ETF Trading Research 7/24/2017

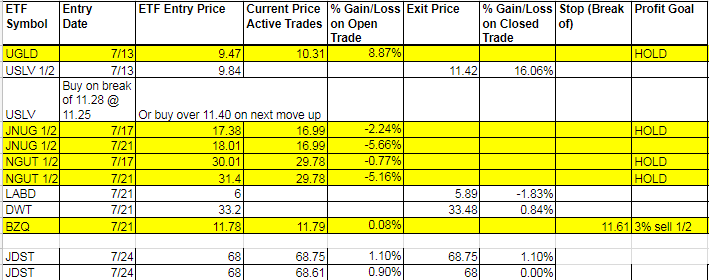

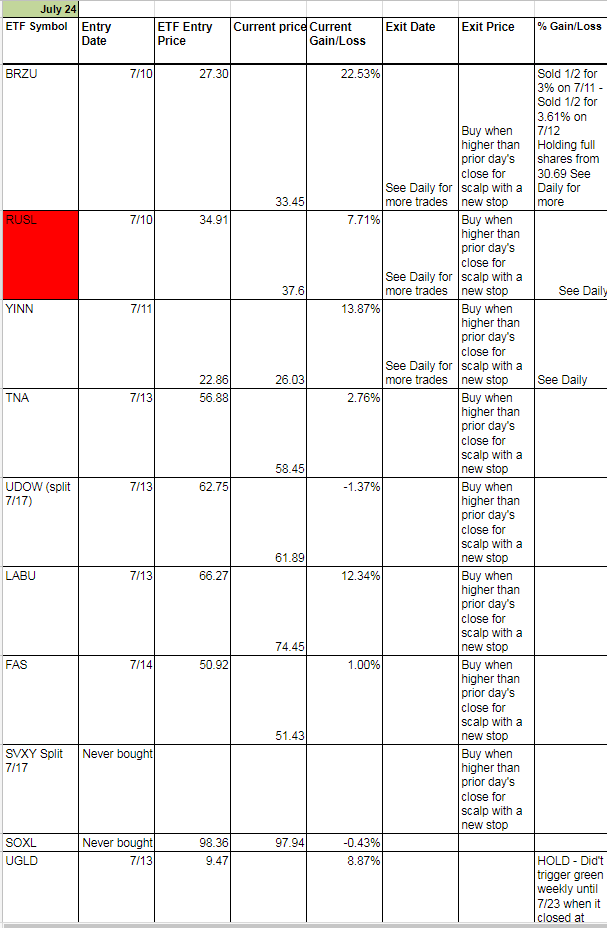

Today’s Trades and Current Positions (highlighted in yellow):

Received a lot of good feedback on the precious metals calls. Fed weeks are difficult to begin with, and I prefer to not even trade them because of market maker moves that push markets around. Today we are at the cusp of a 5% pullback with 1/2 shares of our JNUG and NUGT trade (the second trade). While we hedged with JDST for 1% on half shares, we are at the 5% level where I don’t like holding through and technically, per the rules, should be a stop out. But I held on only because gold and silver did not participate. Also, the USD/JPY didn’t keep moving higher. I figured it to be a one off Fed week move and tomorrow we may very well open lower, but a big move like this is concerning to say the least. When I saw the USD/JPY break 111 and at the same time we reached within about 40 cents of the 1260 resistance, I should have just called us out. My confidence in where we are going medium term, and sifting through this Fed noise and with gold/silver looking good, I chose to stay the course but gave you the best thoughts I could so you could make up your mind on what to do based on your goals.

Repeating this and added it to the Trading Rules along with adding Trailing Stops on day trades and green weekly trades rather than just a stop below the entry point so there is no confusion. Using a trailing stop with the percentages I have on day trades would have had us out on JNUG and NUGT as they have not triggered green on the weekly. I am going to try and stick with this from now on to 1. protect profits and 2. keep us from getting trapped in a falling ETF longer than we want. These rules are a work in progress and I am constantly looking at choices made and creating rules or tweaking rules to allow us to take profits when handed and keep stops when we get reversals. The issue is my bullishness gets in the way of price action and when they collide, it’s especially tough when I look at Fed week as the reasoning, and not a falling gold/silver price. I have said many times, if I want to look good for the service, I would sell right here. As many times as I have said that, it seems like that is your signal to sell it seems. Or if I use the words, “I’m going to get greedy.” It amazes me how many times I say those two things and markets turn, so use that as a signal as well. Check your greed at the door even if I don’t. And know if I was just all about locking in profit and forgetting the medium term picture, I would probably take more profit. Doesn’t mean you can’t which is why I constantly remind you too and give you things like TMF and USD/JPY to confirm what you should do, even if I stay the course.

If we open lower tomorrow we have to have the willingness to sell and get back in or to just ride the storm out. Gold sentiment only moved down 2 but we got a first red candle in awhile on gold just as it almost hit that 1260 mark. While it didn’t continue the selling in the afternoon, miners did and any further move down in gold might take miners even lower. This doesn’t change my conviction of where gold is headed, but I do think a hedge in JDST may be appropriate and we may lock in some profit on UGLD if necessary but we had such a good entry that a move lower with a day left in the Fed doesn’t really bother me. Only the price action in JNUG and NUGT bothers me. If I was just trading GDX mind you, I wouldn’t give a hoot on this pullback as any downturn would just be bought or I would sit through the downturn. But since we are in JNUG and NUGT the moves are more treacherous or exaggerated as you see.

Pre-market I may make a call in DUST since it has a lower spread than JDST if we see weakness. As far as a 5% stop out rule no matter what, the last time I held onto JNUG too long past 5%, got stopped out and it immediately went higher and we jumped right back in. I’m not afraid of making up for losses and gold moving higher is something that I think is coming and it’s just a matter of how long it will take to break $1,300, not $1,260 I am looking at. A couple weeks at this rate, so a grind until then.

The Fed can always wreak havoc and I know some of you are simply waiting until the Fed speaks and will trade accordingly.

In doing some bottom fishing, UGAZ, LABD and UVXY should all be on your radar. For that matter, SOXL and SQQQ too. I noticed TQQQ fell hard at the end of the day. That was a big move and I take note. The headline in tech is “Alphabet missed and stock drops on concerns that revenue growth is going to cost more.” http://www.cnbc.com/2017/07/24/alphabet-earnings-q2-2017.html

Regarding the Fed I think this article sums up my thinking best; Crash in bond markets, Fed mistake are investors’ biggest fears right now, survey finds http://www.cnbc.com/2017/07/19/crash-in-bond-markets-fed-mistake-are-investors-biggest-fears-right-now-survey-finds.html “45% of investors who responded to the survey highlighted a bearish view on markets.”

It’s all about this lady by Wednesday.

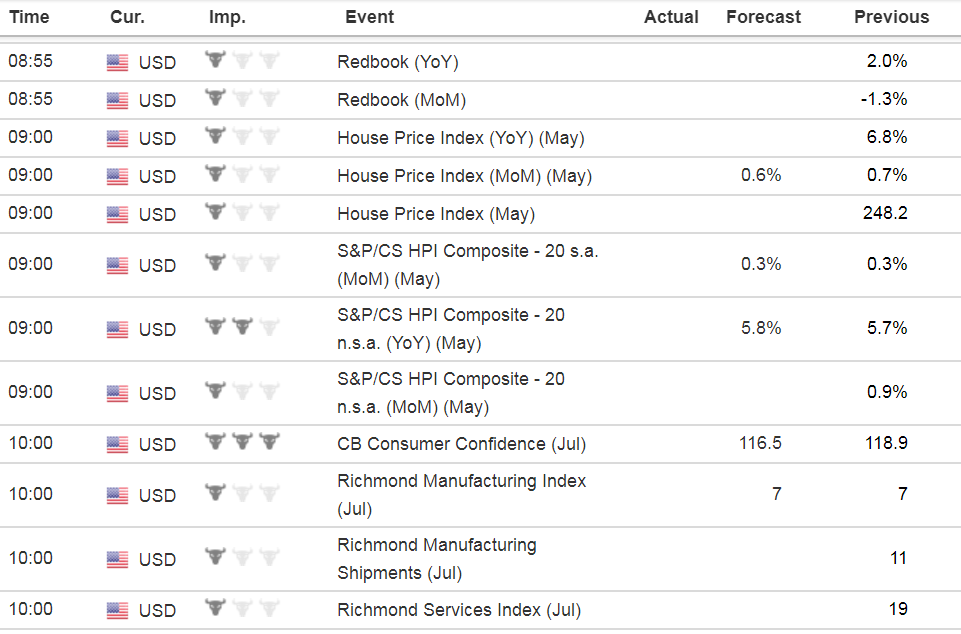

Economic Data For Tomorrow

Lots of data tomorrow but only Consumer Confidence is of real importance. Most traders it seems are waiting on the Fed based on today’s non-action after the mixed data and the Dow just sitting there all day.

http://www.investing.com/economic-calendar/

Energy

Nat Gas still looking for 2.80 break. Maybe we get it by tomorrow and can buy UGAZ soon. I did say pre-market that I leaned DGAZ and it did move up as I was expecting it too, but no official call. Just waiting on the bigger move with UGAZ, assuming this time I am right about a break of 2.80 in Nat Gas. What is making me even more excited about UGAZ is the fact DGAZ has spent 3 straight days on the Hot Corner list and vice versa for UGAZ. Only one time since March have we had a trade not work out for us if we take the Cold Corner 3 day up move and buy it, so any dip in UGAZ tomorrow morning I would more than likely be a buyer of, but be leery of the 2.80 break in Nat Gas for an ideal price buy. Cost averaging may work here too.

Oil is just too volatile to play right now. No calls on it today. Still think we fall back towards 40 at some point for you option players out there who want to take a little risk and have a few months to play with.

Precious Metals and Mining Stocks

Loved gold and silver price action overall and we did lock in our nice profit of 16%+ on USLV and will be looking to buy back the closer we get to 16 or if we break 11.40. Should know soon. But miners see above. Really at an inflection point and hard to decipher, unless you have a couple weeks to allow gold to break 1270 and then head to 1300 which I am in the camp for.

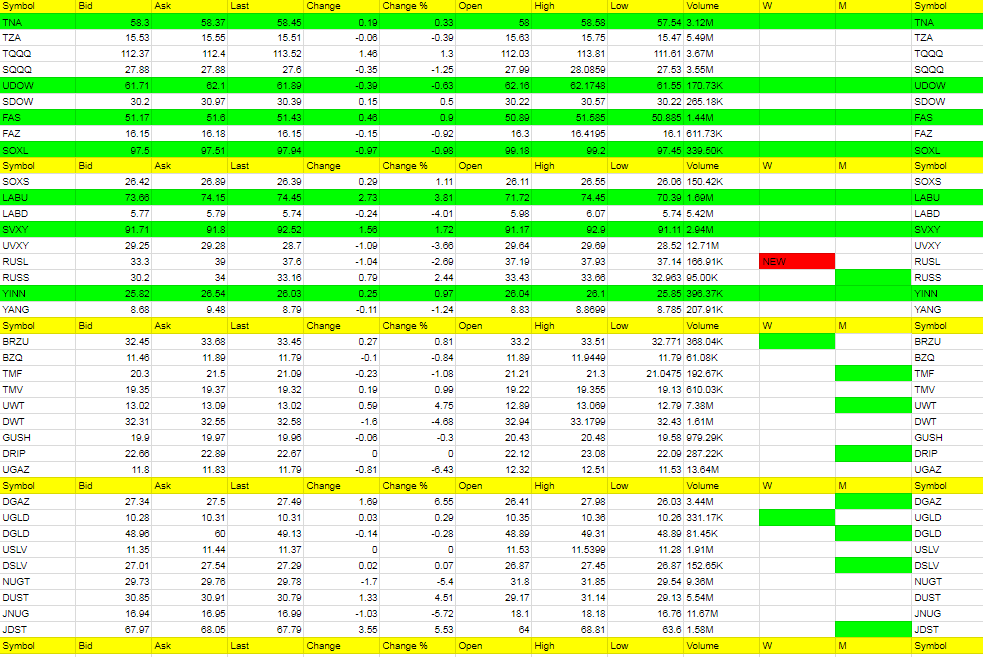

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

DGAZ, JDST, UWT, DUST, LABU

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UGAZ, JNUG, NUGT, DWT, LABD, UVXY – RUSL new red weekly

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.