ETF Trading Research 9/19/2017

For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

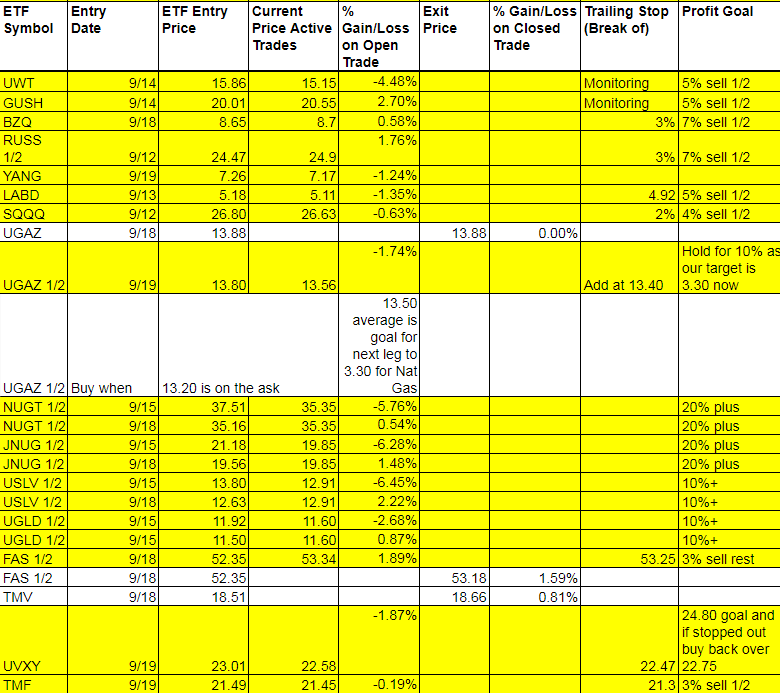

Today’s Trades and Current Positions (highlighted in yellow):

Today was pretty much a nothing day. Look at the Hot and Cold Corner below. Nothing.

But we did get in the last 1/2 shares of miners pre-market and UVXY which is poised for a bit of a run assuming the Fed doesn’t surprise with something. Either way, I lean short the markets still and see trouble with North Korea after Trumps UN speech. But part of me really just says go fishing till the end of the month and come back to some good profits. As a trader though, I can’t do it. But that’s how I feel.

It’s going to be a little crazy at first. Lot’s of unknown’s this time around. I don’t expect the Fed to do much because Yellen wants to keep her job, so we will see if there are any surprises. I doubt it. And I think we are positioned well either way with our trades. I really want to say at the close tomorrow; “I fell great about everything!” I won’t make excuses for our positions and still hold out for our moves higher in gold, nat gas, oil and lower in markets as I have been consistent with this for some time now. But for you that are only in metals and miners, I do think you should go fishing. Tomorrow may be a wacky kind of day but I won’t be bluffed out of positions by immediate market maker tricks.

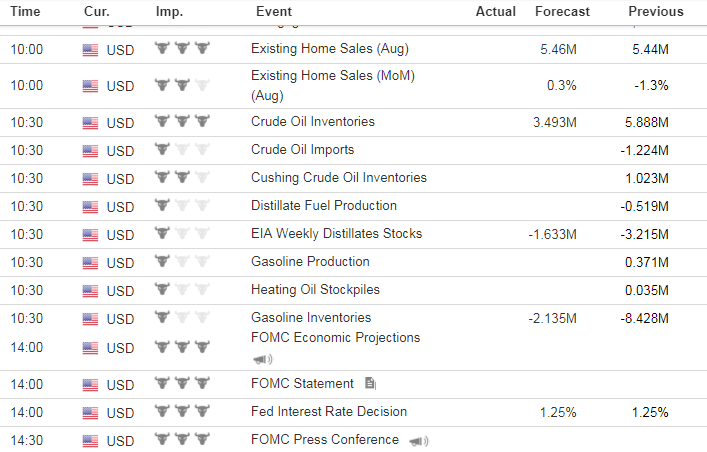

Economic Data For Tomorrow

Tomorrow we have EXisting home sales and Crude Oil Inventories after the market opens, so won’t make any new calls pre-market to exit current positions or add new positions. Expect the pre-market report to come out around 9AM.

Tomorrow though is all about the Fed at 2pm. They are NOT expected to increase rates. But they are expected to reduce balance sheet some. Any disappointment there would be negative for market. Watch FAS for exit. Also watch UVXY.

http://www.investing.com/economic-calendar/

Precious Metals and Mining Stocks

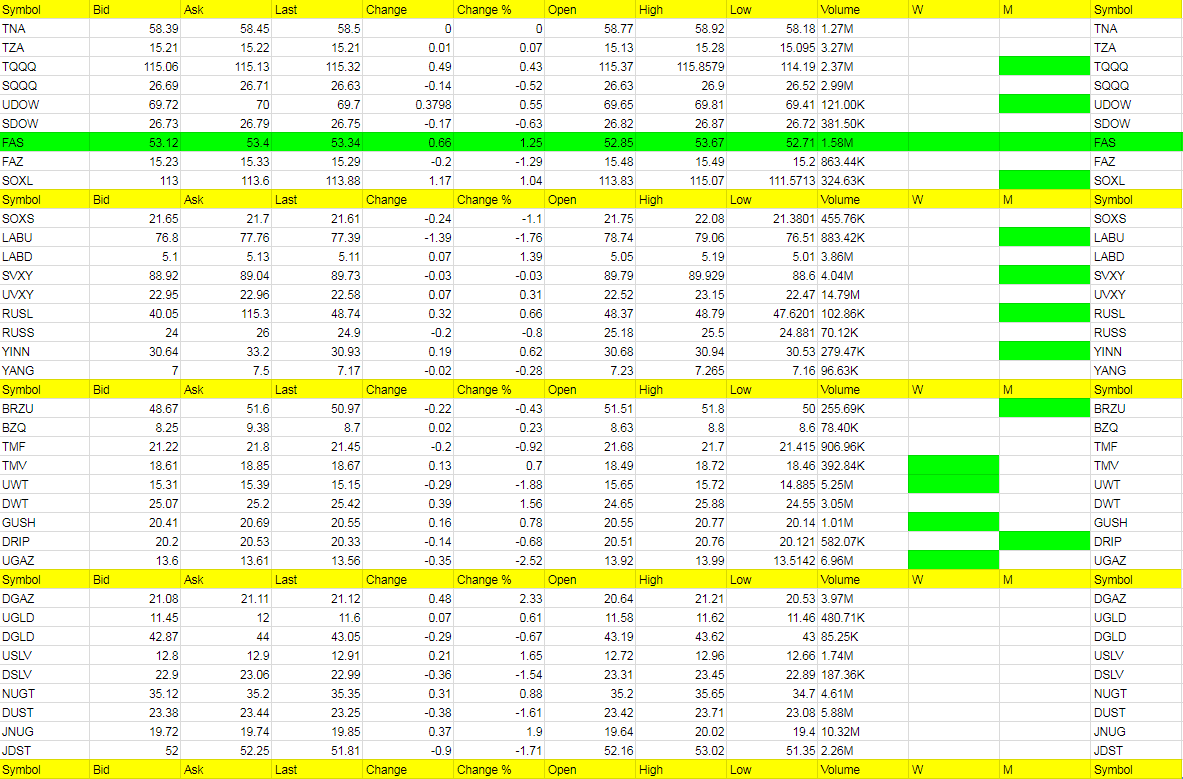

Tuesday’s prices after hours

Monday’s Prices

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

2nd time since tracking, no ETFs qualify.

Cold Corner (the biggest move lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

2nd time since tracking, no ETFs qualify.

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out typically well before they start to fall again or turn red on the weekly. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list (the one’s at the top of the list by Entry Date) the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!