ETF Trading Research 12/02/2018

Was a decent day for us and if you got the non-call on UGAZ with my last thought of the day you may have rode that up. As well, I made the statement that I thought we would pop up into G20 and after with some sort of an understanding with China on tariffs and it looks like that has occurred. That said, it was just an extension and no new agreements were made. The market should continue to drift higher.

Economic Data For Tomorrow

Decent amount of data and FOMC members tomorrow.

http://www.investing.com/economic-calendar/

Stock Market

Wrote this early in the morning but didn’t hit “Publish.” Looks like we did get to 2800 on /ES and now 2900 becomes a potential. We’ll lean long until further notice.

Markets have made the bottom and now trying to push to that 2800 market we have been discussing, We should get there and maybe even push to 2900 into Christmas but from there the wheels should come off this market bus in a big way. The FOMC meeting Dec 19th is key in that they plan on raising interest rates once more time, but what language will they be using?

We are seeing bullish hints in the data below.

Foreign Markets

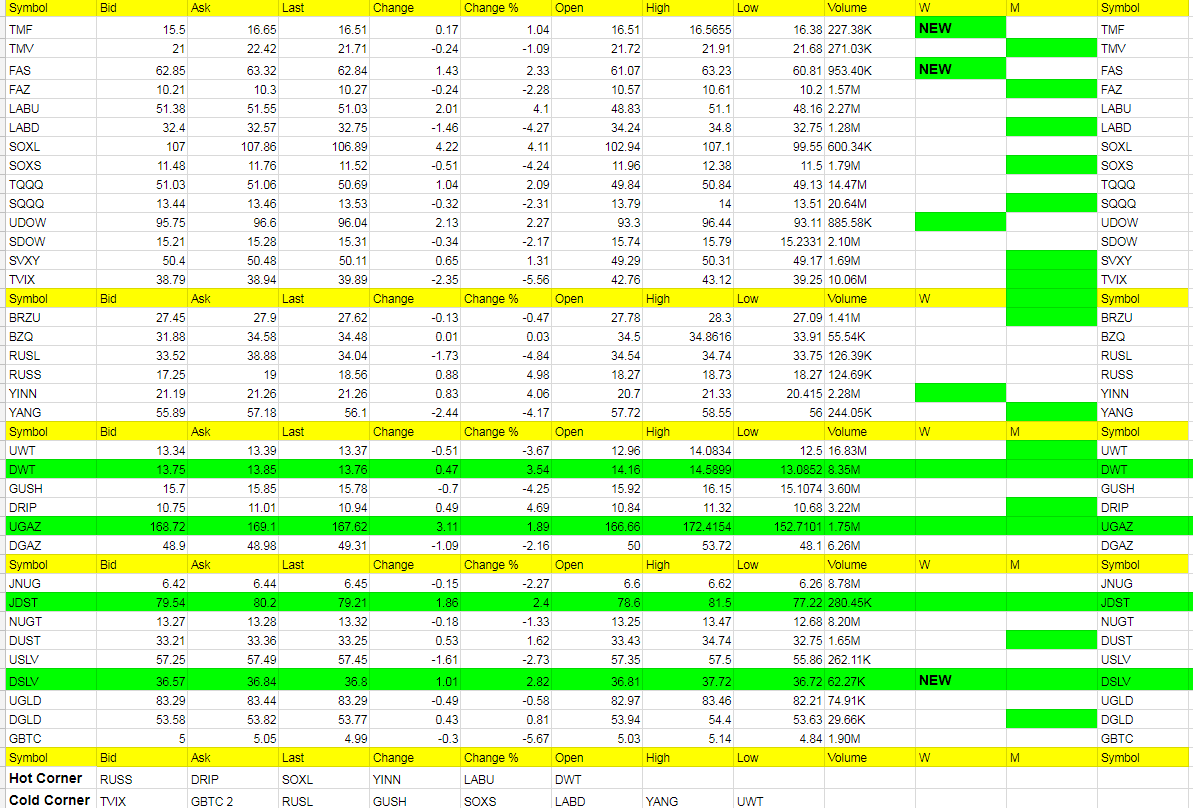

Still focusing on the other ETFs because of the up and down nature of these for the last week or so. They can up up or down 5% or more and many times not much action during the day. I do like BRZU if it opens positive and YANG if it opens positive. I would concentrate on those two.

Interest Rates

TMF is the new boss in town with a green weekly signal. See how long it lasts though.

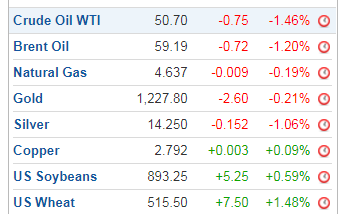

Energy

I chose to concentrate on UGAZ to start the day as I thought we would get a repeat of the prior day’s run it had. It did, but only traded via paper not an actual call. Was testing out a quicker way to gauge ETFs and it worked perfectly, so will be looking forward to next week’s trading all around because of it.

Late note; Nat gas down 12 cents and have to play both sides of this till we get a leader.

December 6th OPEC meeting this week. If oil has any life in it to follow the market up into Christmas, it should begin this week. Russia though said they are not doing anything to cut production, so the real question is, what will come from this? UWT has shown signs of life to 14 but it keeps getting smacked down.

Late note; oil up 1% plus so far on Sunday. Bottom for once may be in at least until OPEC.

Precious Metals and Mining

JNUG and NUGT will become a buy I think here soon, but the lean with the strength in the dollar is clearly with JDST and DUST. I could almost say whatever opens positive on Monday, buy with a trailing stop and feel good about that. But the lean is with short right now with our signals.

Recent Posts