ETF Trading Research 9/11/2016

Trading Rules – It helps to review these each week before trading, and if new to the service, each day.

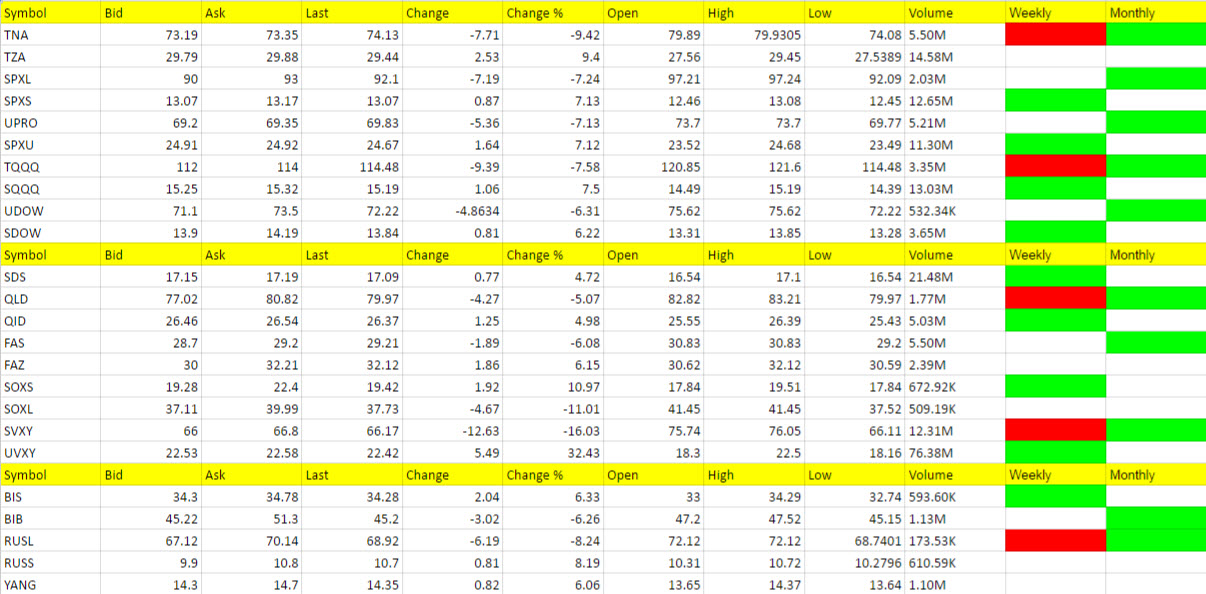

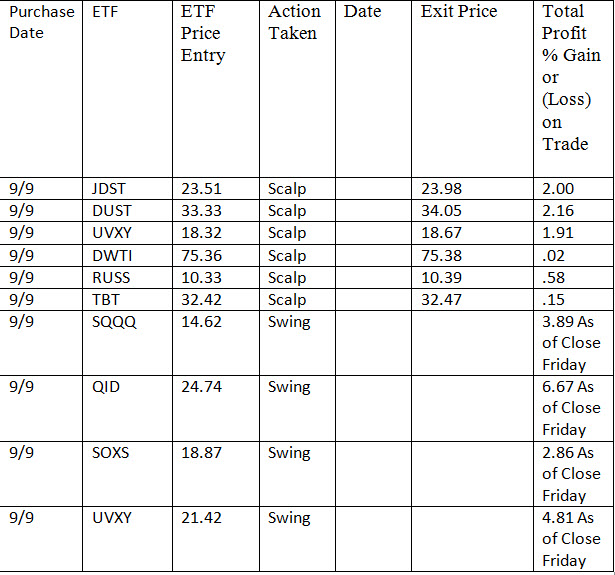

Trades for Today

We had more trades than normal on Friday and I know some of you emailed me and said you did well. Futures are lower now to 2112.75, down 3.25 points with the dollar down 5 cents to 95.28 with gold down $2 to $1,328.60 while silver is weaker downt .26 to 19.05. Oil futures are down .48 to 45.50. I expect some carnage early, a bounce that could take us green and then more carnage. We have a weak market but want to see what the Fed members say Monday. I will be looking to take at least half profit on the longs and because of the volatility in UVXY might make the call to sell all if I see a bounce. If long these trades and happy, take profit at your leisure. With no data tomorrow we could see market makers jump on any words from the Fed just for fun. That’s what they do.

Economic Data for Tomorrow

Tomorrow we have a couple Fed members speaking and after one spooked the market lower with talk of we must raise rates last Friday, I don’t expect continued spooking from these members.

Stock Market

Friday’s are days we patiently wait for and we were blessed with some good moves lower that we could take advantage of. Early on, before trading opened pre-market for many, and before the market opened I gave 5 ETFs I liked and all of them did well. But I conservatively waited for the market open to make a call. We got a quick bounce and then a pretty big reversal so we took profit. I gave as much guidance as I could to strategy, and waited for a few weekly signals to hit and they finally did. We went long the 4 ETFs above and Monday should get us a nice down open to either take profit or get greedy. I definitely lean towards being greedy but I also LOVE taking profit so it’s always a dilemma. I know I can always get back in a trade too. What you do in locking profit should be based on your own personal goals and if you continue to do this, you don’t have to wait for my call. Reversals come and with them we have either buying opportunities or a final stop out. If you are happy with your profit, always take profit. There is always another trade coming. You’ll hear me say this over and over. Buy and hold is for who? Not us!

Foreign Markets

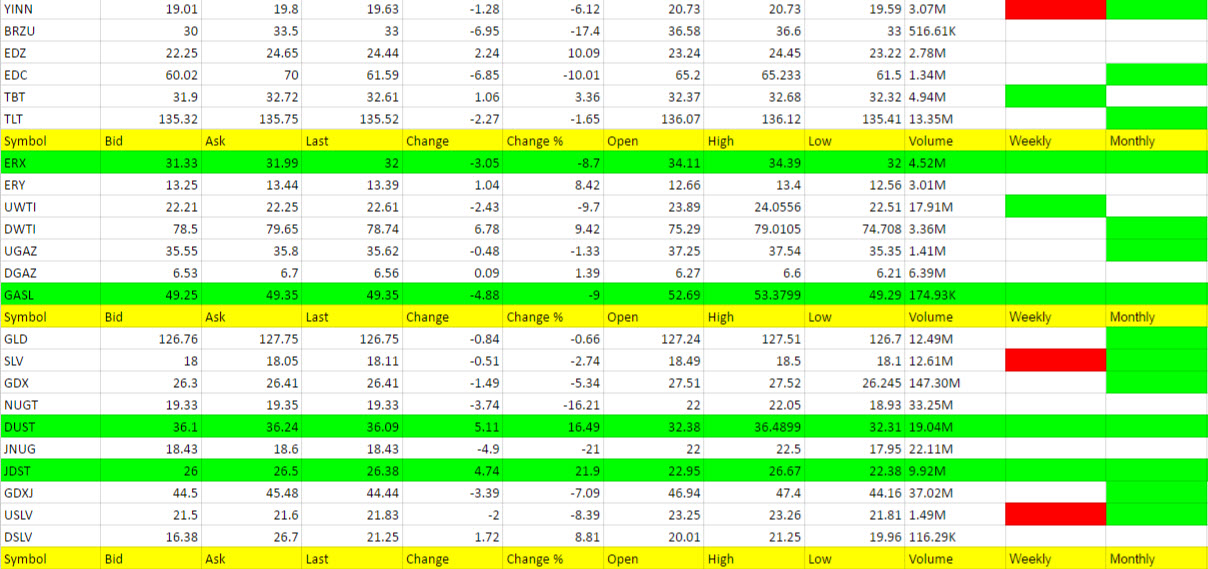

RUSS became the play now and we scalped some from it. I still like it to move big. We were early on it last week, for the right reasons, and market makers took the market higher into the holiday. It’s payback time.

YANG will be the one to watch with EDZ. Like them both if we can get this market crashing.

Interest Rates

TBTdid continue higher and I’m still iffy on it only because I see lower rates ahead. But we can’t ignore the trend and thus follow it long.

Energy

DWTI took over form our long UWTI trade yesterday and we traded it flat, however, we could have stayed long a bit longer. Keeping tight stops is what I do on volatile trades. Plenty of time to profit with the trends here.

UGAZ gave way to DGAZ and no call.

Precious Metals and Mining Stocks

We have been following DUST and JDST with trades and now they have triggered long on the weekly and you can buy on a gold down and these positive on Monday.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.