ETF Trading Research 5/23/2017

I wanted to take a moment to talk about JDST and what market makers do so you can understand a little bit how we can play their game and win. I am sending what I wrote at 2:23pm and again at 2:54pm.

Gold fell hard below 1255 to 1251.70 here and silver is now down 12 cents as the dollar popped even higher. We should move up the rest of the day from what I see and gap up tomorrow where we might take half shares off. Could be a nice gift.On the stop side I still have it in at 1 point. The last thing I want is to have a stop out first, then have it shoot straight up, so I will make this a wider stop. There is NOTHING that tells me this will happen or we all of a sudden reverse here. Nothing. If anything, the opposite. We shoot up to 80 maybe. Dollar has done nothing but go straight up now to 97.28 and has a ways to go there too. Market makers can make some easy money though bringing it down first and getting panic sellers. For that reason I will widen the stop to 2 points and take that risk of not getting stopped out on a mini reversal market maker move.We will be looking at JNUG soon enough but I don’t think we are there yet. NUGT too. In fact I will switch to NUGT only until this GDXJ re-balancing act is over come June.Reference NUGT is 33.98 and JNUG 17.35 and JDST 77.52, bouncing around a bit.

In a perfect world, we in the last 5 minutes move up over 77.50 and even 78 on a big spike.We would have got stopped out with original stop but are higher than that stop presently. See if we get a move.

JDST had broke higher to 78 from our last entry at 77.50 but started to get weak again. I had written when JDST was 77.28 what might happen and moved the stop lower than 76.50 one point so we wouldn’t get stopped out and have market makers run it higher. Sure enough they did move it below 76.50 by a little bit and then we had a run into the close and hit exactly the 78 mark I mentioned in the 2:54 alert. It moved up and down right at the close and shortly thereafter but it now at 78.27 in after hours trading. We will sell half at 80 in the morning on a spike up and not get too greedy and use a trailing stop on the remaining shares of 1 point.

There wasn’t enough reason for a market maker to push us around after profiting so much earlier in the day, so we took a little more risk and now should get rewarded. It is best to do this when you are up on the trade overall, or in this case with gold see that the dollar is up and gold falling to give us that added insight.

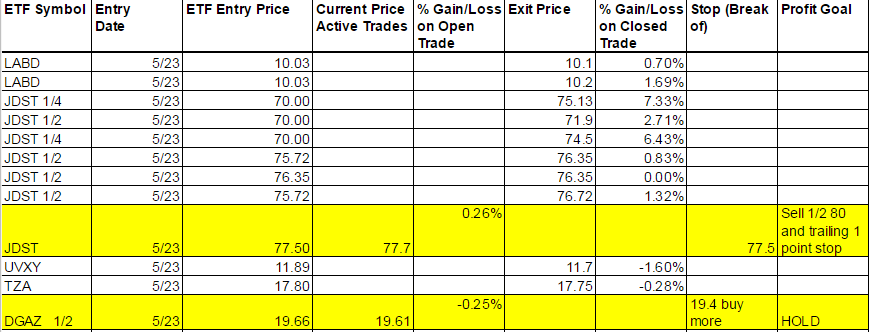

Current Positions and Today’s Trades

This morning there were a few ETFs I could have traded early on, and should have, including BRZU and DGAZ, where we could have got in later. I wanted to micro manage JDST though and see what we could get from LABD and while we did well there, I have to admit I can’t get them all. But the good news is we are making life simpler for me internally by rolling out an alert system that will get trades to you faster on the Illusions of Wealth website, and I will no longer have to punch in numbers, take screen shots, save, copy, paste, and use 3 more stops just to get an email alert to you. All of us will be happy with the new system and we’ll look for your input to always improve it too.

We tried 2 trades close to my cut off time of 1:30 where I don’t like to make new trades, and those two didn’t pan out. I thought we would get some reversal in the markets as UVXY broke higher, but it didn’t come. Only a small loss in TZA and a bit bigger in the always volatile UVXY. But anyone who trades UVXY knows they accept the extra risk associated with it. SVXY I did’t put in the sheet below but it only moved up 50 cents and didn’t offer much if you took it.

DGAZ I am liking here and now adding shares if it goes lower (which I don’t really mind) at 19.40 or lower if you can get them tomorrow. Down a hair on it now and a bit more after hours.

LABD took its time but we did manage to get the 10.20 mark to sell half and the high of the day was only 10.21, so nice there. Stopped out of the rest.

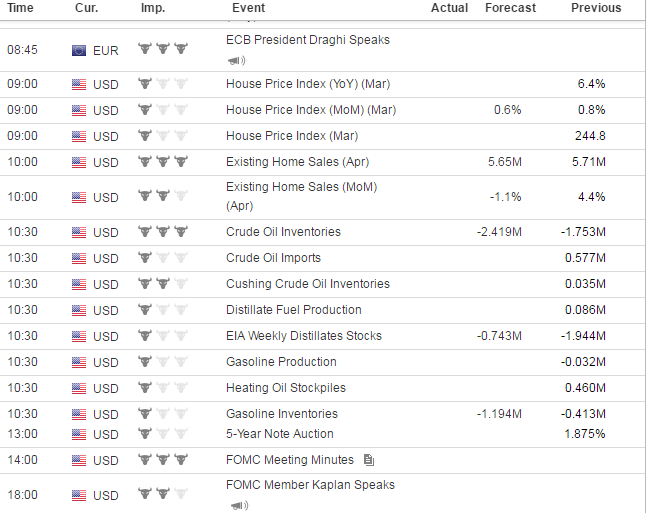

Tomorrow is all about the Fed minutes but we also have the ECB’s Draghi speaking, Existing Home Sales and Crude Oil Inventories before the 2pm FOMC Meeting Minutes.

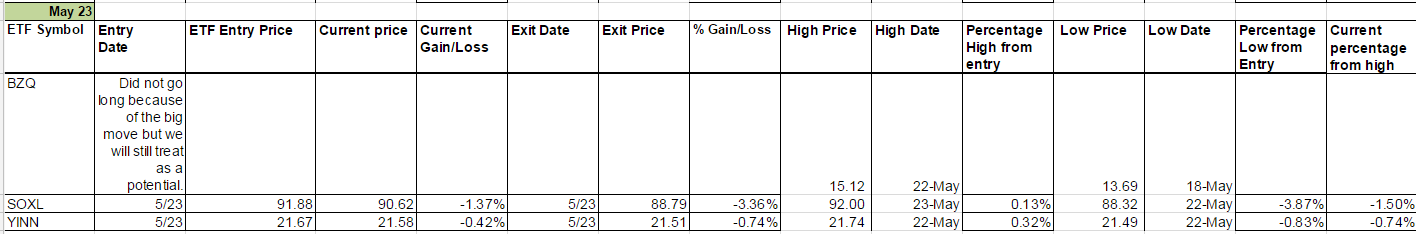

Ignored BRZU today just because there was one piece of red data today and it had me ignore what could have been a good trade for profit.

YINN small stop out loss. Can still day trade just in case it reverts. The process would be to buy at the open is up from the close the night before. This should be a standing rule as well.

We haven’t talked about RUSL or RUSS in awhile but I do think they will give us a trade soon enough.

Interest Rates

TMV higher with the market. Once I got us out of TMF the other day, I should have put a call out to TMV. It was an easy call to make too as these don’t move too fast.

Energy

I wanted a little higher in UGAZ before a long in DGAZ and knew we were close, but we didn’t get the move higher and DGAZ took off. We are long and will manage it closely here, trying to scoop up some more shares lower if it comes but still keep a stop. I 100% want to keep this trade on though if we do get stopped out. Meaning we should fall in price for Nat Gas and DGAZ should get us a run. So buy back just 10 cents higher from your stop out on a reversal back up. If we just move higher, then adding to a winning position the remaining shares is easy to do.

Could have called UWT a couple days ago but didn’t trust too much with OPEC volatility. We have the data tomorrow and if it is bullish for oil, BUY UWT! We will try and have a price set beforehand. UWT over 19.50 is the early call. 19.24 now.

Precious Metals and Mining Stocks

I wrote yesterday that I’d like to see if JDST had one more leg in it to move higher and it did. We will look to sell tomorrow and lock in profit and as gold gets to 1245 look to start buying NUGT. Some of you may use JNUG as your buy, but that is up to you. With GDXJ rebalancing it may make NUGT a more attractive call so we will use that from now on. It will be hard for me to look away or even accidentally mention JNUG though.

Silver finally had a pullback today and on this dip we will look to get long USLV and DGLD again.

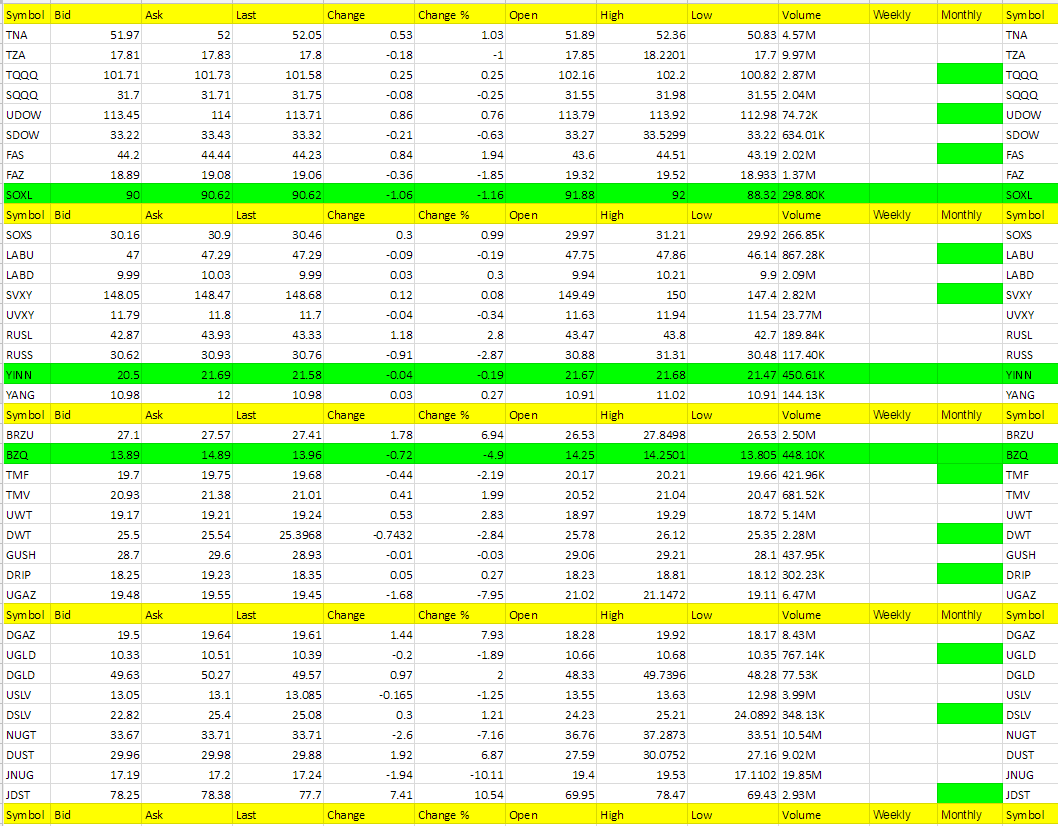

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, DGAZ, BRZU, DUST,

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JNUG, UGAZ, NUGT, BZQ (didn’t have UVXY 3 days in a row on this list so maybe watch it tomorrow).

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.