ETF Trading Research 9/21/2016

It is said that if you know your enemies and know yourself, you will not be imperiled in a hundred battles; if you do not know your enemies but do know yourself, you will win one and lose one; if you do not know your enemies nor yourself, you will be imperiled in every single battle. Sun Tzu

And so it was with me the last 10 trading days. I have made mistakes, reprimanded myself, and made them again. First it was overtrading and I did cut back on that, but the 2nd this week was not paying attention to the signals right before my eyes and sticking with a narrative from two other subscriptions I belong to, which have been extremely successful in the past, but wrong this time around.

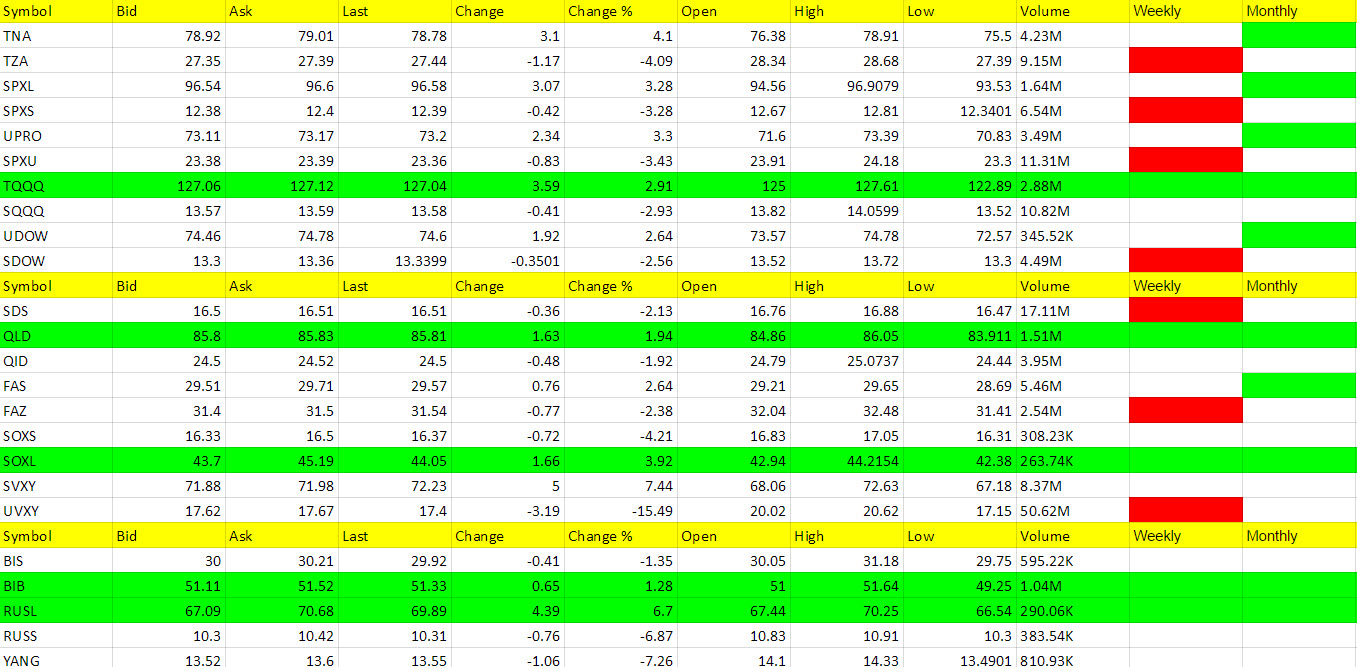

Simply put, I overstayed my welcome, ignored the #1 Trading Rule, and suffered defeat but the data was there before me with some triggers that I chose to ignore like with SLV, USLV and UGAZ all triggering over the levels I look for 2 days ago for the first 2 and yesterday for UGAZ. There were a few others too. I hesitated to post them and it wasn’t the right move.

I am going to concentrate on SWING trades at the moment and get the mojo back that I am confident this service can provide you, like when we did 68% in August jumping in on some weekly trends.

With the markets mixed and some green weekly and opposites still green monthly, I should have played it safer with the Fed week (see Trading Rule #2).

Please read the Trading Rules before doing any trading with this service.

Economic Data for Tomorrow

Tomorrow we have Initial Jobless Claims expected to 262k at 8:30am EDT and Existing Home Sales at 10am EDT as the U.S. market movers. We also have Draghi speaking at 9am EDT. This is the 3rd major central bank figure to speak in what has been a move towards all weakening their currencies and pushing asset values up.

Stock Market

Today the bulls had control and I expect this to continue for now unless Draghi throws a wrench into things. We had TQQQ, QLD, SOXL, BIB all trigger long on the weekly/monthly.

Foreign Markets

RUSL and YINN have triggered long on the weekly and monthly. EDC may trigger tomorrow on the weekly for a trade as long as market continues higher.

Interest Rates

TLT was up again today, closing up 1.08 today. Still like it as well as on the dips now that the Fed has spoken.

Energy

The storage report came in bullish for oil and thus the markets. This was an early sign to be more cautious on shorts and I didn’t pay attention to it. UWTI has not triggered long but may on the weekly soon. Last time it did we got 13% from it.

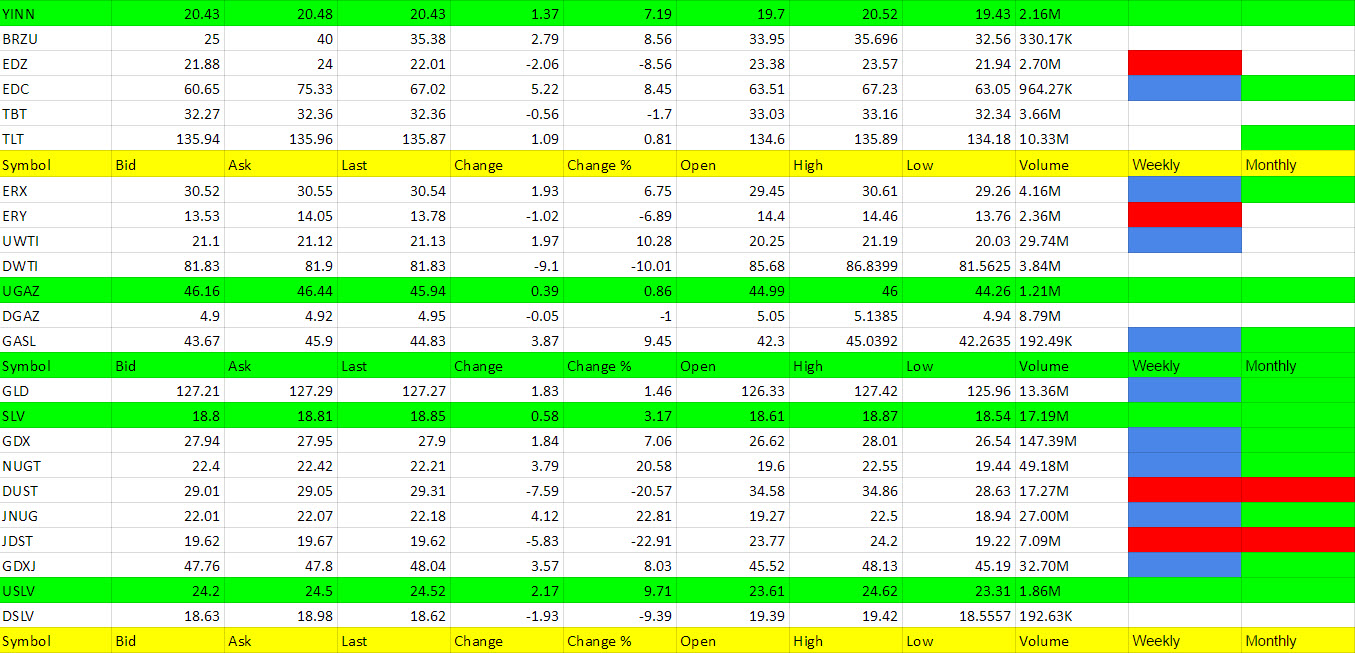

UGAZ has triggered on the weekly and monthly but had a big dip down to 42.28 before closing at 45.98. It may be ready for that breakout now to 50.

Precious Metals and Mining Stocks

Yesterday I said I will take the risk and hold through tomorrow at this point and it was the wrong choice. Dollar got clobbered after the Fed and there was no recovery. I did say in the Trade Alert Update at close to 4am EDT the following; “If we did jump ship and move the other direction, it would be the gold area I would concentrate on switching to JNUG/NUGT. ” But I didn’t act upon it. Even later I gave prices that I normally would have jumped on with JNUG and NUGT when I said; “I have to look at the opposite end of the metals here too, and could make a call to buy NUGT over 19.76 and JNUG over 19.27 as a scalp trade but will stick with the JDST and DUST trades because I am still sticking with the markets moving lower over the next week, despite central bank moves.” Bottom line, I cost us with my stubbornness and Sun Tzu predicted the outcome before the battle was fought.