness. I imagine those in Argentina in the past (maybe now?) and Venezuela when things were doing well and started to go south, there was plenty of time to transfer wealth. But if one doesn’t do their own homework and ask some tough questions about what makes sense and what are the probabilities of occurrence, contraction, war, etc., then they are letting others manage their wealth and most likely won’t be able to exchange that wealth into something of value very easily. That’s why I view gold as insurance first. At times it’s been great insurance and other times not so great. It’s not too far fetched to say this is one of those times, no matter how low it might go in the near future, to consider 50% into that physical insurance.And to break down those years of good and not so good, since Nixon separated us from gold;

1971-1980 good – 9 years

1980 – 2000 not good – 20 years

2000 – 2011 good – 11 years

2011 – 2018 not good (although you could have bought the low of 1050’s in 2015 and be ok today) = 7 years

That’s 20 good years and 27 bad years (give or take)What do the next 7-10 years look like if you add the National Debt to each of those time-frames and the lack of Congressional responsibility to future generations? Now add credit for each time-frame.The Federal Reserve Note has 47 short years of history without a relationship to gold. Not too many people get that. 20 of those years the dollar sucked.But to make a long story short, if the dollar sucks, does that by default mean that the Euro, which makes up 57% of the dollar is going to shine? The Pound? Hardly. That’s 70% of the dollar. That’s a lot of Europeans clamoring for gold if the South Americans and African’s haven’t already scooped it up. Eventually, it will take more of all currencies to buy gold, just as it did from 2000 to 2011, but on steroids possibly. Richard Russell was the first to say that gold will go to “undreamed of heights.” And today we’re talking about a maybe 20% or so drop. Some see the big picture. Some worry about the micro picture and the 27 years of dollar supremacy over 20 years of gold supremacy since the 71 separation. Which one can an astute monetarist/economist make to possess moving forward? Does that monetarist/economist include credit in the equation? What are the probabilities that the Fed will have/keep everything under control? What is their track record? How has their balance sheet changed?I’ll dive into that in the next article as I personally think it’s time to start being a bit more proactive about gold as insurance.

END

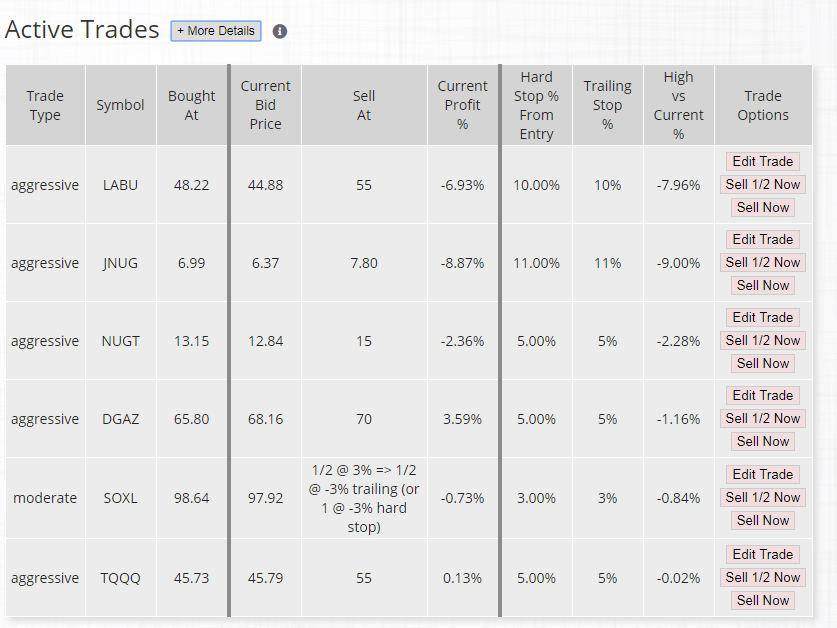

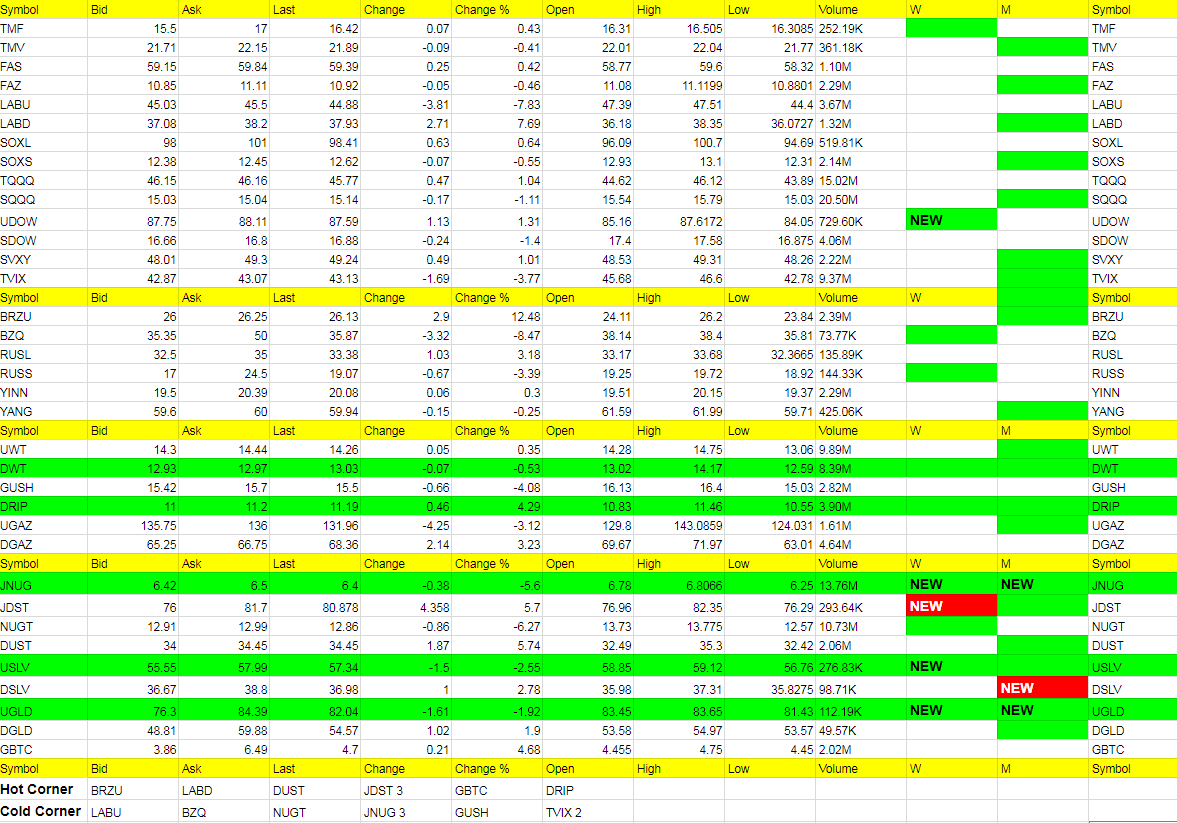

Today’s trading went well overall but got stuck on the wrong side of gold after a false signal in NUGT. I thought after all this time it would give us more than it did. I still think we get a push to 1250 in gold though so we’ll see what we get.

We did well with SOXL and TQQQ and twice in GUSH and came back after an earlier loss in UWT to be net positive. I do see a turnaround in LABU tomorrow and hope to get back in UWT and GUSH which before the close went the conservative route on them.

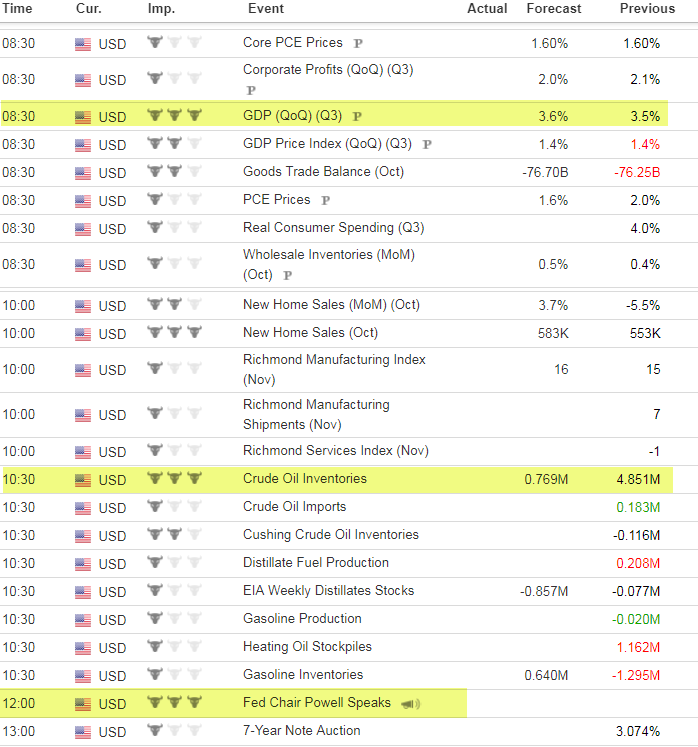

Economic Data For Tomorrow

Big data highlighted below.

http://www.investing.com/economic-calendar/