ETF Trading Research 9/18/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

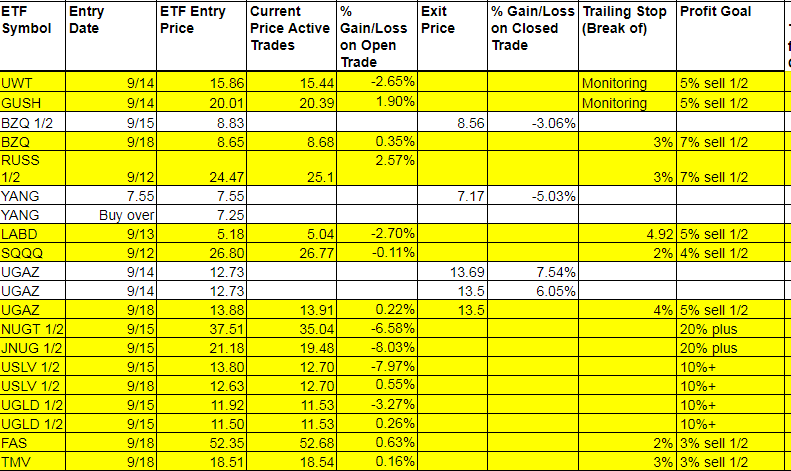

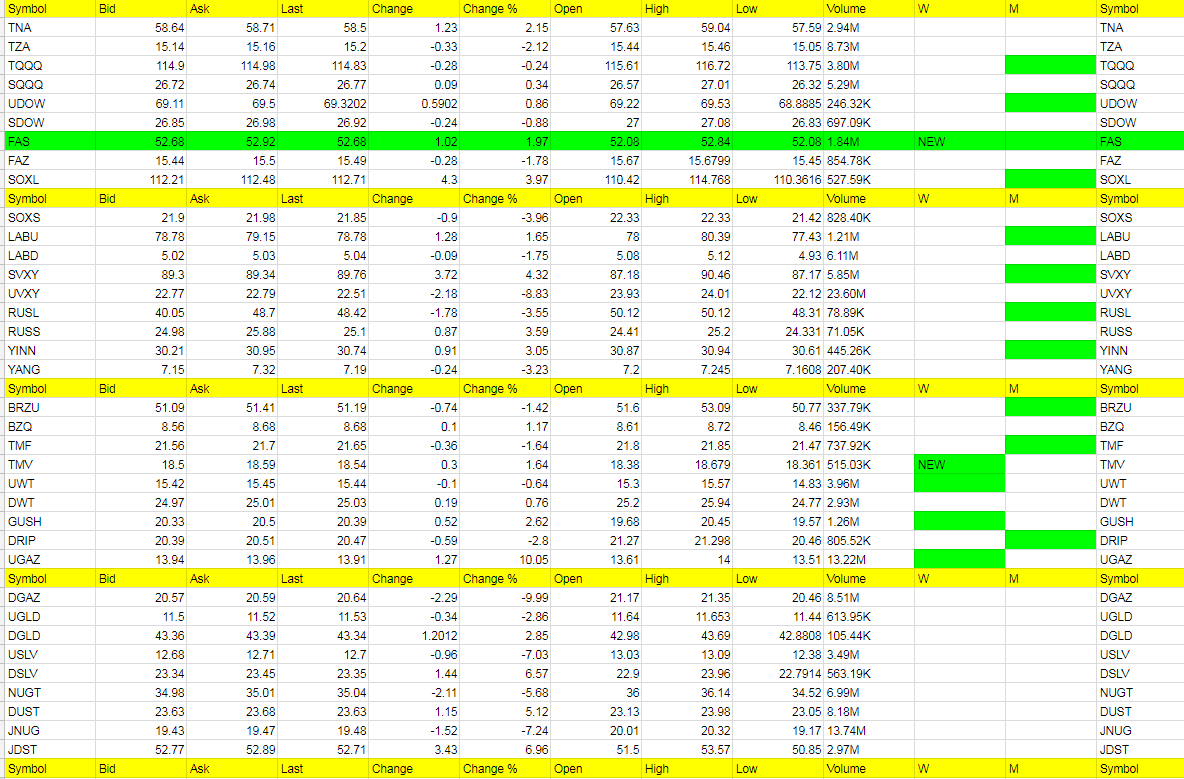

Today’s Trades and Current Positions (highlighted in yellow):

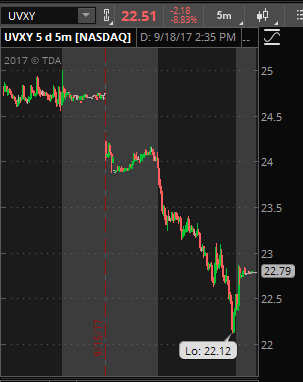

You’ll notice I raised the profit goals for some of the ETFs. I probably will for LABD too, and UWT/GUSH. Metals and miners complete analysis is below. Liking oil still with GUSH and don’t mind picking up the rest of the shares of JNUG and NUGT lower here soon. Don’t normally let some of these ETFs go this far, but have given you the reasons why for metals/miners. Either way, we were only about $4 from the 1300 mark I gave out to be all in metals and miners last week, hitting 1304 in gold. Tomorrow we will keep a closer eye on UVXY. I liked the V shape close.

Gold 1400+ (90% odds) – Don’t want to miss the next missile bump.

Oil 53 (will go over but we’ll be more cautious) – into next year higher

Nat Gas 3.40 (we hit the 3.10 Monday and now have higher support and a 3.00-3.40 range we will buy the dips of)

/ES 2400 (led by a tech crunch- Yesterday I said I am short term cautious still but SQQQ finished positive and we have to like that since I think it will lead markets lower post Fed and maybe sooner with NK reaction to Trump)

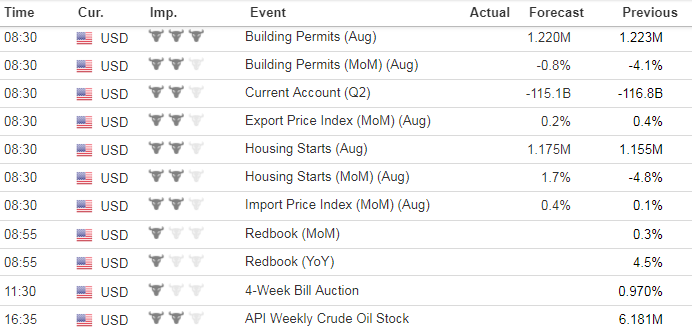

Economic Data For Tomorrow

Important data is Building Permits, Housing Starts and API Weekly Crude Oil Stock tomorrow.

http://www.investing.com/economic-calendar/

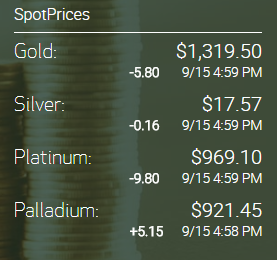

Precious Metals and Mining Stocks

Monday’s prices after hours;

Friday’s Prices at the close;

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UGAZ, JDST, DSLV, DUST, SVXY, SOXL, YINN, RUSS, DGLD (New Green Weekly for TMV and FAS)

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

DGAZ, UVXY, JNUG, USLV, NUGT, SOXS, RUSL, YANG

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!