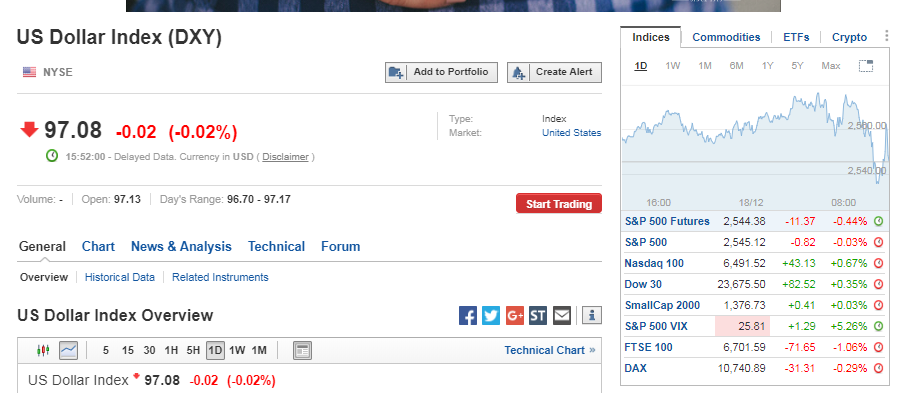

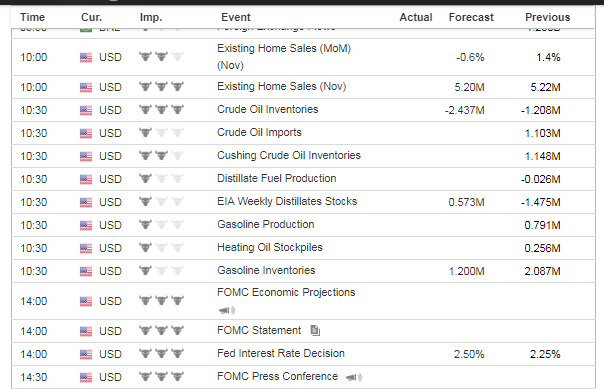

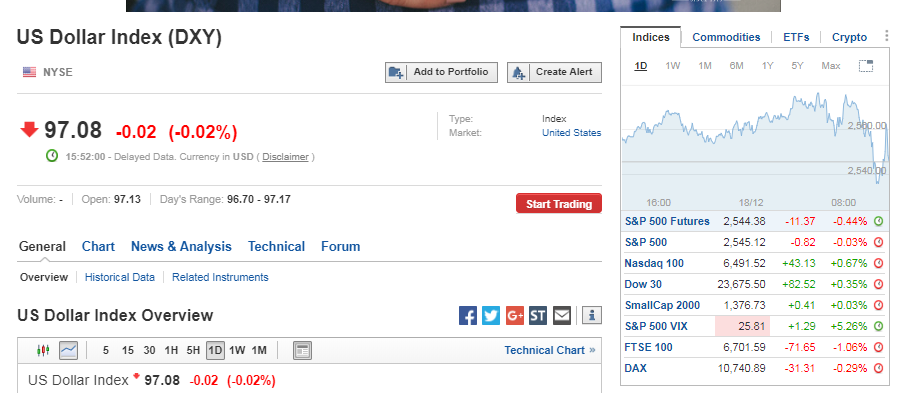

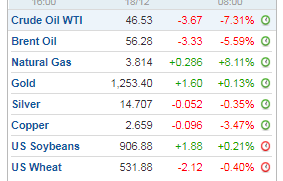

This is a market on life support right now and even after hours they are bringing /ES futures back to the lows of the day, currently 2536.75. Was a rough day that teased us higher, but in the end, the price of oil dragged this market down. We have some data out tonight and tomorrow in oil and perhaps it can kickstart this market as well as the FOMC meeting where the Fed is stuck on what they say (higher rates) and what the market needs (no more rate increases) right now. We have housing data out early that will set the stage for the day and the Fed.

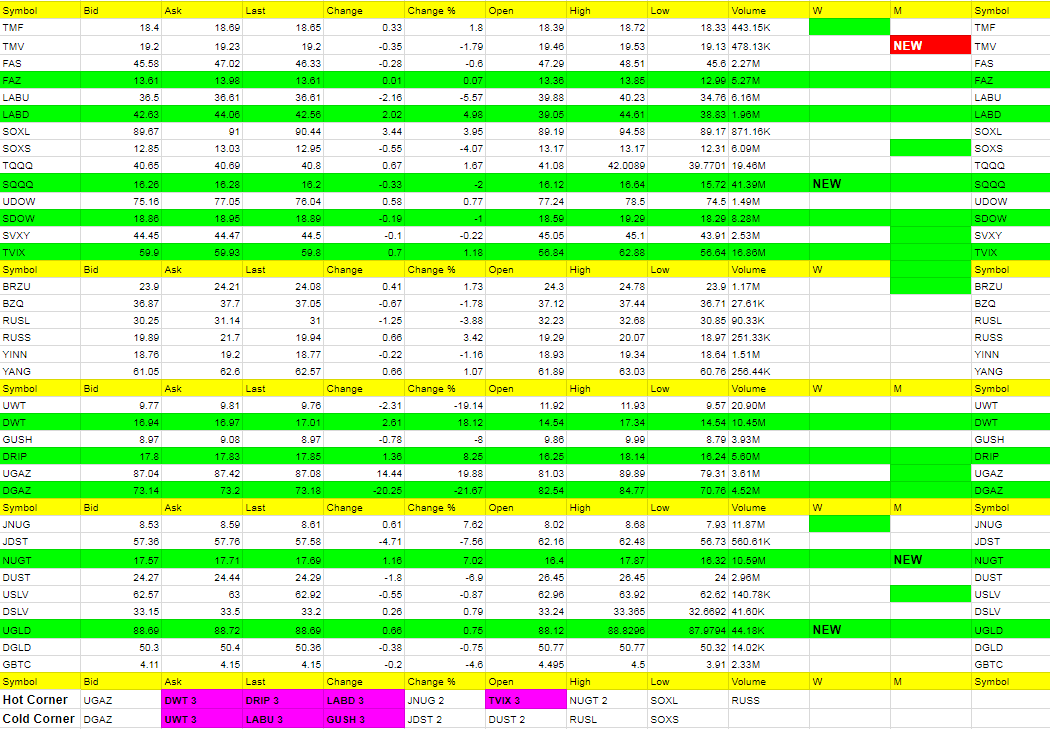

IMPORTANT; Using the 3 day rule we need to look to get long UWT, LABU and GUSH tomorrow as all 3 have been in the Cold Corner 3 days.

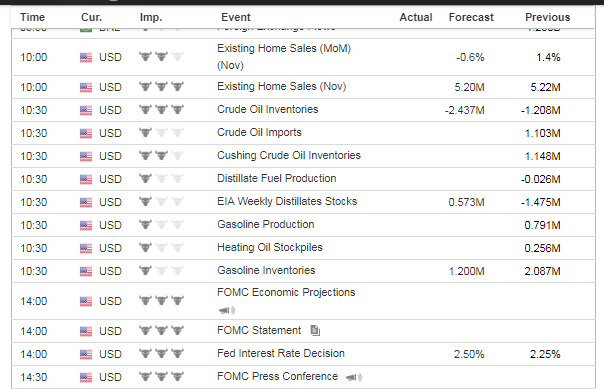

Economic Data For Tomorrow

Existing Home Sales and Crude Inventories in the morning as well as FOMC at 1PM.

http://www.investing.com/economic-calendar/

Yesterday I said; “We may still fall till /ES 2500 break and that I do expect us to continue lower putting extreme pressure on the Fed come Wednesday.” We got to 2531 after a nice open to the day. But the rug was pulled and even with an end of day bounce, was not worth taking the risk holding longs overnight. We break 2500 tomorrow we may consider a long around 2480. We do note that SOXL, TQQQ and UDOW were higher today.

Foreign Markets

BRZU higher today with YINN and RUSL laggards. All the may be good tomorrow. Tried today but no follow through in the markets. These can move big once they get going.

Interest Rates

Still a run to safety here.

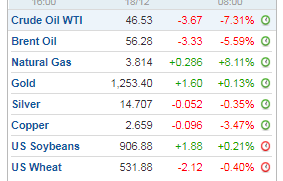

Yesterday I said nat gas is “Overdue for a bounce with UGAZ 4 days in the Cold Corner.” We got the 20% move up in it today.

UWT fell hard today and I see us moving up big time here soon. Way overdone. But storage needs to agree tomorrow.

Precious Metals and Mining

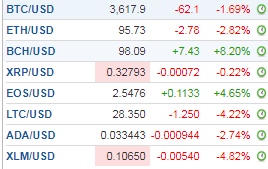

Gold and silver really didn’t participate in the miners move up today. We did move up more than I thought we would. Tomorrow if DUST or JDST is positive, then buy them. If JNUG and NUGT is positive, you can use a trailing stop to capture what is left of this move up. The Fed most likely will raise rates and that should put a damper on gold. But if for any reason the Fed doesn’t, gold can fly. The odds are they will raise. Still trade these inverse the dollar.