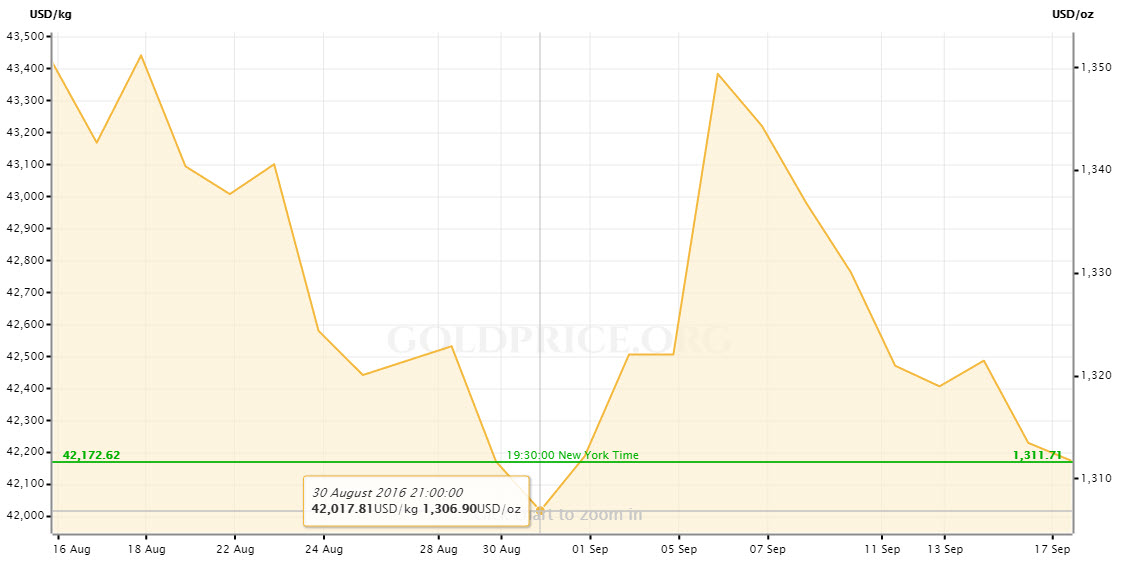

ETF Trading Research 9/18/2016

Tonight’s report is longer than usual as we have a big week ahead of us.

Please read the Trading Rules before doing any trading with this service.

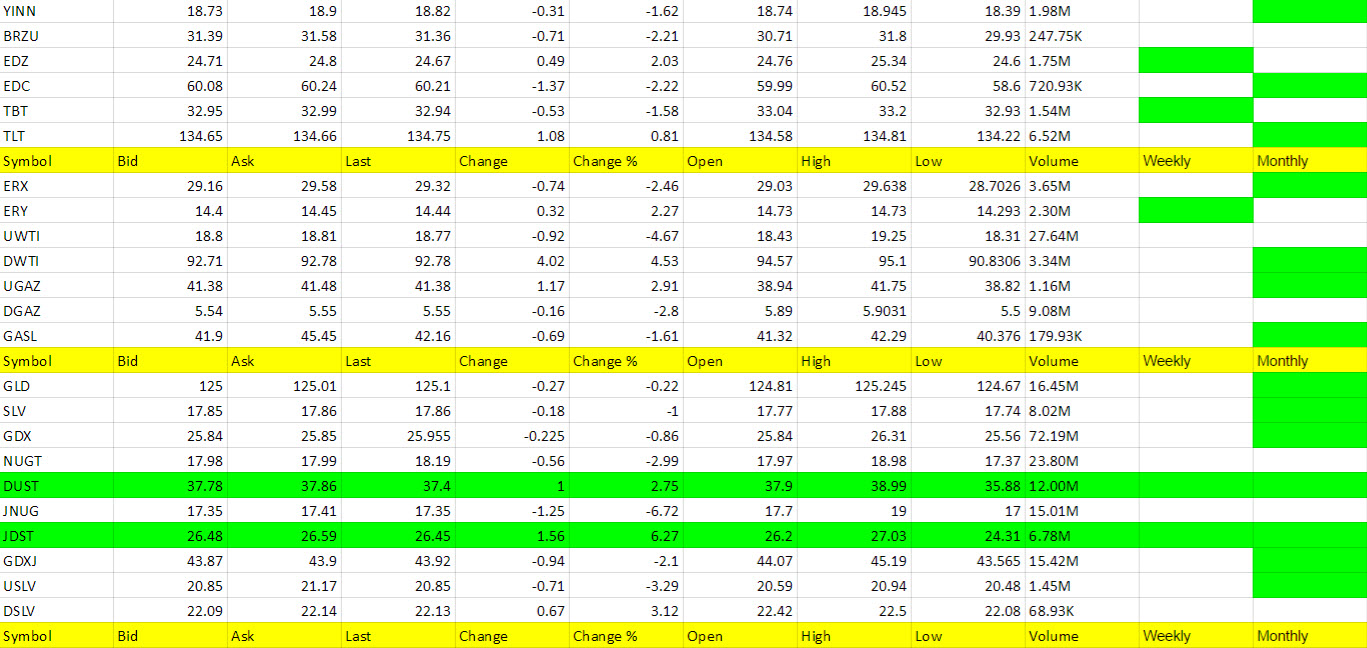

Trades for Friday

When the ETFs are lined up with the market trend, we want to take the risk they will continue higher for that trend. Sometimes market makers will reverse, take out stops and then return to the trend. We did get stopped out for 2.5% on JDST and DUST but JDST we got back in and rode it as high as 4% before it retreated again, but both DUST and JDST were still green on the 2nd attempt.

I want to clarify something for you here in how we trade these ETFs when we have a nice run higher, but hold on because it is a SWING call. If you want to take profit, after being up 3-4%, which JDST was, or up 1.5 points in DWTI or what have you, no one is stopping you from taking profits. I could easily have several times this week taken a profit when up but chose to stick with the trend for more profit. I could take the profit and have my overall data look better, and have admittedly taken a hit this week and probably should have locked in some profit on ones like JDST, but I am a believer in trends and I want to give that trend a chance at providing more profit. I don’t like being shaken out of trades that continued in the weekly green trend direction.

I also could just call weekly trends when they hit and manage those trades and my end up doing that at some point, but trying to see what works best for you. The weekly trends when they first hit last Friday got us 10 out of 10 trades when they hit. The up and down movements since then didn’t fare well this week. Neither did the two days up Wed. and Thurs. and reversal lower again on Friday. If I stuck with just the weekly trend hitting and cut out the scalps last week we wouldn’t have had a single trade last week and that’s better than getting stopped out on an up and down week. I’m evolving with this strategy as we speak as it worked well in August.

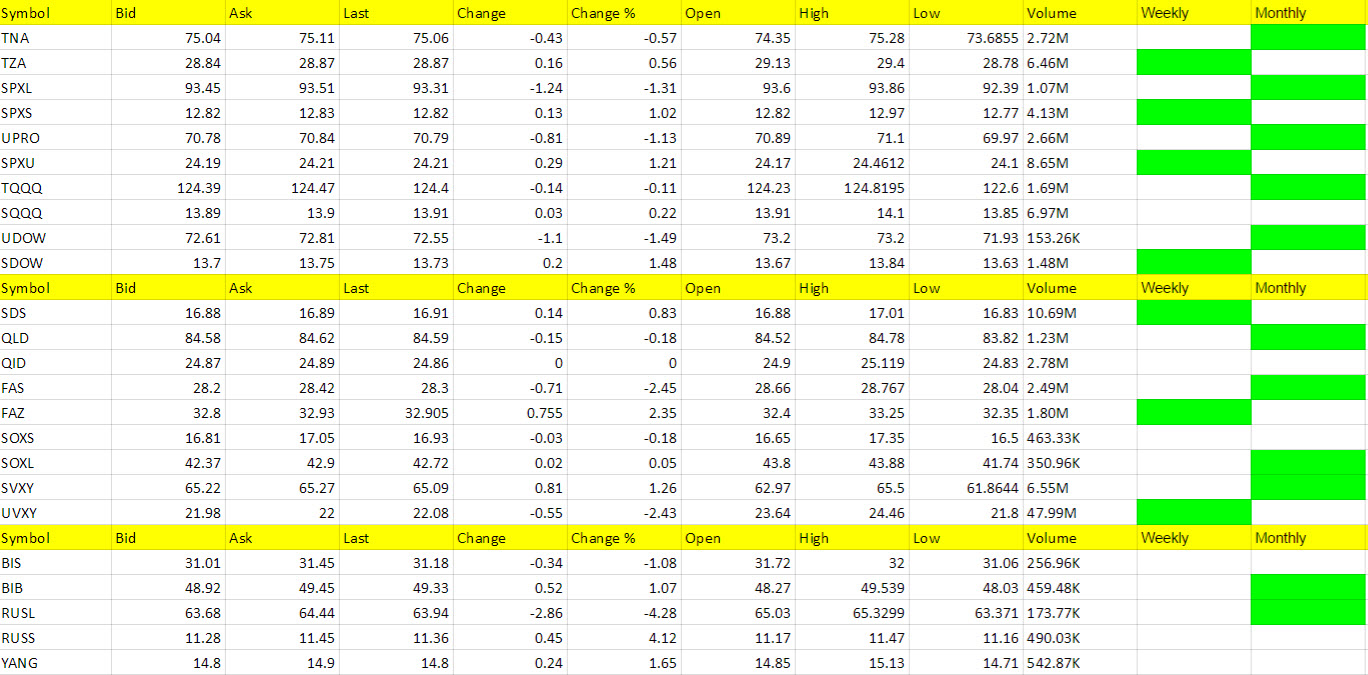

Holding overnight and over weekends is also always a gamble, and if you do, you accept that gamble. But we do so with the trend and normally we come out on the right side. The trend is not powerful when we have weekly greens one way and monthly green the other way. Naturally this makes for an even more risky trade overnight and the weekend. That’s what the table below has shown all week and there were no new weekly trends to take advantage of, mostly scalp attempts that didn’t go well. Naturally I am aware of this and have come up with some guidance because of the feedback I have received. I do know some actually profited from some calls and others did not.

I made the call a bit too early on Friday morning just after the market opened and these ETFs never broke out to a higher price like they did the week before when we hit 10 out of 10 trades. I did say when we got stopped out; “Still think they (futures) fall. Still think gold falls lower.” This was the case, but as I said, off on the timing by a little.

When I call SWING trades, you can still take profit as a SCALP to either make yourself whole for the day, or sell some shares, locking in the profit and holding out for the bigger profit potential. We have to be in the game to profit and I’ll take that trade 10 out of 10 times, both the scalp in the morning with a stop and the latter SWING.

DWTI also hit at 93 but only got as high as 94.60 before closing at 92.78. Oil is opening up .42 to 44.04 in Asian trading and we’ll see what happens.

Futures have opened in Asian trading up at present and we’ll probably have a gap up if Europe continues the trend. Then I suspect market makers will try and squeeze out shorts then move the markets lower at some point on Monday. Tuesday should see big volatility as explained below.

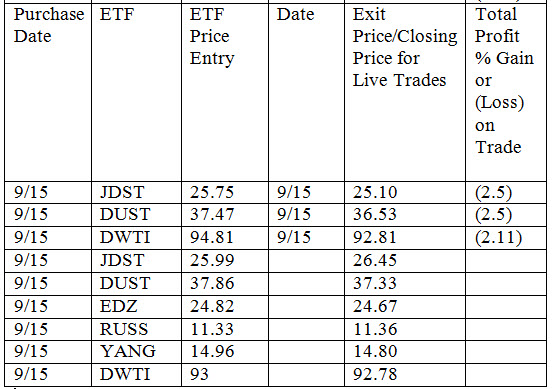

Gold has opened up $4.70 to $1,311.80, resisting that $1,300 support level with all it has. Silver has been a bit weaker overall but up 3 cents overnight here to $18.84 while the dollar is down 7 cents. We’ll see what gold, oil and the markets do heading into the European open. I actually expect a little upside with China and Hong Kong coming out of a long Holiday weekend and some possible short covering after the move up in the U.S. markets, which I mentioned could happen last week, and then by the time U.S. markets open a continued lower move in line with the trends in the table below. I have to respect the weekly trend which is why we trade short right now, with blips up along the way. You would think another terrorist type attack in NYC would trigger a little selling, but so far the market is shrugging it off. Japan has a Holiday today so is closed.

If we pull out and look at the S&P 500 we see that the 2100 level needs to be broken to have a nice meltdown and some larger profit potential with the short trades. But there will need to be some catalyst to get us there and that catalyst may not come from the Fed but from Japan. Japan has a BoJ Monetary Policy Statement and interest rate decision on Tuesday along with a press conference. CNBC has an article analyzing what Japan does this week as something more important than the Fed’s decision, which there is only a 15% chance of an interest rate increase. This is naturally priced into the market.

With this being Fed week, as usual, expect some volatility and whipsaw. I would like to close some of the position on a nice move higher in the ETFs we are swinging if we get a strong enough move on Monday, but am willing to hold into Tuesday as well, widening stops more than usual so as not to get whipsawed out of a position. Personally I think traders will start viewing the Fed as chicken little and grow tired of their talk of raising rates and begin to pull out of the market for a bit. It would help if it got that trigger.

JDST and DUST have been in a range for a bit and are the only two ETFs that have been green on both the weekly and monthly. We have to respect this and since they are trading with the market now, more than with gold, we need the market to start triggering some of the weekly greens that are short to the market into monthly green’s.

Gold’s safe-haven rally appears to have run its course, RBC says RBC is calling for $1,258 for 2016 average which would point to lower prices ahead. For me, gold has had an almost perfect correlation to the dollar this year and you can see that from looking at any chart. I am dollar bullish overall and think we go back to 100 again. If we can get the markets lower from this la la area, then we should be able to profit nicely. The dollar has to make up its mind this week.

Only the QQQ’s which is mostly AAPL related are bucking the trend, and that’s just because of a Samsung recall. That is a one off event, not a trend.

DWTI we’ll take profit once handed on Monday simply because it has not triggered on the weekly yet, only ERY has which is why I am trying to get an early read on DWTI. If it hits it can move 10 points rather quickly and I’ll risk a couple points now and then to catch that run. There is always more risk with the oil trade because news comes every week that drives it one way or the other. If I was in control of OPEC I could open my mouth and make profits on my trades. Don’t think they aren’t profiting off of these rumors. A move below 43 and we should get a nice run lower in oil.

Economic Data for Tomorrow

There is no economic data coming out tomorrow which means market makers are in control and will move the market up and down at their own leisure, trying to knock you out of positions. I would prefer to just not watch the markets tomorrow and come back to trade on Tuesday but obviously I won’t. Late Tuesday’s and early Wednesday is all about Japan followed by US Building Permits data Wed. morning and the Fed interest rate decision Wed. afternoon. We also have Oil inventories before the Fed meeting. And if that’s not enough, the ECB’s Draghi speaks on Thursday along with Initial Jobless claims for the U.S. That’s the week in a nutshell and I expect some fireworks. You can view the Economic Calendar here: http://www.investing.com/economic-calendar/

Stock Market

We should be range bound for a bit with a slight downward tilt overall as the markets decipher . The DOW is approaching that 18,000 support level falling to 18,123.80 on Friday, down 88.68 points. We need that level broken soon. Perhaps it will this week.

Foreign Markets

We trade the foreign market short because it offers the best opportunity at a run should we break down. Meaning, these ETFs will offer a higher profit potential. You’ll see me concentrate on these first before any U.S. short the market ETFs trigger for this reason. EDZ, RUSS and YANG fit this strategy.

Interest Rates

TBT and TLT still playing tag with each other. The Fed should give one a boost here this week and I’ll have to lean TLT as I have the last few years and after this move lower from the 140 level.

Energy

Took another stab at DWTI with ERY having triggered on the weekly but it’s just not offering more than a 1.5 scalp which is not much to profit from. I still only trade this with small shares at present.

Natural gas slightly lower at present. No call but will keep an eye on a trade here while the rest of the market churns away.

Precious Metals and Mining Stocks

Still trading with the market. Fed week will give us a trade but for now expect some volatility this week. Dollar being flat isn’t giving us a micro direction yet but metals moving up a hair in early trading is. See what the morning brings and by late Tuesday we should have our answers heading into Wed Fed. I can see $10 moves each way but want to keep an eye on $1,300 as a level to breach for a ride up with JDST and DUST. A break of $1,306.90 is the first target.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.