ETF Trading Research 7/13/2017

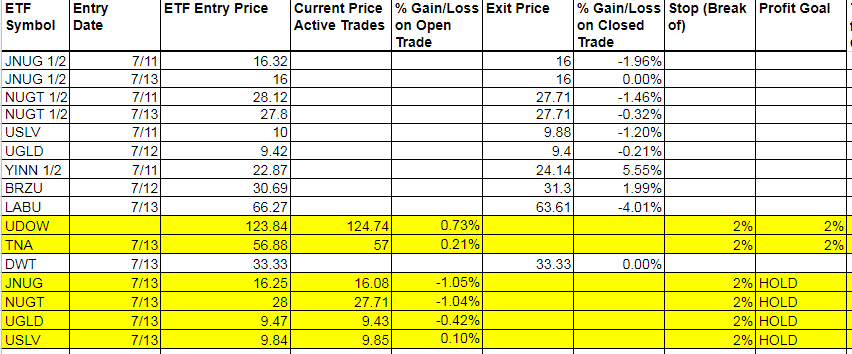

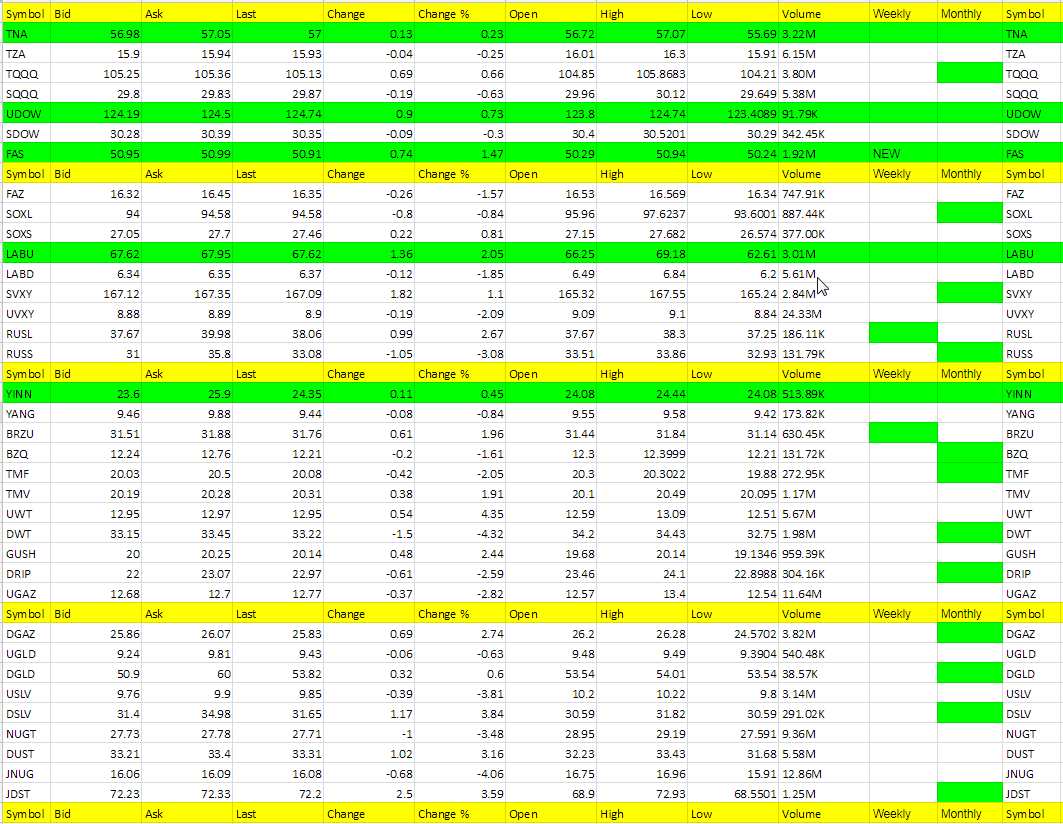

Today’s Trades and Current Positions (highlighted in yellow):

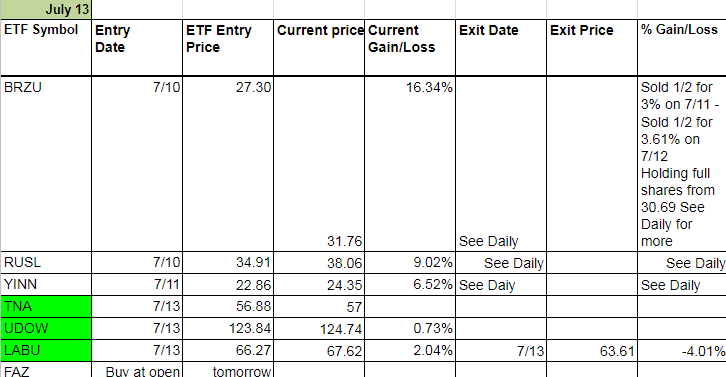

I wanted to day that I had a subscriber tell me he has doubled his account with my calls. Those who have been with me awhile know my weaknesses and stick to the Trading Rules. I admit my own weaknesses, and know my mistakes as well, but the real money is typically made with the green weekly’s. And yes, I keep analyzing on how to play these darn green weekly’s that don’t move up immediately, like LABU today, so we don’t miss out on those. My Trading Rules keep evolving for the better. But one I keep breaking is to not just scalp the non-green weekly’s. We actually did scalp JNUG and NUGT yesterday, and we could have easily twice today for 1% to 2% each time. And technically I should be taking these miners home, but last night’s move below 113 in the USD/JPY really had me concerned about missing the run up with full shares. I kept our 1/2 shares this morning because of this concern when I had already typed out the sell. Should have stuck with the sell. Now we’ll see if we can get lucky on the overnight hold with some USD/JPY weakness. Still a difficult spot. We may just hedge with JDST though. I had a trade on with JDST that did trigger but I had already removed it from the list. Wouldn’t have got much out of it anyway.

I am also still tempted to make some calls on some beaten down ETFs. It should be a new Trading Rule though to NOT play a beaten down ETF unless it is 2 days on the Cold Corner. This might get us some good trades in the high flyers at least.

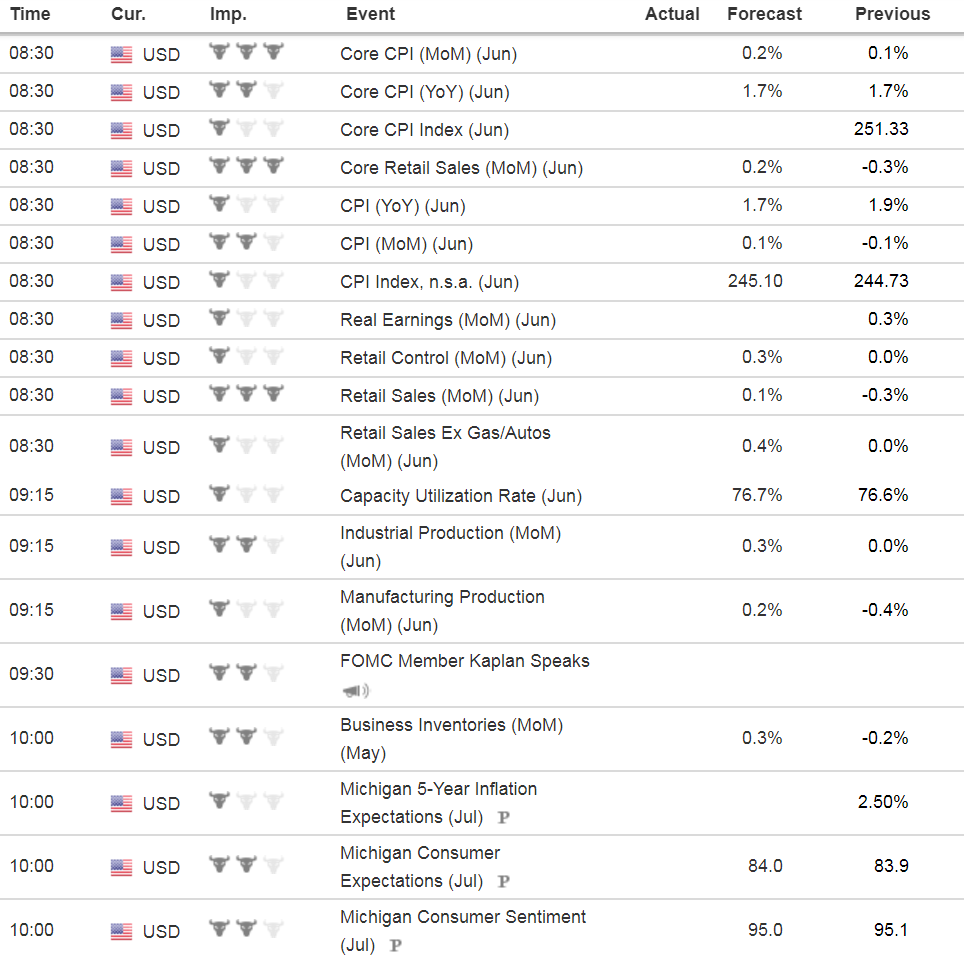

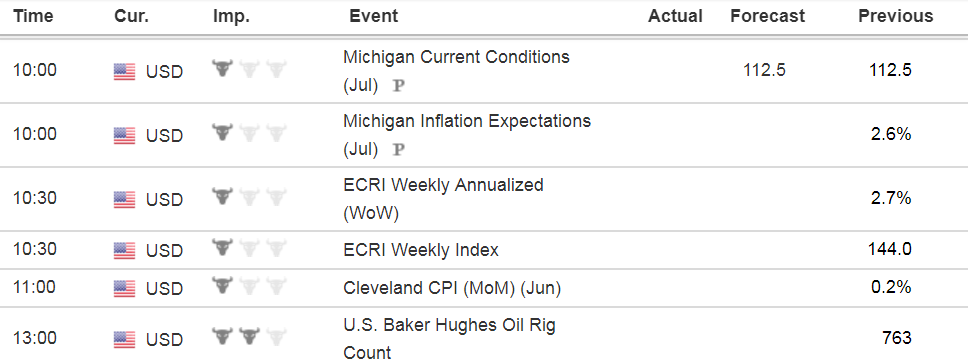

Economic Data For Tomorrow

Tons of data tomorrow with Core CPI, Core Retail Sales, Retail Sales Jun, Fed member speaking, Consumer Sentiment and Expectations, Industrial Production and Baker Hughes Rig Count.

Today was 100% a professionals day as we saw futures rise, fall hard and rise again along with LABU and even TNA fell at the open but finally triggered for us. End of day was actually a positive for the markets but I still want to lock in 2% on TNA and UDOW as these moves up I don’t have as much confidence in.

Interest Rates

TMV might have been a false move as well with Yellen speaking, but TMF will pop igher with metals so use it as another indicator to confirm metals will be moving higher tomorrow.

Energy

DGAZ I could have called for a trade today but just referenced it.

DWT didn’t quite cut it so might switch to UWT tomorrow on any strength, at least until the rig count.

Precious Metals and Mining Stocks

The Yellen dovishness didn’t last long did it? USD/JPY moved up and metals lower. Said it 100 times it seems now; need USD/JPY under 100.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, DSLV, JDST (FAS new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DWT, JNUG, USLV, NUGT, RUSS

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.