ETF Trading Research 5/2/2019

We had another whipsaw kind of day with a slight push up in the morning after we got out of our overnight holds with some profit, then a big push down, then another push up. Not the best for trading.

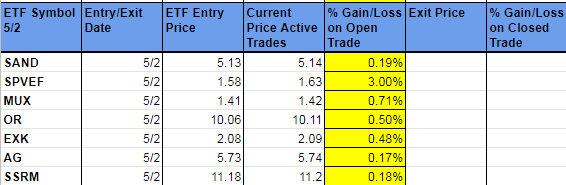

Was hoping for a bounce in metals and miners today and we did get one but it had no follow through. I did however call us long in some miners for 50% allocation. We have been beaten down 39% from the highs of our last buy where we got about 27%. So we are buying 12% lower than our last purchase. The dollar will be the key short term here and we’ll look to add to the position on a dip to get sentiment below 20 or 10 for gold and silver. It’s about 37/33 now (as of last night).

Here’s where we stand.

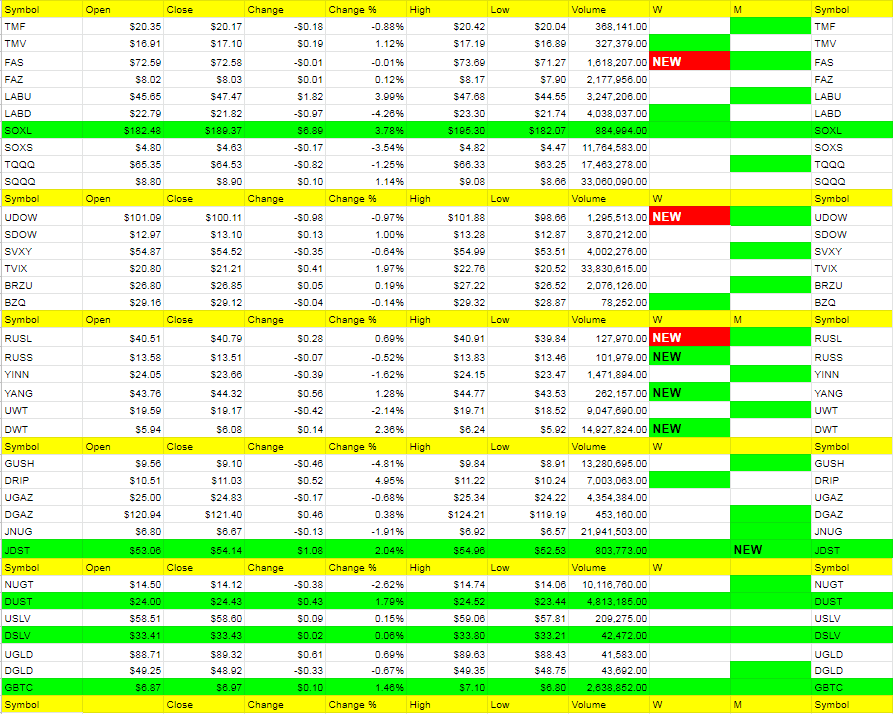

DWT is officially in buy the dip mode.

Nat gas still neutral.

Markets themselves can dip first and move higher or just move higher. Only reason I went flat overnight. Fed did a lot of dumping of their balance sheet the last week, taking advantage of the uptick.

I don’t see a significant pullback, but we will get short the market or long the market after employment data tomorrow. If bad, unlike today’s bad jobs data, gold and miners should pick up. And market should fall.

I wanted to hold some miners into the report after today’s data but decided to go home flat.

The market is a much easier short if we break 3000 and on the way back down than from here. That’s the big picture.

And gold sentiment down under 20 and maybe into the teens. Worth waiting for after we try and scalp some profit here on current trades.