ETF Trading Research 2/18/2019

I have added a pre-Trading Rules section that I have alluded to at times, but is my worst weakness as a trader. At times I simply do stupid stuff and it is mostly because I am reading too much into what others are saying and not paying attention to the charts. You’ll see me moving forward with leveraged ETFs follow this rule below and if for any reason you see me break it, email me info@illusionsofwealth.com and call me out on it before close. This is a must moving forward for our success, once I get us out of the current trades we are in.

First and foremost, I have used this trading system long enough to know that I am my own worst enemy at times. Sometimes my stubbornness gets in the way of a good trade, or worse, keeps us in a bad trade. There is a simple solution to my human tendencies, whether they be stuff I read or going against the nightly report; do not go against the nightly report. Ever. If you see me do it for ANY reason; 1. call me out on it. 2. ignore what I say. 3. Don’t take home an ETF that goes against the nightly report. Making this one adjustment will save you from staying in or being in a trade that makes no sense. This means that if you see a green weekly on an ETF (whether it is green monthly or not), do NOT take it as a hold overnight or over the weekend.

Futures are somewhat flat with gold up a bit as we open trading internationally as futures and gold markets in the U.S. are trading but U.S. markets are closed.

I have said that we could go up to 2800 in /ES while I prefer an immediate decline on Fed minutes week. Markets are oversold with the S&P at 88 on Daily Sentiment Index although volatility can still take a day or two to decline (TVIX) to a lower level. However, if we can get below 2763, then we have a decent chance we can break 2730 and start heading down to a minimum of 2650 once we break 2700. Lot to ask for right now but that is the next level we should fall to. Whether we break 2650 though is still up in the air.

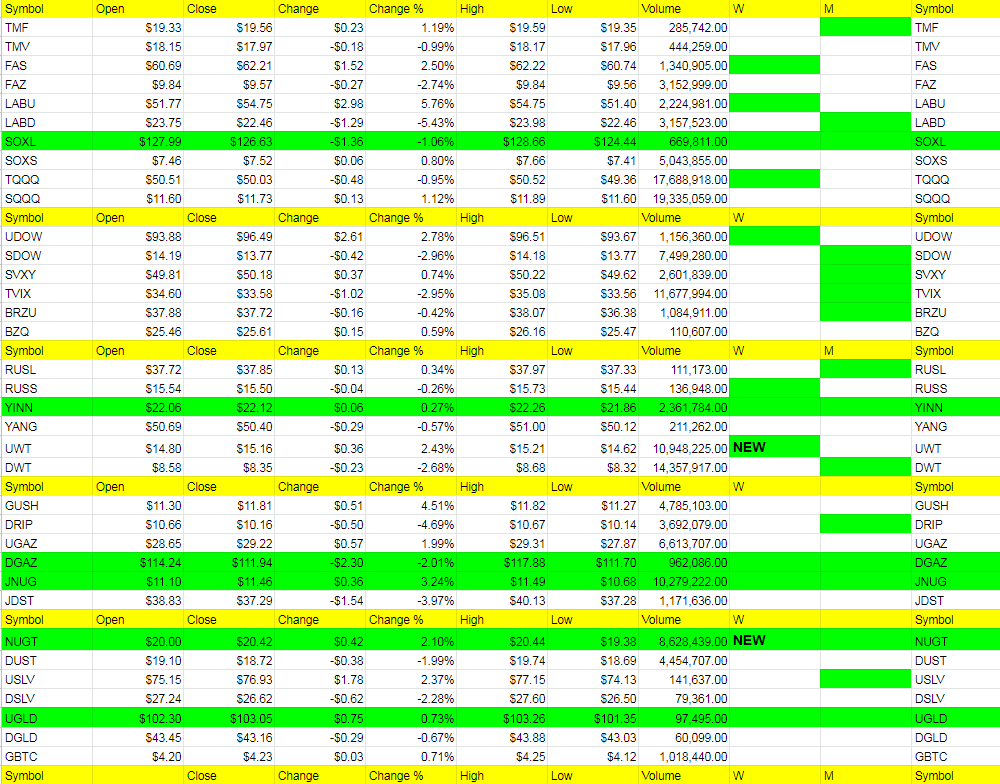

Oil still has a destiny with 51 but is somewhat bullish with the market as we can see. It should fall with the markets. Unfortunately UWT went to a buy so we need that market to turn south quickly.

Meanwhile gold is showing some bullishness and we do have JNUG as the trend with UGLD, so watch the dollar for clues there. Right now it is below 97 again at 96.78, down 12 cents. NUGT also turned green on the weekly so some longs there may come into play Tuesday.

Nat gas is due for a potential bounce at some point but the trend is with DGAZ right now.

I want to get back to trading again as I am tired of this current approach, waiting for the reversal. We had one decent reversal day last week where we saw half shares of TVIX go positive for a moment but then a continuation of the move up in the markets with all the China tariff talks (nothing settled) and avoidance of a government shutdown) Trump going after the wall anyway. Meanwhile more talk of Trump/Russia/Collusion. Somewhat a mess and at the same time data has been just terrible for the markets. But if you listen to the bull case for the markets to move higher, they make a good case too, in that markets are ignoring all negative data for now as the Fed provides the liquidity and dovishness post Powell’s 180 on interest rate policy. Markets are simply trading on fluff from the Fed and so far the Fed is winning. We are just looking for a retreat and can get out of the current trades and get long again for the next move up to 2900/3000 in /ES.

It is important to note that SVXY for the second time turned to a sell but went to a buy again. The question becomes, will the 3rd time be charm and we get the sell signal on it again and some more long the market ETFs this week. Should be a wild one as usual with Fed minutes. But we pretty much have all Fed euphoria priced in so I do think we get a pullback to exit. Prefer it to start now not from a higher level on Tuesday. We do have sells still on BRZU, YINN and RUSL so let’s see if that carries over into this week for the U.S. markets.

I glanced at all the Elliott Wave charts and they all say the same thing, a bigger move south is coming. They just can’t agree on where the top is. Futures are at 2775.88, -1.12 as I type.