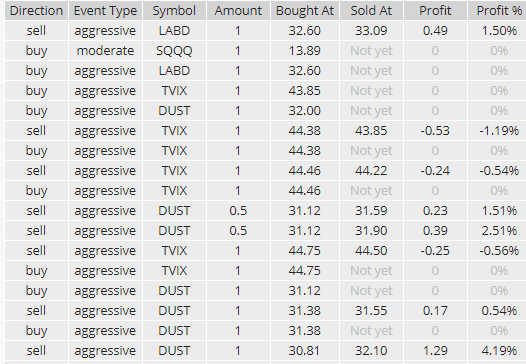

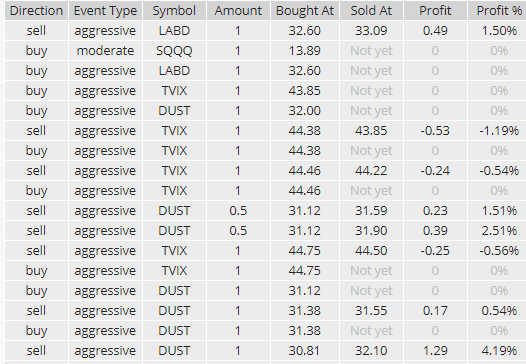

Started off the day with a good DUST trade and could have taken more out of it but signals came in to swing it for bigger profit so we are.

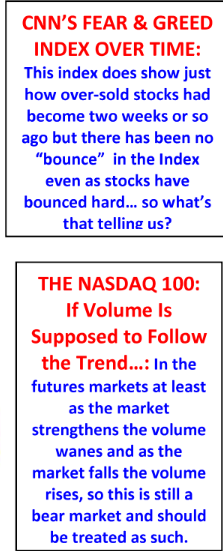

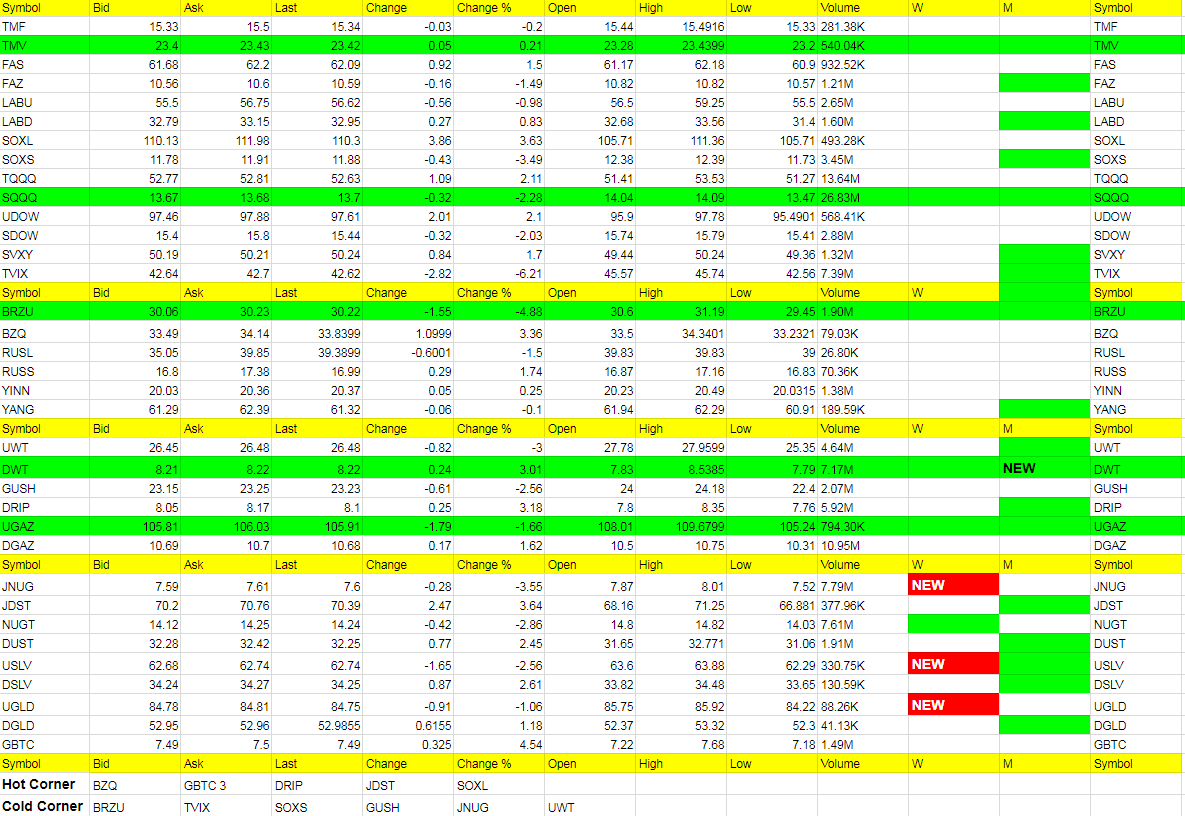

My indicators had us moving lower from the morning but unfortunately picked TVIX instead of SQQQ to concentrate on and while SQQQ was moving up with the continued pullback in /ES, TVIX kept hitting fresh lows. While we had tight stops to begin with, we got long again and rode out a move down to get to profit but decided to hold till maybe even Friday now. I’ll practice a wider stop but think we break 2700 still. Same goes with SQQQ trade. We will add LABD and SOXS on any moves up.

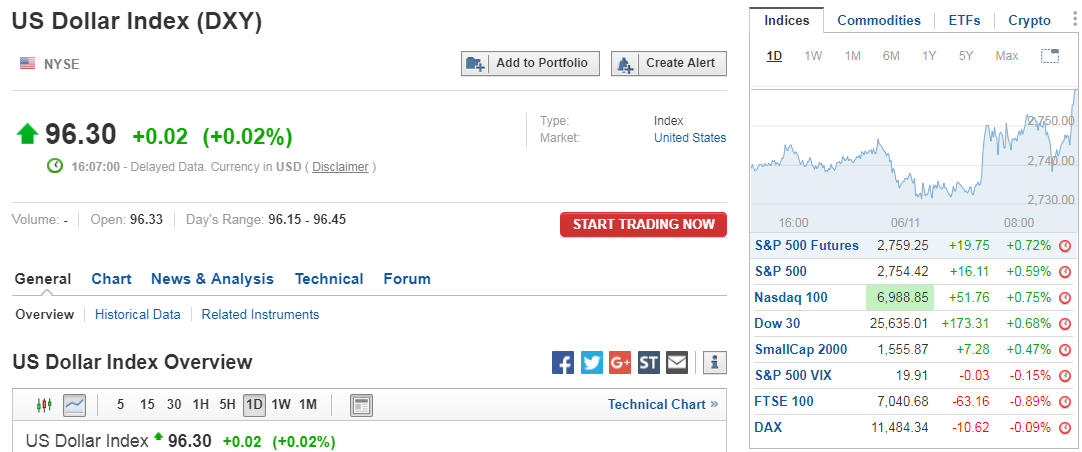

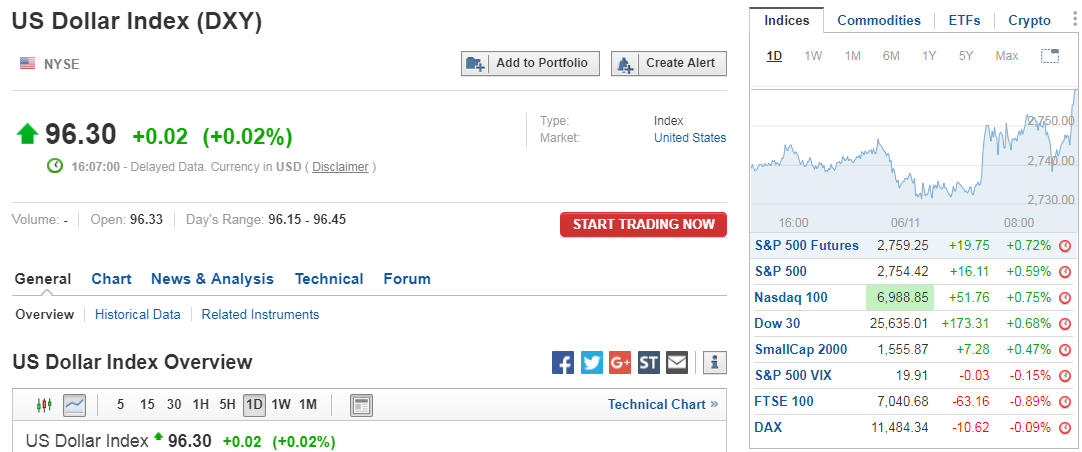

After hours we hit 2761 and have fallen to 2752 and small bounce up to 2755. See how it plays out by the morning. Addendum: I am not sure what happened, maybe first results coming in from the East Coast, but futures just fell to 2745 pretty quickly. Will be a long night for some people. I just want to be on the right side of it with our trades.

We will also add JDST on any move up in miners.

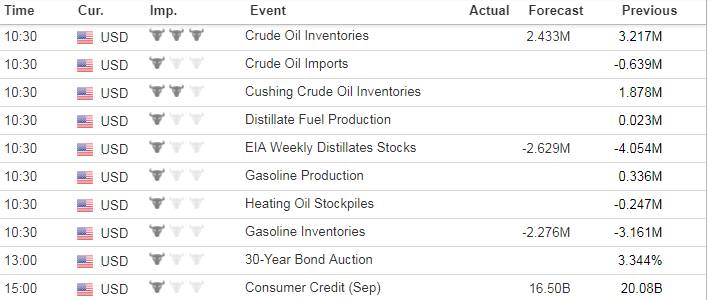

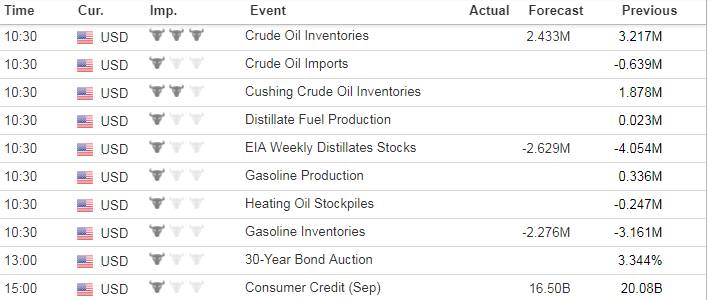

Economic Data For Tomorrow

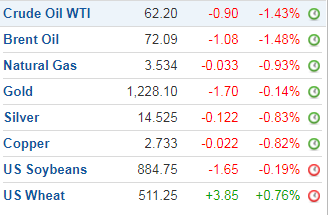

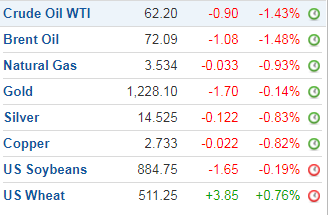

JOLTs Job Openings came in negative and markets didn’t care. Tomorrow only Oil Inventories is the important one.

http://www.investing.com/economic-calendar/

Wanted to be neutral the market and for the most part traded well. Called the first and second resistance but SQQQ would have been a better trade. I did lean short after we potentially hit the first resistance level and it should have paid off a bit better than it did, but even the longs in SOXL and TQQQ were not going to give you much profit. Difficult day to trade but thought we did well.

The following is from Dennis Gartman’s newsletter for today. Interesting the part about Nasdaq and why I am comfortable shorting.

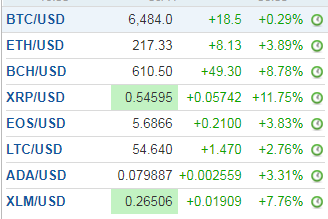

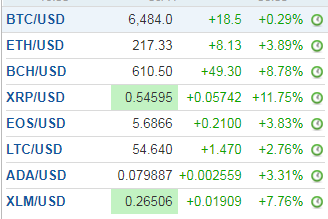

Bitcoin has probably had its run for now or soon will reverse. 3 days in the Hot corner.

Midterm results will come tonight and cause some havoc if Democrats take over the House most likely. CNBC had a story about it for next year’s market too if you are looking long term with non-leveraged accounts to stay long into next year. Caution would be advised.

Either way from the bottom under /2700 we want to get long again somewhere.

Foreign Markets

Was tempted to buy YINN today, or the dip in BRZU as we played foreign ETFs well yesterday. But too much risk with RUSL also negative and they never got going. No signals here right now as today’s move lower in BRZU was in conflict with the nightly table below. If market does fall, then will most likely get a pullback here too.

Interest Rates

Not much action here. Fed will vote to increase rates again on Thursday so have to lean on TMV still.

Didn’t even bother with the nat gas and oil volatility today. Soon maybe, but ignoring for now.

Precious Metals and Mining

Did well with DUST again and plan on maybe adding JDST if we get any push higher in metals the next couple days. Target is 1180’s in gold as the ultimate sell area and switching sides possibly soon thereafter to JNUG/NUGT. Dollar still key here. 97/98 and possibly higher on the table.