ETF Trading Research 7/13/2019

I’m always trying to put pieces of a puzzle together and I found an interesting one that is worth mentioning. As the DOW breaks to a new high over 27,000, the World Series of Poker this year had its second highest number of entrants. The last time it had this high a number of entrants was in 2006 and shortly before some sort of crash that culminated in 2008/2009 market lows. There are many other signals out there. Real estate is topping led by a fall in housing stocks (small move up recently but I think close to topping again). Consumer debt has topped the 2006 levels to over $1 trillion. Fed is lowering rates at a time when there is no need to. Why the heck would the Fed lower rates when according to them and Trump, the economy is doing great. Well, employment is doing well, but the underlying economy mostly of other countries where they have negative rates occurring, might be the real story. It might be the Fed lowering rates here so too much money doesn’t flow to the U.S. as it has been, fueling the stock markets to all time highs. Even gold and silver have caught a bid of later, especially the miners, but there is more trouble ahead for those and the markets and our nightly report will lead the day. Follow it and prosper.

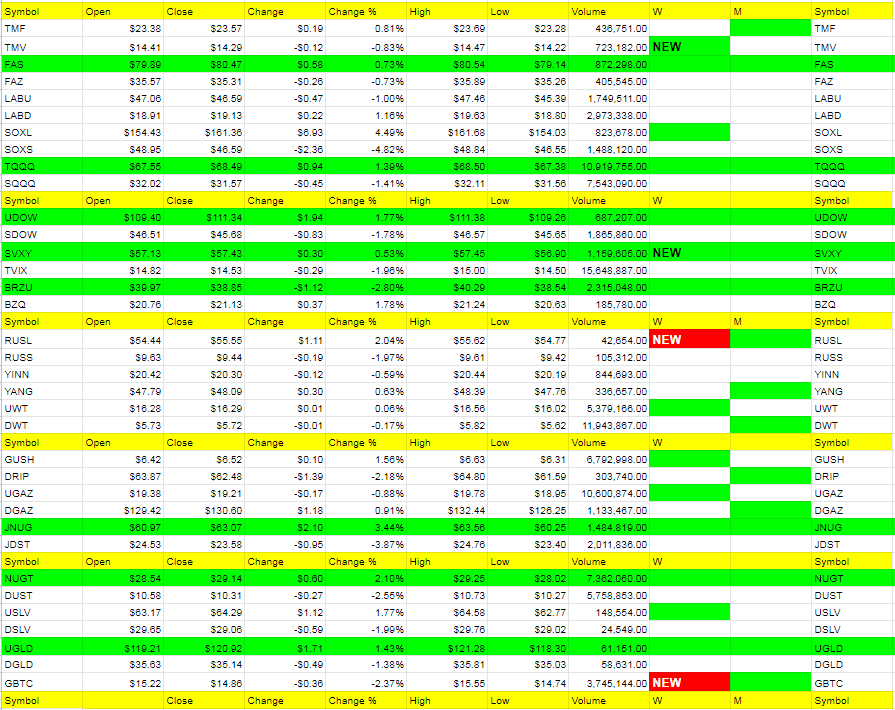

There were no real trades given on Friday. You might have got long DUST for a little and miners perked up a little, but overnight here gold shot up to 1421 and has fallen since to 1414. Futures up a point.

See what the week brings but mostly the markets will wait on the Fed once again and we’ll see if the Fed follows through with a rate cut. Either way, a .25 cut is priced in and there is absolutely no reason for them to do a .50 cut, so we will look for some red to appear in the nightly report and when it does, start leaning south in the market. We are getting some higher rates too and that isn’t necessarily good for anything. Please, please, please pay close attention to TVIX the next 2 weeks. We’ll time it the best we can.