ETF Trading Research 9/12/2016

Trading Rules – It helps to review these each week before trading, and if new to the service, each day.

I added something in a “Note” to the Trading Rules today. It can help you take the risk out of trading some of these ETFs. It is right before area where “Trading Rules” is written.

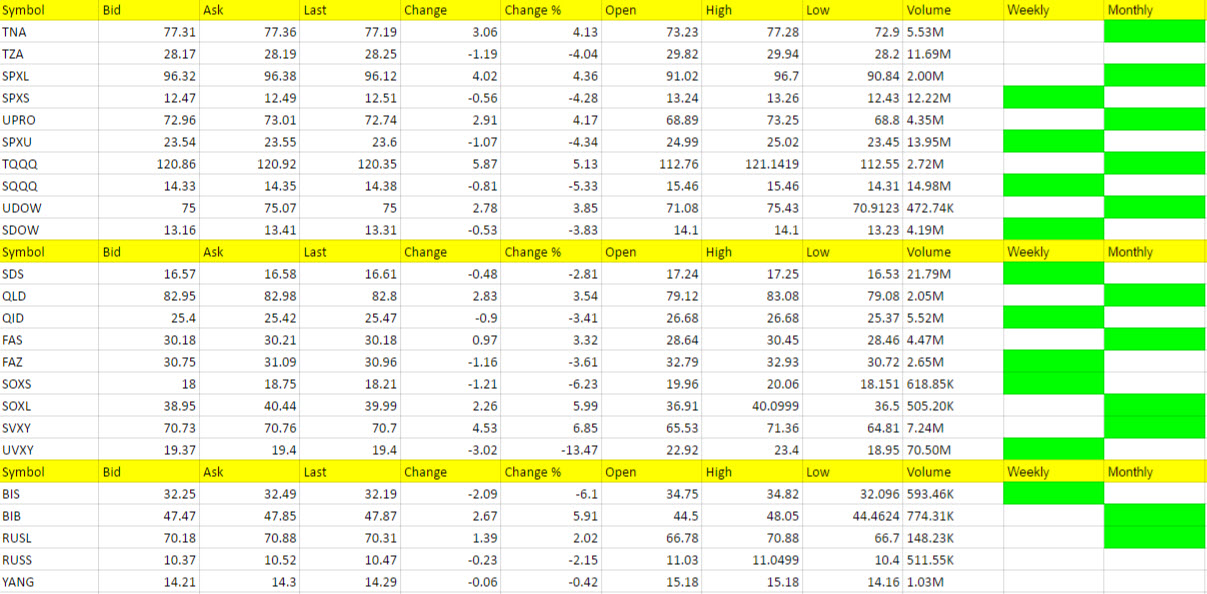

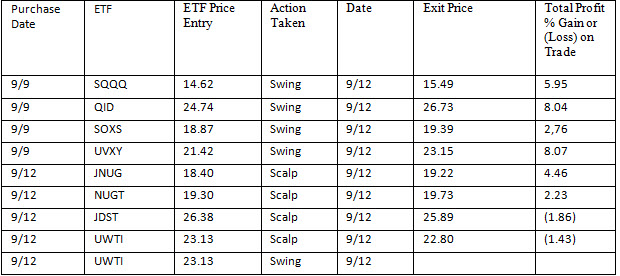

Trades for Today

We got out of the 4 trades carried over from Friday, some with really nice profits. We had to sell pre-market but SOXS didn’t give us as much liquidity so hopefully some of you got out at an even higher price than I listed as the track record for the service. I used the data for after the market opened.

We got in 2 trades early that we were profitable on and one trade we were not and kept a stop. We are presently in a trade (UWTI) that is down from the open but I liked the price action overall and think we can profit from it still after a nice run up in DWTI and subsequent decline today. I went ahead and put the loss down for the track record for UWTI but will keep it up as a trade to track because I know some of you are still in it.

Economic Data for Tomorrow

Today we had Fed members come out and ruin our JDST trade, right when it seemed ready to jump. It happens and we keep a stop and don’t look back. With this ETF Trading Service you must keep stops. We have shown that new trades come and most of the time they are good and sometimes great. They will make up for the small stop outs over time. Don’t be afraid to continue trading if you get stopped out. Losses are part of trading.

Tomorrow we have not much data but we do have the API Weekly Crude Oil Stock that may have us out of the UWTI trade before the market closes if we are up nicely.

Stock Market

I sure hope we are not in whipsaw territory again, but then again part of me likes it if we can jump on the same ETFs we traded on Friday for profit. With not much data coming out tomorrow, we may just trend a bit higher for now. No calls at present. Lean long but only for scalps. No trends long have developed in just one market day up, albeit a big day up. I will alert you to calls should they come tomorrow. I will NOT overtrade and try and get you something just because nothing is happening with trends. There’s a lot that goes into successful trades and I try not to guess but give educated guesses with my calls. Futures are already whipsawing us lower, down 3 to 2149.

Foreign Markets

All of these ETFs playing reversal with each other and no calls (RUSS, RUSL, YINN, YANG, EDC, EDZ)

Interest Rates

TLT looking a little better than TBT but no call. TLT couldn’t even muster up average volume today.

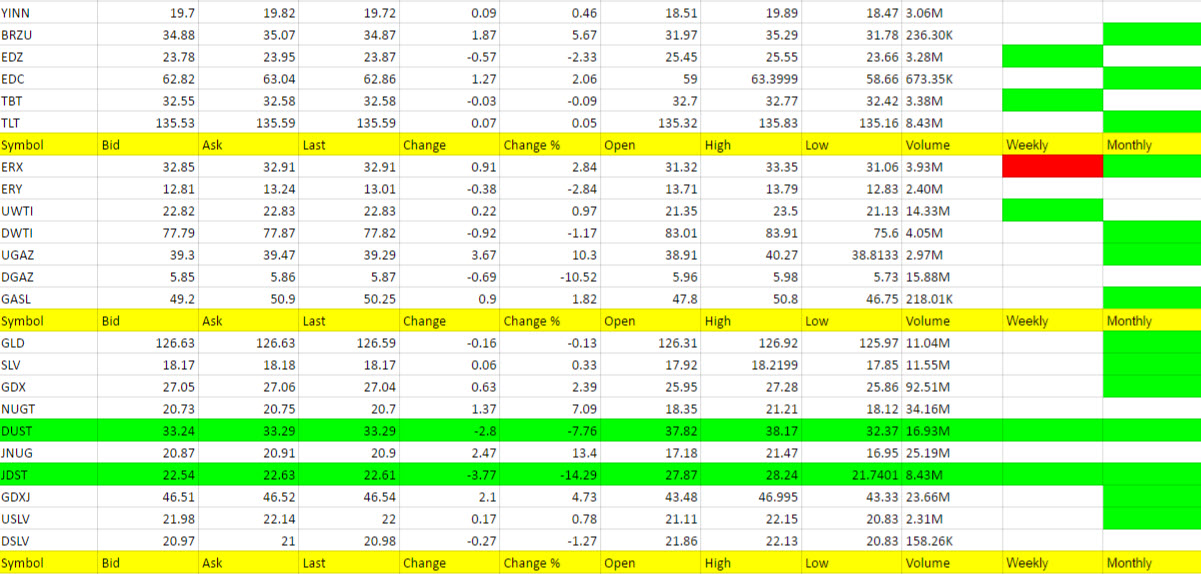

Energy

UWTI and DWTI keep trading places of late so we might as well see what we can get from UWTI being green but not yet a weekly trend.

UGAZ gave way to DGAZ and no call. UGAZ moved higher and is worth keeping an eye on.

Precious Metals and Mining Stocks

Gold opened down but dollar was also lower and only a scalp was offered on these at the open. We did eventually get a scalp long in JNUG and NUGT but didn’t stay the course to higher profits. I saw DUST take off higher and we missed a 50 cent scalp but a few cents and tried JDST end of day but it didn’t take off and the Fed spoiled the party from there. No call at present.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.

I almost called a short on GOOG on Friday and it would have got us 10 points as of this morning, but I didn’t think many would play a $700+ stock and like the rest of the market went higher today. I am being patient with my “other” calls, waiting for something we can swing for more than one day for more profit.