ETF Trading Research 7/16/2017

First thing I want to say, is crypto currencies like Bitcoin and Ethereum getting hit hard again and have further to fall. Not much I comment on here but in my book I said they weren’t quite ready for primetime. Speculation with money you don’t mind losing, maybe, but I think much lower still.

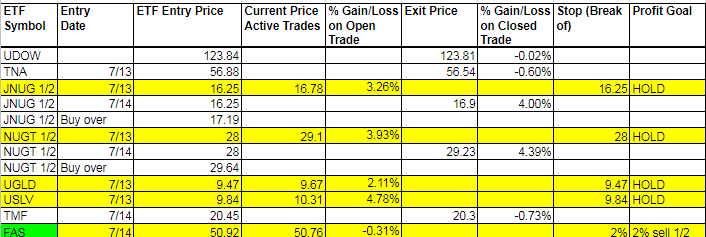

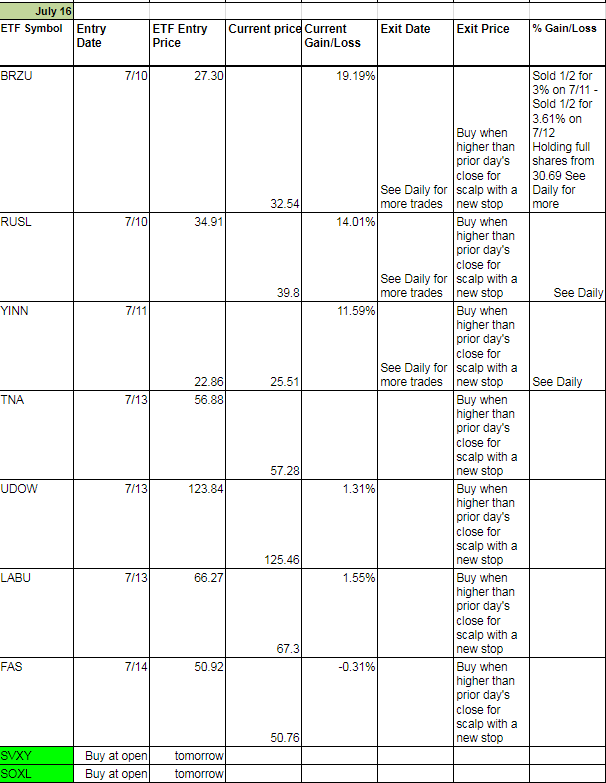

Today’s Trades and Current Positions (highlighted in yellow):

We locked in some profit on JNUG and NUGT, primarily because they were not taking off higher. While we did fall lower in those, we still need to get those 1/2 shares back. Follow the instructions below. Markets are somewhat bullish right now with two new green ETFs triggering. See below.

Economic Data For Tomorrow

No real market moving data tomorrow except for the NY Empire State Manufacturing Index (Jul) at 8:30.

http://www.investing.com/economic-calendar/

Neutral on rates right now.

Energy

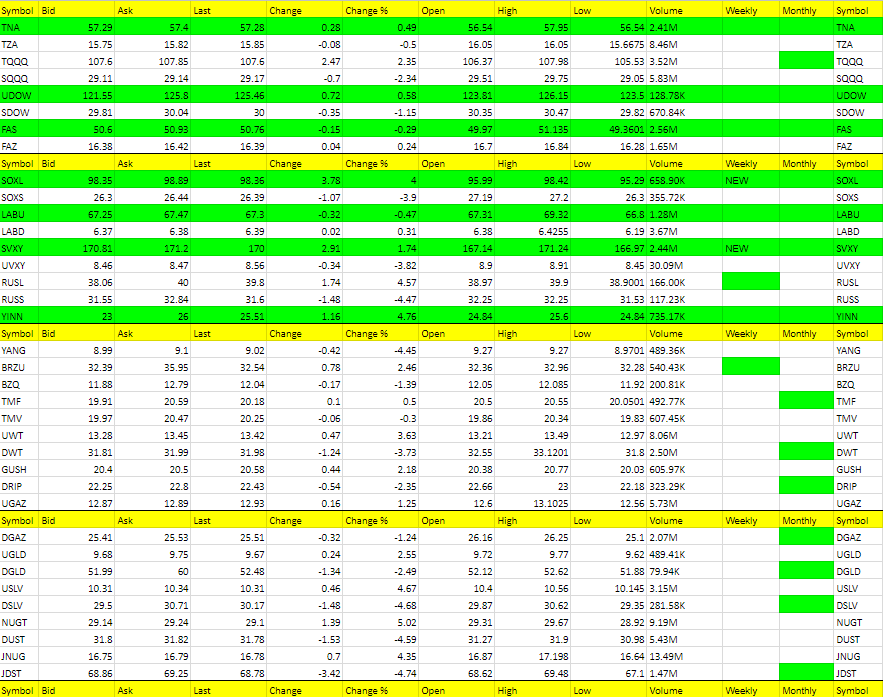

DGAZ and UGAZ we’ll play what is higher for the day but watch for reversals and keep a stop as there is no trend right now. When or if we bottom in Nat Gas, UGAZ is going to take off, so medium term, we’ll get a good swing trade coming. Just have to figure out the bottom first.

We have to lean long DWT at present. I would be a buyer at the open if higher than Friday, or if it opens lower and goes positive.

Precious Metals and Mining Stocks

The USD/JPY moved lower like we wanted. Now we need to see it break 111. Also, gold is up a little in Asian trading and USD/JPY is up a hair. We’ll see what the open brings. I will make a call to buy back the 1/2 shares of JNUG and NUGT at our sell price no matter what. If we open lower, then great, we buy lower. Still long USLV and UGLD and not much will scare us out of those I don’t think. I prefer a down open, but so far it doesn’t look like we’re going to get it.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

YINN, NUGT, USLV, RUSL, JNUG, SOXL, UWT (SOXL and SVXY new green weekly)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DSLV, JDST, YANG, RUSS, DUST, SOXS, UVXY, DWT

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.