ETF Trading Research 9/12/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

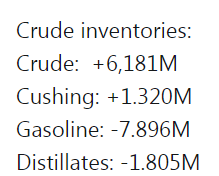

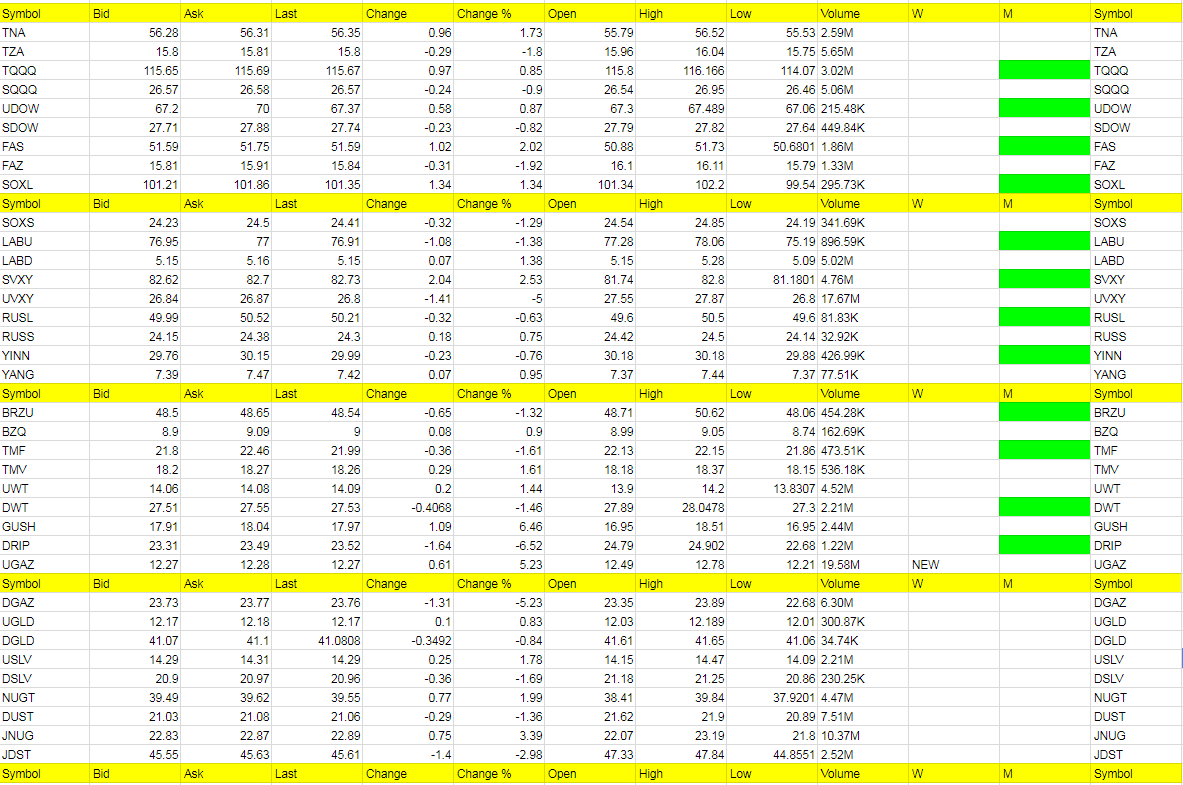

Today’s Trades and Current Positions (highlighted in yellow):

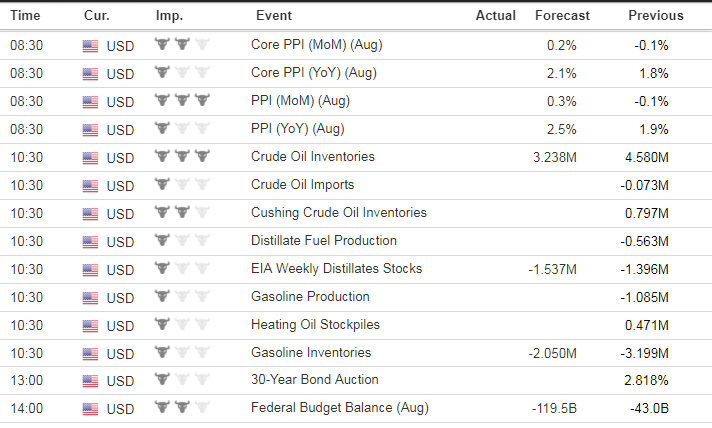

We woke up this morning and saw Nat Gas was higher, then we got a nice little move up with as much as 13% profit but I put the sell price in at 10.07% (12.35). I then said to sell the remaining shares 6 cents from the top at 12.72 and UGAZ fell to 12.25 and a low of 12.21. I do have a buy back in at 12.05 for 1/2 shares.

UWT we got the after market data after being up all day and it was mixed. We’ll see what tomorrow brings, but we need to still lean long and look to add shares over 14.20. If we do gap up tomorrow I may have us sell and lock in the profit before the data. Goal is still 50+ in oil and possibly to 55+. That could be a big run and we want to catch a good portion of it, but for now have to sit out some short term data.

We finally let go of WEAT. I talked to my father about it and he told me something that I’ll remember as I was mistaken on his trading of wheat. He shot me this note; “Remember I said I never traded wheat. It was hard work and then the mkt a lot of times proves you wrong.” That said, the shake out in WEAT might have been the bottom and WEAT may take off here. I think I just got tired of watching it every day as it was a drain on me. I could never be a buy and hold trader, so I got the negativity out of the way by selling. I’ll take the blame on that but if you are holding out you will more than likely be rewarded with a move past 6.60 confirming a bullish trend.

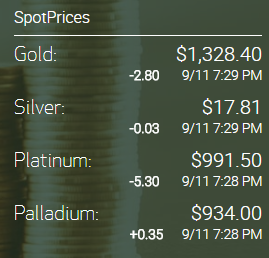

Metals and miners were a mixed bag as the USD/JPY played tricks on my mind all day. The dollar going negative might have been a better indicator today. We are up on our current JDST trade though 1.26% after hours. If we get a gap up tomorrow, I want to check out the dollar, USD/JPY, silver and the overall market including UVXY before making a decision to lock in profit.

We got long half shares in BZQ, RUSS and YANG, and I want to point something out here. With the Dow up +300 points the last two days, today this trio wanted no part of the bullish side of things and perhaps we have caught the bottom. If we do fall in the markets into the end of September, these 3 should do well even before hitting a green weekly. A longer term, wider stop approach might pay off big for you. Same with LABD which did hit a higher high before a little sell off at the close. I warned that the 5.20/5.30 level would be resistance still and we got to 5.28. First trade over 5.30 now and we should see a runner here. It is also showing strength the last 2 days with the markets moving higher. We should find out soon if tech will lead the markets lower as AAPL was down today. UVXY was a joke at the end of the day. Yes, I will say it now as I have in the past, I think another 30% move in it is coming sooner than later. That would be a move to 34.70 from its current price of 26.69 on the ask. But I would probably take half off the table after it filled the gap to 30.80 for 15.40%. May not start from 26.69 or maybe lower, but you get the picture.

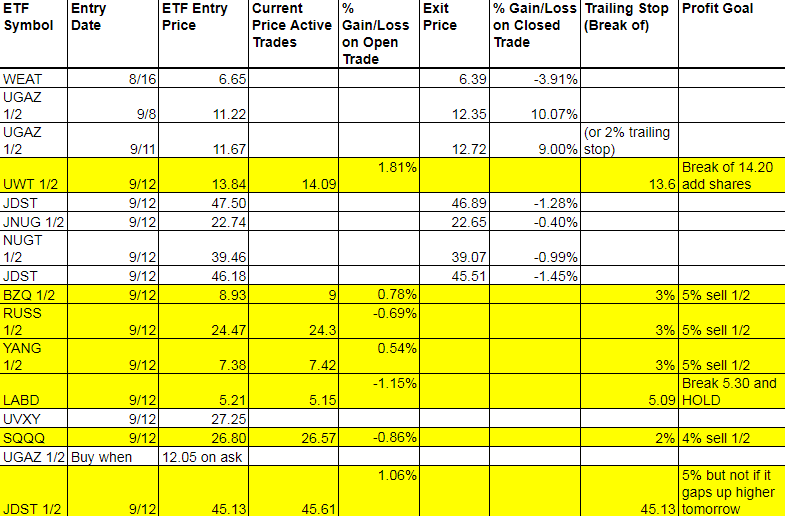

Economic Data For Tomorrow

PPI tomorrow pre-market and that should dictate the market moves. Crude Oil Inventories at 10:30.

http://www.investing.com/economic-calendar/

Will be interesting to see if oil rises no matter what the data tomorrow.

Precious Metals and Mining Stocks

If Jolt’s Job’s Openings was better than expected, then why the strength in gold/silver today?

Current Price

Monday’s Price

See metals analysis above. Somewhat neutral and all eyes on dollar for a continued bounce and USD/JPY for direction. Where is the fear propping metals up? Why are they up with stock market up again? Why is USD/JPY up and metals also up? Some things to ponder. Why I only went 1/2 shares on last buy of JDST. We probably should have been a little more cautious with JDST because it was on the hot corner for 2 days.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

GUSH, UGAZ, JNUG

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DRIP, DGAZ, UVXY

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!