ETF Trading Research 6/03/2019

We took profit as soon as we could today on our weekend shorts and came out ok. From there it was a move up, move down, move up, bigger move down, and end of day to after hours a decent move up where /ES sits up 4.25 off the close and only 10 points from the high put in today. Trading that kind of market isn’t easy, but today we had the Fed interfere on the positive side and then the White House interfere on the negative side.

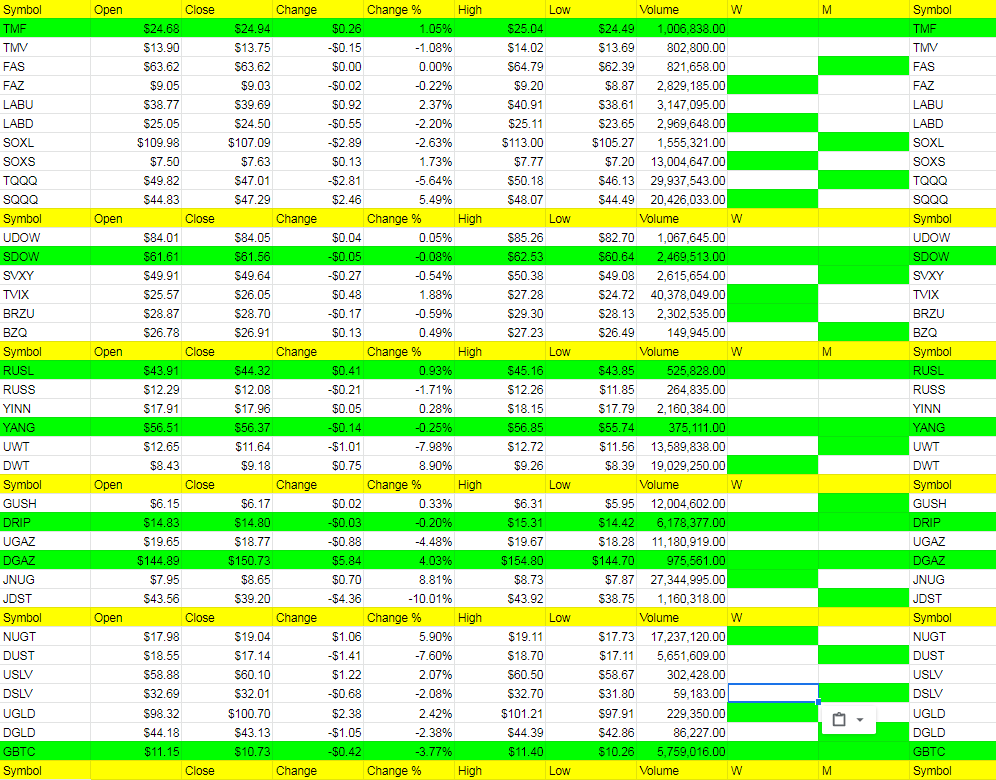

Fed board member Bullard came out and said they would probably lower interest rates next go around and /ES shot up over 10 points. We were long SOXL and immediately saw it go up over 2.5% then fall quickly. Why? Because the Trump White House went after both Apple and Facebook. We got out with some good profit but went to the sidelines until one last trade where we scalped a bit. All in all a good day, but bigger picture we are still looking to short tomorrow this move up in the market. See where we land with TVIX, but because of the attack on tech, SQQQ had a great day.

We were long metals and took our profit on half early on, but wanted to let the rest ride higher. Unfortunately my system sold all of JNUG rather than half and I had the stop too tight on NUGT and the 1% stop triggered before the open and before it took off. I didn’t want to chase at that point as I thought with the market moving up, it would hurt metals and miners, but then Bullard spoke about lowering rates and metals and miners shot up more. We didn’t chase and they are off their highs.

The DGAZ buy signal last week is seeing it move up even more as nat gas is getting hammered. Many who are long are wondering where the bottom is. We will turn our attention to UGAZ soon I think. Hasn’t warmed up here in San Diego at all and it is already June. I look at the Cubs games at Wrigley Field in Chicago and it’s the same. Chilly.

Going to be an interesting day tomorrow and most likely will look for a spot to get aggressive short again. Lot’s of issues out there in many areas that should push this market much lower possibly.