ETF Trading Research 5/25/2017

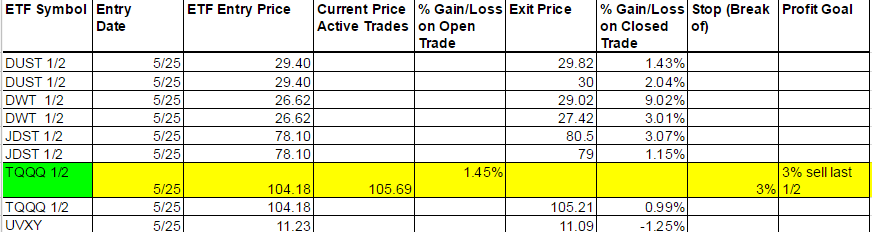

Current Positions and Today’s Trades

Today we made up for not getting into the JNUG/NUGT trades by profiting from the opposite side in JDST and DUST. With JDST we let the price come back to us and didn’t chase pre-market and DUST actually wasn’t a bad price to get pre-market. I said in Sunday nights report that DWT would be the trade of the week and it took a few days but eventually we got to today and bought in. Even though it started moving lower from the open, moved up and hit another low, we stuck with it. The new green weekly did well for us and yes, the last 2 green weekly’s YINN and SOXL were up again. Still upset I kept too tight a stop and sold out. Tried one trade in UVXY and said if I removed it from my list of ETFs we trade, it would make for a more profitable service, lol. But I did last time say it would move 30% and it did in one day and I will say it will do so again sooner than later and this time I want to get more out of it than last time, so that’s why I still take shots at it.

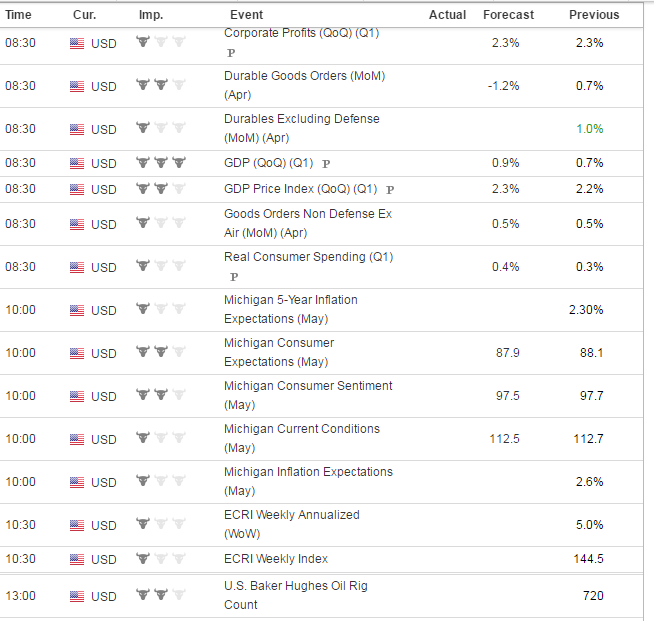

Tomorrow is all about the GDP and it comes out early. Also Durable goods. For the oil trade we have the usual After the market opens at 10 we have Michigan Consumer Expectations and Sentiment. U.S. Baker Hughes Oil Rig count in the afternoon. Today’s negative data, which even CNBC’s Steve Liesman confirmed was bad (hard for him to do), didn’t matter to the markets. I do have to give Rick Santelli some credit for turning from an almost looking at the market negative guy to looking at it positively. I accused him of getting paid more for his bullishness as he used to always fight with Liesman, but I have to say he is a straight shooter and will be back negative again when the market is ready to turn.

Yesterday I said that BRZU spent 2 days on the Hot Corner and that we might look for a reversal, but unfortunately didn’t call BZQ which ended the day higher. It’s ok for you to think for yourself and go long these trades when a reversal goes green. I give my insights here when I am tuned into the data each afternoon, and may not “catch em all” to use a Pokemon saying (taught to be me by children). I would like to be able to catch every trade, and some of you write to me with questions on some of them, so if I miss something, feel free to ask; “hey, what about?”

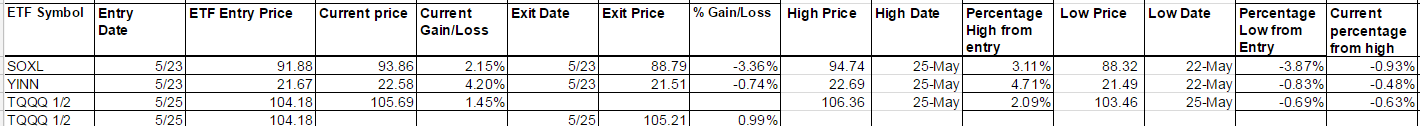

Yesterday I said “YINN didn’t do much today but is still green on the weekly and you can buy at the open if it is higher.” YINN made most of its move overnight but it did end up a little higher.

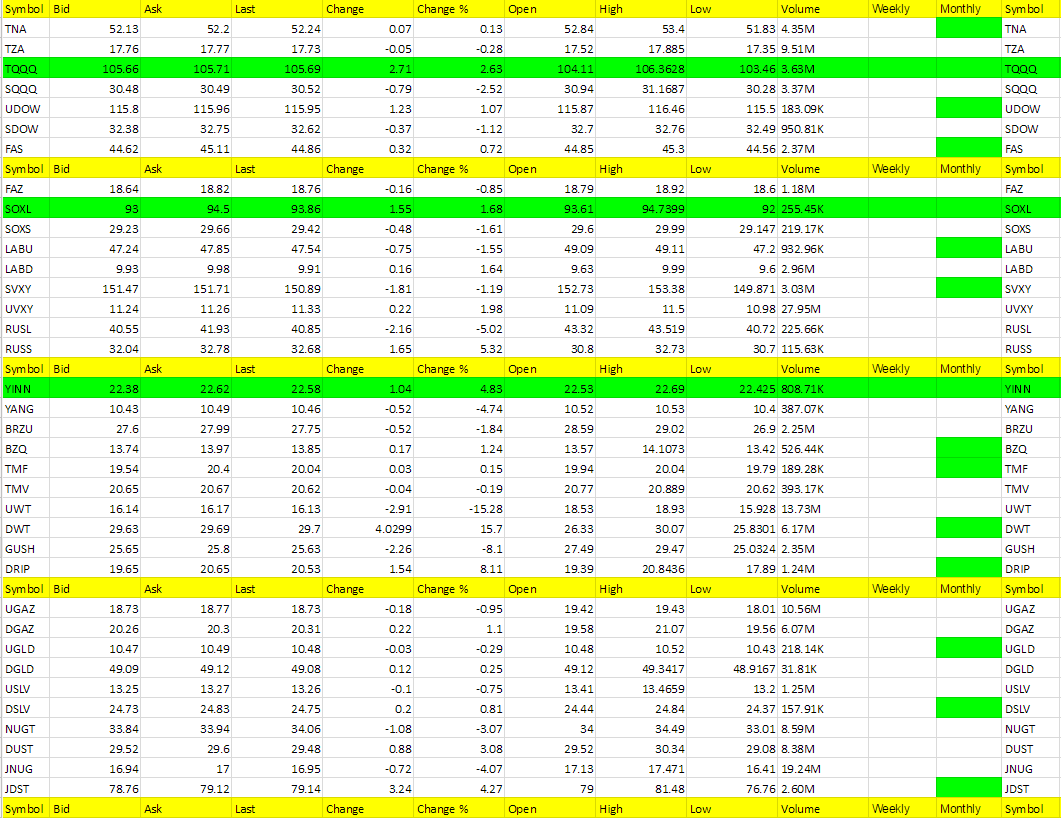

Yesterday I said; “We haven’t talked about RUSL or RUSS in awhile but I do think they will give us a trade soon enough.” Missed the trade in RUSS today too. It opened at 30.8 and went as high as 32.73 and we should keep an eye on it tomorrow.

I prefer to have all of these on the same side; RUSS, YANG, BZQ and RUSL,YINN, BRZU. We don’t have that at present.

Interest Rates

TMF was a little higher again today. But FAZ isn’t confirming for a short trade. This correlation isn’t working right now.

Energy

The Nat Gas report came out negative for nat gas and didn’t give us the long trade in UGAZ I wanted. DGAZ might have got us a scalp but I did ignore them. Might have a better chance at a trend developing tomorrow, but since there is no trend, any trades in these is more risky at present.

We got in DWT and came out smelling like a rose with our scalp of 3.01% and held out for 9.02% on the last half of shares. We have seen the over 50 long UWT and under 50 long DWT play out a few times and we’ll look for a bottom in il and go long with UWT at some point. Right now we want to see if DWT can continue helping us profit now that OPEC is finished meeting.

Precious Metals and Mining Stocks

It was funny how gold stayed steady all day yet we did well with JDST and DUST. It was mostly because they traded inversely of what the dollar was doing. We will look for that tomorrow again but GDP may dictate our trade differently. Know more after that but watch that dollar’s reaction to the GDP number then make your trade.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DWT, DRIP, RUSS, YINN, JDST

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UWT, GUSH, RUSL, YANG, JNUG, NUGT – Keep an eye on GUSH for a pop at some point maybe tomorrow.

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. You’ll notice in the last column on the right it says “Current percentage from high.” This is your normal stop out for any ETF where I don’t specifically call it per the Trading Rules which lists the trailing stops for each ETF. It is a Trailing Stop percentage from the high and I have noticed the pattern that the closer it gets to 5% the sooner the ETF turns red on the weekly.