ETF Trading Research 9/20/2016

Good to see the market move lower into the close. I think it shows there is still fear heading into tomorrow, but I also believe there is some pressure on the market right now. What does the Fed see? I’ll tell you how I think this will play out tomorrow.

First, we have to see what BoJ does. This will set the tone. I don’t see anything that will surprise the markets out of their decision, but I do know they need a weaker yen.

When we get to the Fed decision tomorrow, if we gap down I may sell some positions to lock in profit. If we gap up, I will probably just ride out the Fed storm as I think we will eventually begin to fall hard.

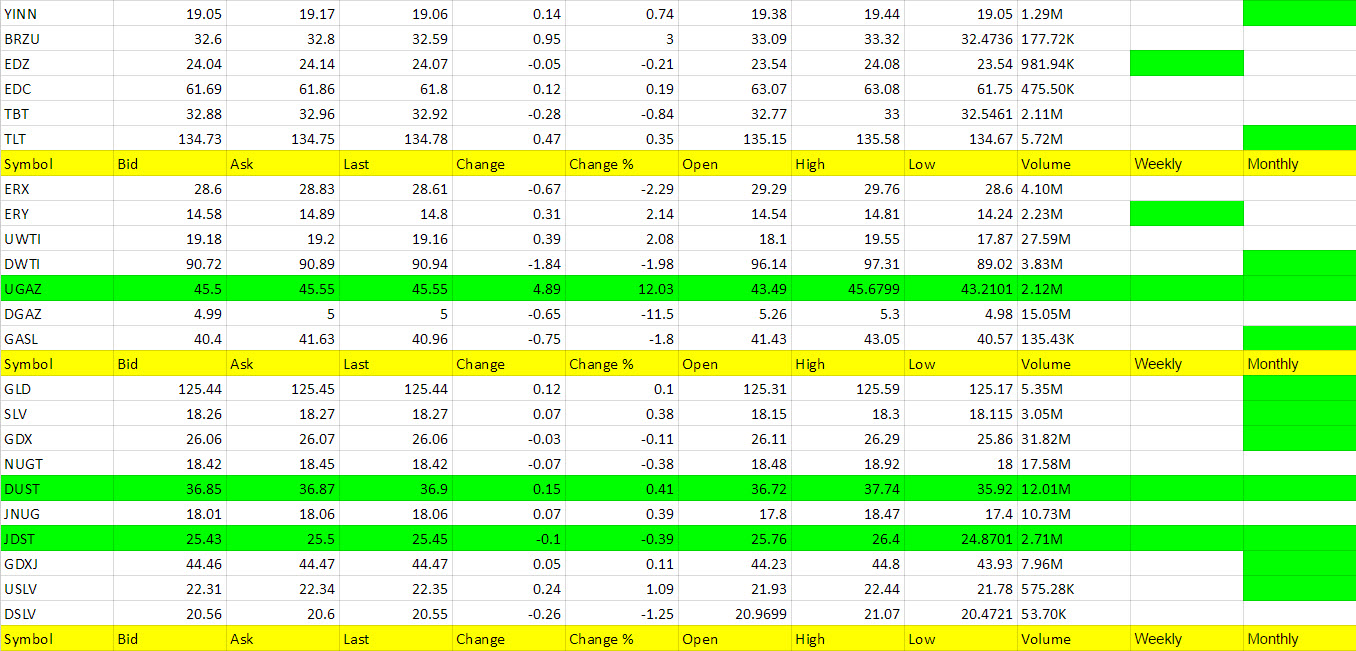

If the Fed for some reason decided to raise rates, gold will get hammered. This is a risk I don’t mind taking holding JDST and DUST through the meeting. Most believe there will be no raise of rates and this is already priced into gold. And with the markets still overall weak of late, (not breaking higher to me is weak) and futures on the low end of the range we have been experiencing, we just need that push over the cliff. I think we get it after the Fed. Futures are lower after hours, continuing a downward move it started with the last half hour of trading.

Please read the Trading Rules before doing any trading with this service.

Trades for Today

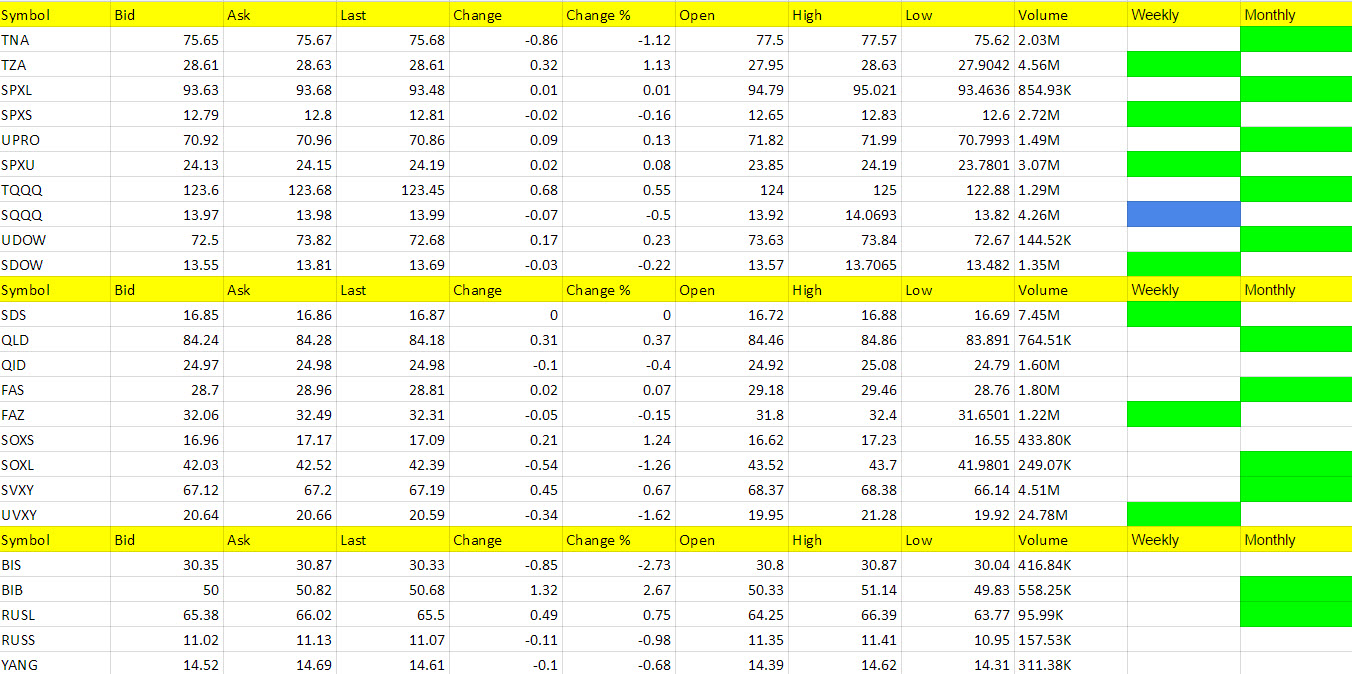

We exited DWTI and got 3.78% out of it. Then it fell like a rock. We entered SQQQ and futures are falling after hours to 2120.25, -3.75 and we want that to continue all night into tomorrow. This is a SCALP, but we may hold it longer.

Still holding the SWING trades from 9/16. Guidance on these tomorrow should be to try and get 5% plus out of them. We need that gap down tomorrow to start with. Plenty of liquidity during the market tomorrow to bail if necessary, after the Fed. But obviously I lean short everything right now, and if correct I am hoping a 5% gain is a conservative number on these.

Economic Data for Tomorrow

The Building Permits and Housing Starts data was lousy and for some reason the market shook it off. It’s just delaying the inevitable fall that’s coming in my opinion. All eyes on Japan now.

Repeat from last 2 reports: Late Tuesday’s and early Wednesday is all about Japan followed by US Building Permits data Wed. morning and the Fed interest rate decision Wed. afternoon. We also have Oil inventories before the Fed meeting. And if that’s not enough, the ECB’s Draghi speaks on Thursday along with Initial Jobless claims for the U.S. That’s the week in a nutshell and I expect some fireworks. You can view the Economic Calendar here: http://www.investing.com/economic-calendar/

Stock Market

Yesterday I said to keep an eye on AAPL for direction and being in sync with your trades tomorrow too. AAPL was up with the markets and ended the day basically flat with the markets. Tomorrow we’ll see what it does as it will be a good guide to your trades till the Fed.

Foreign Markets

We are long EDZ, RUSS and YANG still and Asian markets will tip there hat for these tomorrow after BoJ meeting.

Interest Rates

I said I have to lean TLT and it was up most of the day and I expect after the Fed will continue higher with a run to safety.

Energy

DWTI may become a buy again on weakness. No call at present with the storage report tomorrow.

UGAZ triggered on the weekly and I found myself too cautious. I did mention it as a possibility but passed. I will be more aggressive when my data tells me too. I just didn’t trust it after seeing it up then go red so many times the last week. But it could fly here to 50 where it may find some resistance when you pull out on the chart.

Precious Metals and Mining Stocks

Repeat from yesterday; Still want a break of $1,306.90 on gold as first target. If we are going to go weak for the markets after the Fed, then we’ll get there easily. I did buy the dip and some of you might have done the same on JDST. When I buy the dip like that, I typically sell and do it as a day trade. Turned out to be an ok one and it went down again. DUST is disappointing a little here but JDST we have been green on the trade several times. When you choose to take profit is up to you, because you know it is going to be volatile. All of these ETFs are volatile. But I will take the risk and hold through tomorrow at this point. Dollar was up nicely today and gold needs to take note of that as it was flat today.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.