ETF Trading Research 5/18/2017

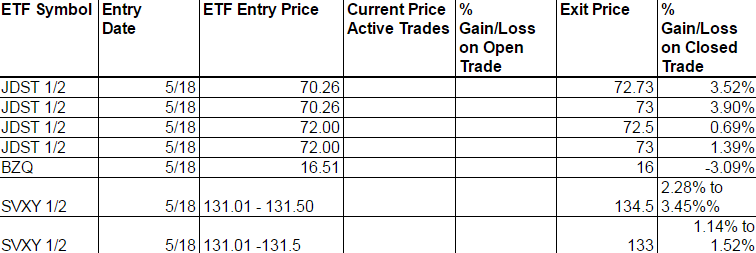

Current Positions and Today’s Trades

Got a few good trades in JDST and one in SVXY that we missed at the open, and one attempt at BZQ that didn’t pan out. Light on our trades but a few good ones a day is what we look for till our green weekly’s come. The new Green Weekly’s struggled a little but still not out of them and holding on for the potential of the trend reversal lower in the markets. See below for Green Weekly’s.

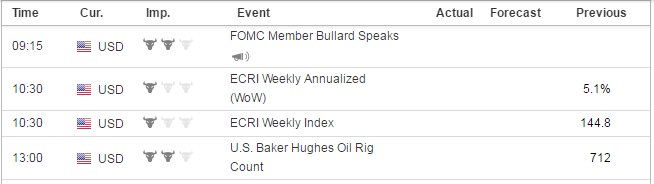

Economic Data For Tomorrow

Not much data tomorrow except for one Fed member and the Oil rig count.

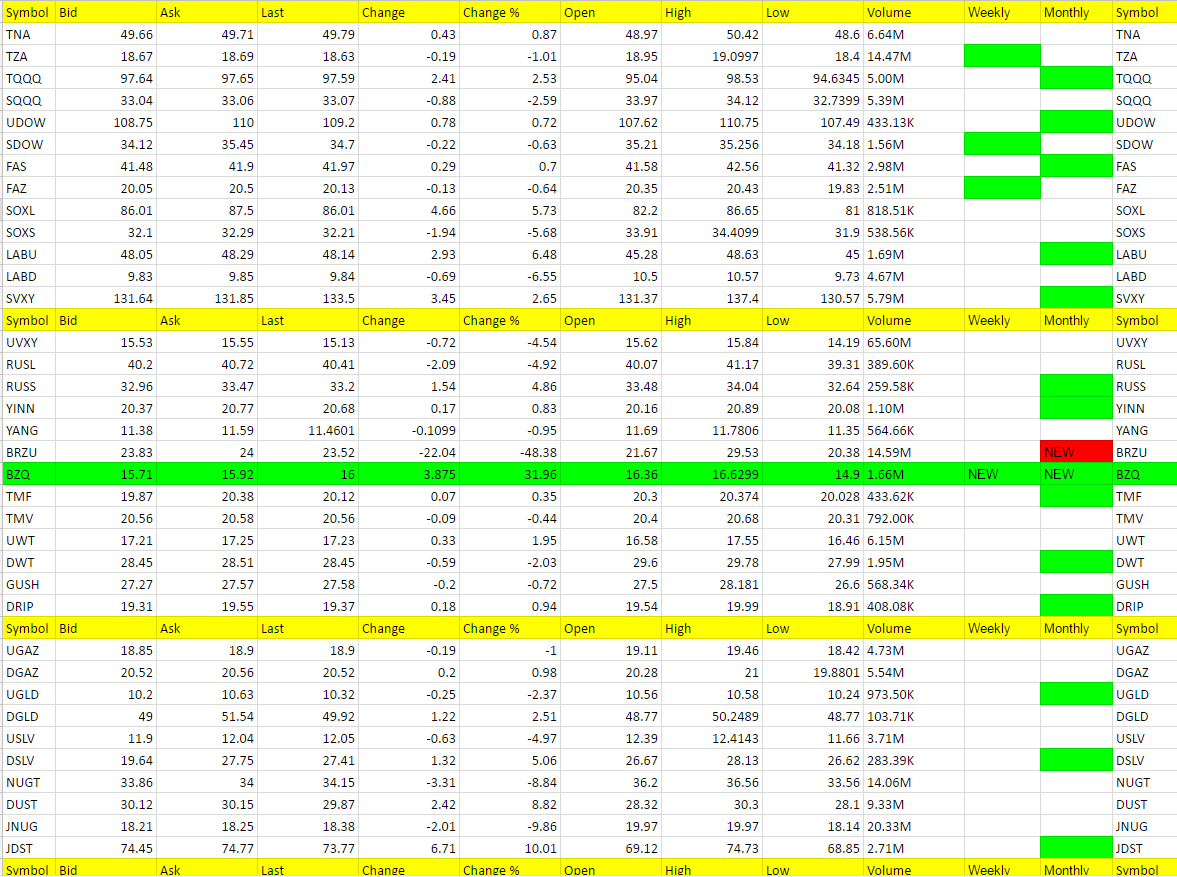

I said yesterday; “We should keep an eye on BZQ, YANG (YINN just turned red on weekly) and RUSS.” Boy how I wish I had called us in BZQ which was up over 30% at one point today. Will keep an eye on all of them and look for a long possibly.

Interest Rates

TMF was up today with an up market which I found interesting. Still liking it and we might enter the next down day we have, Friday or Monday.

Energy

Data came out negative for Nat Gas but UGAZ went higher at first, then lower. Go figure. We’ll wait for a trend.

No trades in oil at present but leaning long UWT until OPEC meeting on the 25th. Let’s watch it tomorrow for an entry possibly.

Precious Metals and Mining Stocks

Got some good trades in JDST and will be a little more cautious on that while we wait for the entry back into JNUG, NUGT, USLV, UGLD. Consider these declines in these four a gift to us that we will eventually profit from.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

BZQ, JDST, DUST, LABU, SOXL, DSLV, RUSS,

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

BRZU, JNUG, NUGT, LABD, SOXS, RUSL, USLV, UVXY, (BRZU turned red on the weekly today.

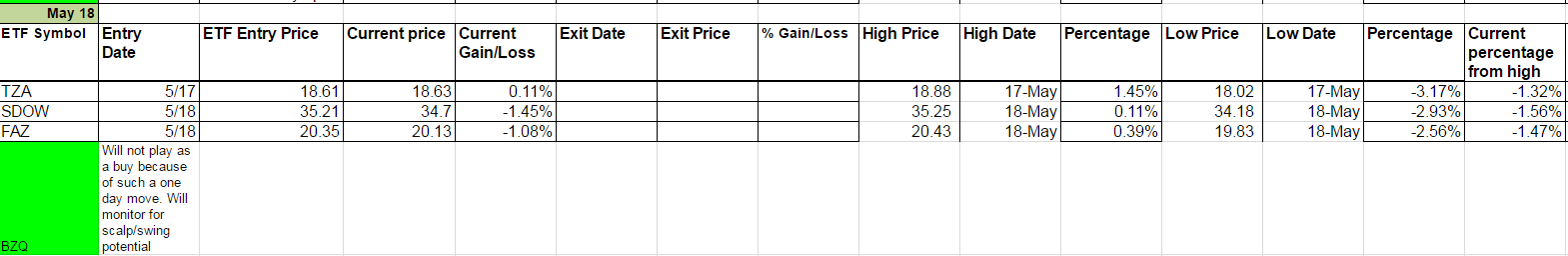

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.