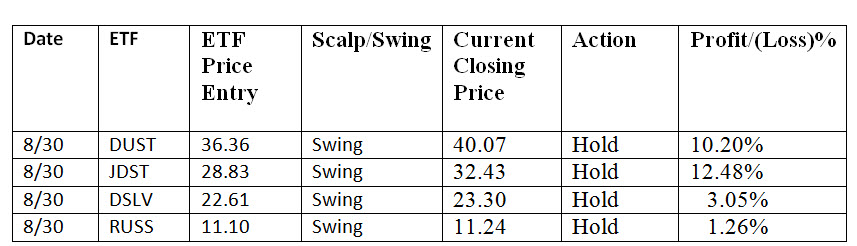

ETF Trading Research 8/30/2016

Friday we saw the pre-Janet Yellen reversal in the markets of the day before trend which knocked us out of our two trades. Then we saw market makers take the opposite play driving the stock market lower, along with gold and miners lower.

Trading Rules https://illusionsofwealth.com/etf-trading-rules/

Today’s Trade Alert

I want the following stops and goals (targets) for these trades now. Just because I set a target, doesn’t mean we will hit it, but these are levels I want to take profit at if possible. Naturally, if you are happy with profit, always take it and wait for the next setup.

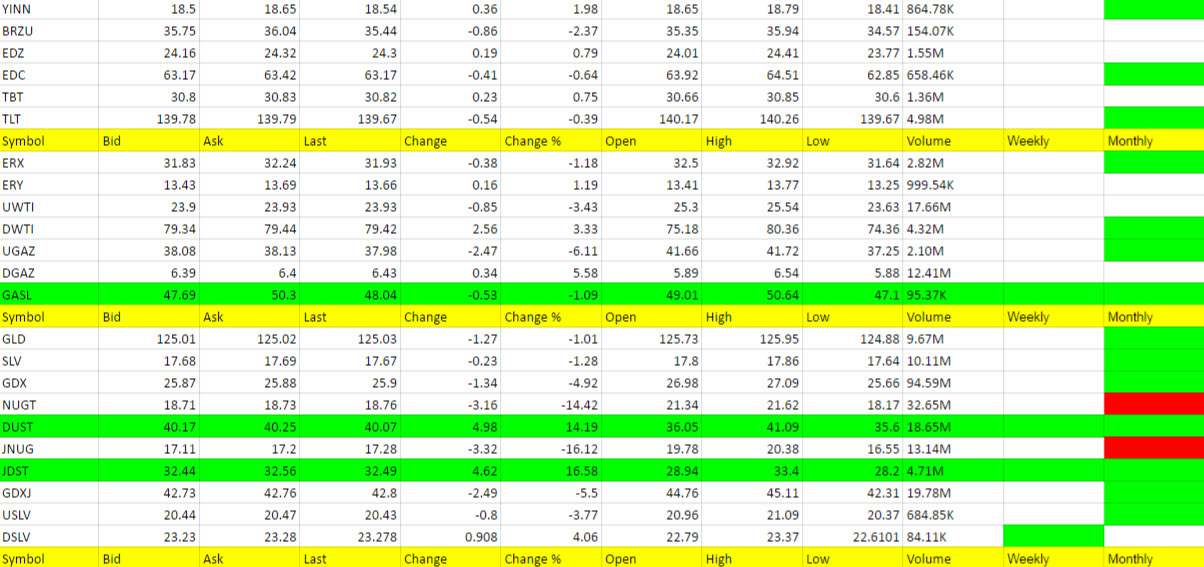

DUST 39 stop and first target 42.35 then 47.90. If we hit 42.30, take half of the trade off. Need to break 41.08, today’s high first.

JDST 31.40 stop and 35.45 first target. Next target 47.90.

DSLV 23.08 stop and 27.77 target.

RUSS 11.10 stop and 12.12 first target. 13.30 next target.

Stock Market

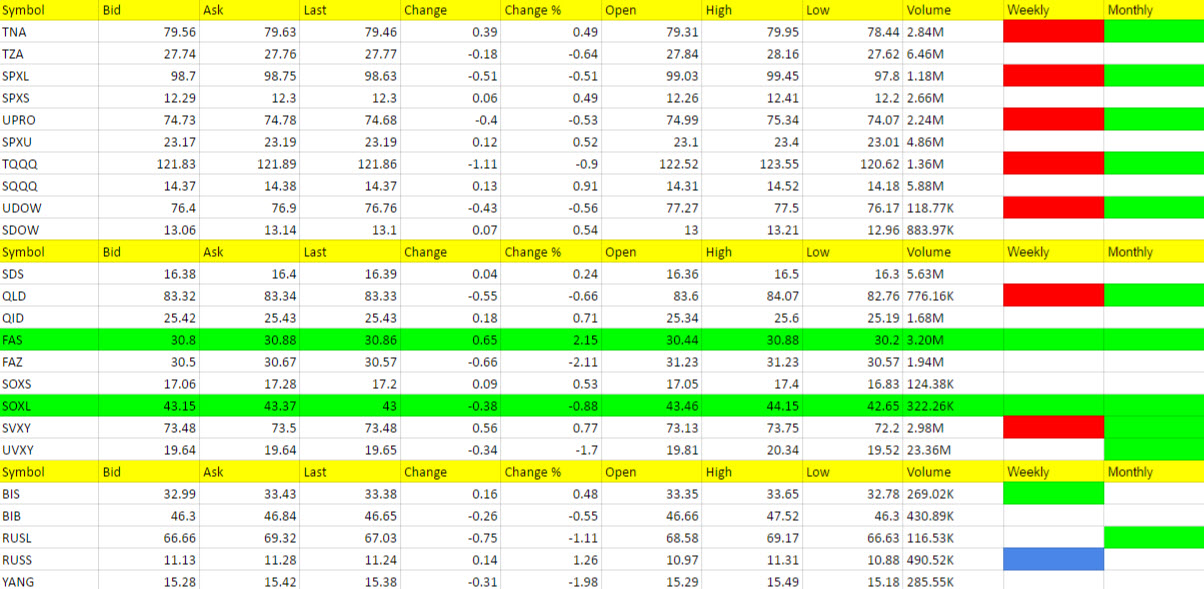

Since we broke lower on futures to a lower low, and combined with the reversal we have seen in the long ETFs, I expect many short the market ETFs to trigger this week. While I follow many I do so to get an overall trend of the markets but of the short the market ETFs, I have my favorites that give us more bang for the buck move wise. These are the only ones you will see me call for trades, even though I could call the others and show a nice profit as well. The profit however would be less than the ones I will be calling.

The markets traded into lunch a little weak but as typical lunchtime trading occurs, they chopped higher for a bit. After lunch trading we can sometimes have a complete reversal, something market makers love to do in knocking traders out of the trend, or they can continue the morning trend. Today we saw a move higher over lunch and then a move in the direction I am expecting to see continue and trigger something to trade for us.

Are we on the verge of a breakdown in the markets? I find it interesting this weakness is occurring without a real catalyst from abroad just yet. I guess you could say the catalyst might have been the markets not believing Yellen that things look good for a raise in rates. Tough call here but we have the scent of weakness for sure right now. We’ll have to look to data this week to see what effect that has on the markets and this smell of negativity.

No call at present. I could color many blue right now, but I need a little more proof.

Foreign Markets

RUSS has been one of my favorites and you have seen me write about it a few times already. If we are going to get a downturn in the markets, RUSS will get us 10% moves probably several times with a potential of even higher profit. YANG and EDC will get us some good moves too. If the strong markets are down, who wants to be in China or emerging markets? No one. Also, China is due for some negative news I believe soon. I addressed in my book Illusions of Wealth and I think they need to still go through a credit contraction similar to the U.S. 2007-2009 era. I will look for some other plays here not listed in the report below for possible shorts but I do think YANG will be good to go higher soon enough.

Call; Not a real positive call on RUSS, but I do like it as long as futures continue south. It has been a winner many times in the past and will be again, but always keep a stop just in case as it has NOT triggered long on the weekly.

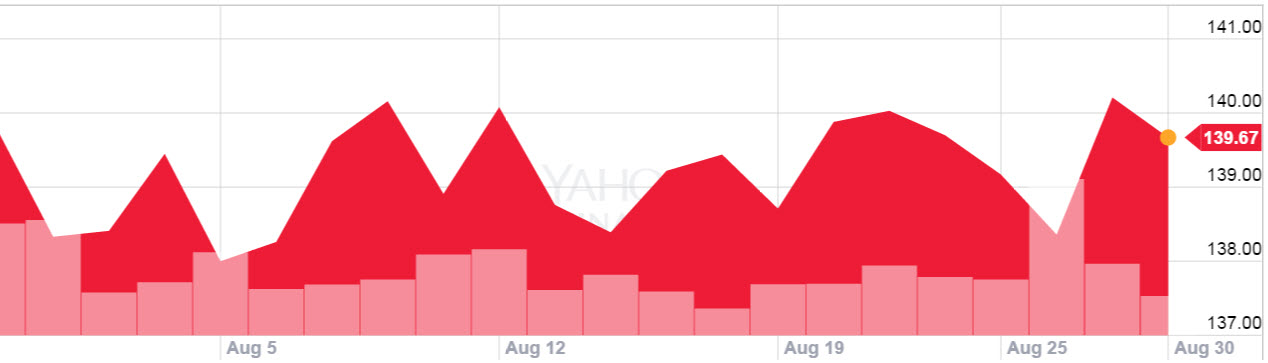

Interest Rates

I had to put a chart here of TLT the last month, to show you how tough it is to make a call on it or TBT. Buying the dip has been my suggestion, but I haven’t ever officially called it (many longer term subscribers know I have liked it for a few years now). But many are negative on rates. I don’t really care, but I will let the trade come to me.

Energy

USLV finally did do the reversal today and even though it had a little run, it couldn’t trigger a long because it has been so darn weak. Now we’ll see what strength it will have after this pullback.

DWTI no call but oil looks a little weak.

Precious Metals and Mining Stocks

The gold mining stocks were a little easier of a call because the trend has been established for DUST, JDST and DSLV and because the dollar shot to 96. We’re going to try and ride this for more, but need to see gold break through 1300 and that won’t be easy. Also need the dollar to try and stay over 96.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

This chart is up to date!