ETF Trading Research 5/5/2019

With Trump opening his big mouth over the weekend here, we have futures down to an area of 2880/2885 that is a buy area if you use 2880 as a stop. Even if we did break 2880, can keep a little wider stop if you buy at the 2880/2885 area. Otherwise, something bigger is happening and most likely after a few attempts to move higher fail, we break 2880 and the wheels would then come off the bull bus. Since most of this moved south occurred overnight, only bulls have got hurt by holding over the weekend. While we didn’t catch the move lower, we didn’t get hurt either and can catch the rebound back up if market makers allow it. They sure as heck might but China already causing a bigger stir, which is to be expected.

Gold was up $2 then $4 and now back to $2. Dollar up a nickel.

Oil getting hammered as well helping push the market lower. Oil has been on a sell signal.

Nat gas we only follow the trend and we got a new sell signal one (DGAZ) can lean towards.

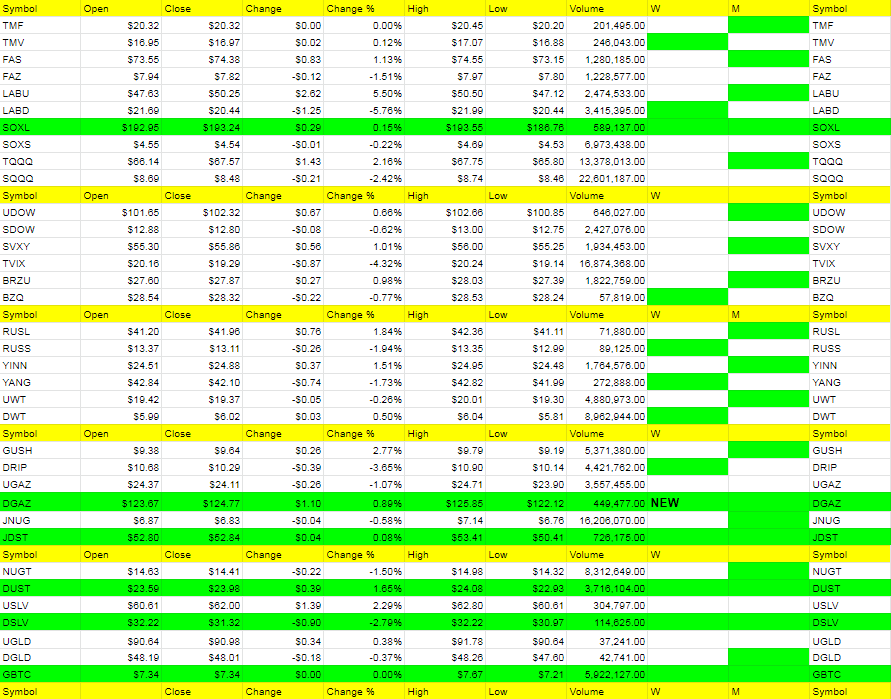

We will get some red signals I’m sure tomorrow in TMV and SOXL.

Interesting how foreign ETFs signaled sell first though. BZQ, YANG and RUSS.

See where we are in the morning but as long as we stay above 2880/2885 we have to consider that a bounce is coming for the bulls again. But below 2880/2885, bears finally take over.

Can make those trades a few times per above, even if stopped out the first time.

Gold should fall with no China deal as well. Will see how the dollar plays out but happy to buy lower if we can get a move lower and the nightly report still points to lower.