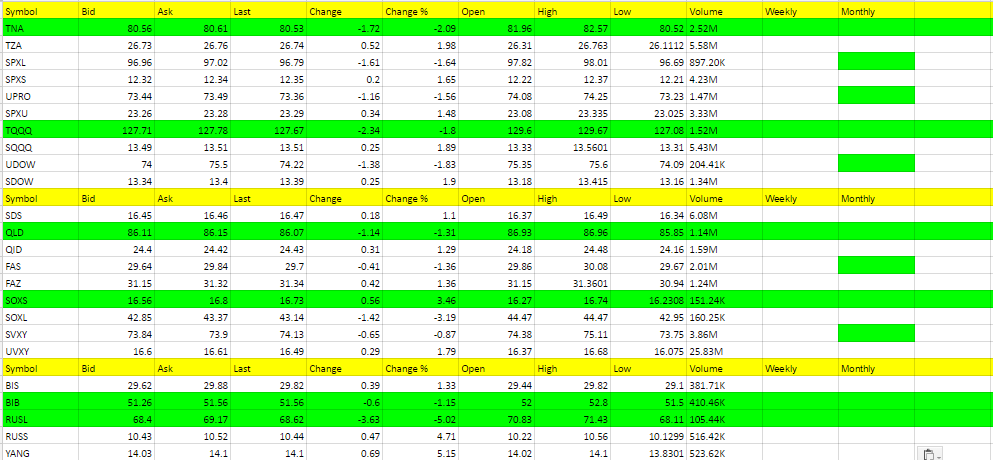

ETF Trading Research 9/25/2016

Now that the Fed and other central bank decisions are out of the way, we should be able to jump on some trends. The table below though is mixed so it might take a day or two to work itself out. I said before the Fed meeting that I lean bearish and I still do. But we are now range bound and need to break below certain levels for me to be fully bearish. The market is topping territory and just waiting for the right news to send it lower. That news can come from China or Europe with their banking issues. The dollar is still our major key to watch along with oil.

I will give my calls for ETFs that have the best opportunities after the market opens and will try to give price setups so you that like to scalp for profits can jump on a trend. SWING trades we just have to be patient for the weekly green. Sometimes these ETFs will turn out to be a big mover for the day. Sometimes they reverse. Anytime they go negative on the day, it should be an automatic sell, but for the most part you would have probably already been stopped out if they reversed that much already. The best way to trade an ETF that begins to take off is with a Trailing Stop. Please review the Trading Rules on Trailing Stops. Always protect your profit at a comfortable stop and keep an eye on the other indicators that trade along with your trade in making sure everything is in sync with your trade.

Economic Data for Tomorrow

New home sales are expected to be 600k is the big market mover potential tomorrow. ECB’s Draghi is speaking along with a couple other Fed members which can always create some buzz one way or the other so we’ll have to be on our toes for that.

Stock Market

The market overall ended up last week and Friday took a turn south again. We’ll see what develops overnight in Asia and Europe but things are flat at present.

Foreign Markets

We’ll wait to see if there are any of these to jump on depending on the direction. I typically like trading these after the open as we can get a move to jump on and not get hurt too much if it goes against us since they for the most part move slower than some of the other ETFs. You do have to look at average volume and can expect better entries and exits with the ETFs that average 1 million or more shares traded on average.

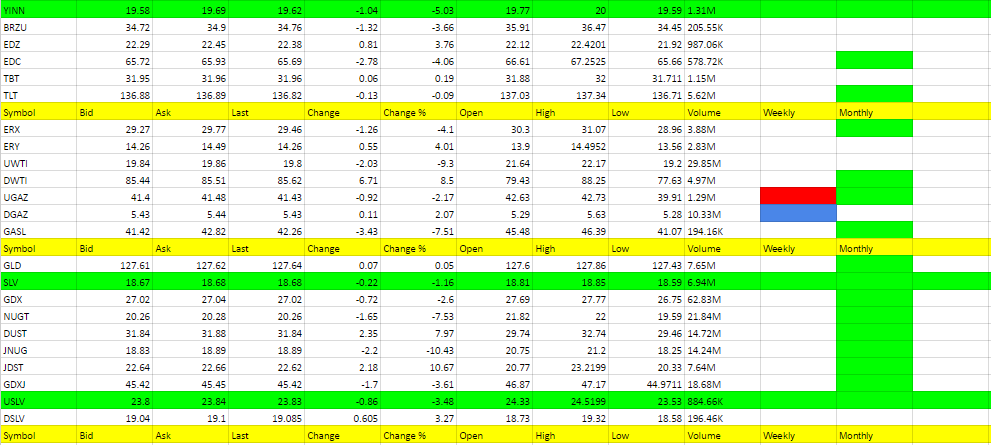

Interest Rates

TLT has been doing well of late but doesn’t spend too many days moving up for reversing course again. If TBT is green at the open tomorrow it will probablyget you a little profit if you jump on it.

Energy

DWTI was a good trade on Friday with mixed news on oil that could have went either way, but went in the direction of short oil. We may bet a carryover effect on Monday to scalp DWTI and as always, watch for news out of OPEC and the reports that come out each week. These are always a little more risky because of news that can come, especially if holding overnight.

DGAZ could be taking over for UGAZ now and we got a little out of it on Friday. We haven’t hit green on the weekly but now that UGAZ has turned red on the weekly we can put DGAZ on our one to watch list and might be the best opportunity for profit if we can get it going in the morning. The last week or so we have had reversals on these, which maybe signaled a top as DGAZ would trade places with UGAZ in volatile up and down trading. I’ll have to lean with DGAZ now.

Precious Metals and Mining Stocks

Gold and silver got a boost from the Fed, but Friday we saw them higher and the dollar higher, but JDST and DUST higher. This is not a normal situation but JDST and DUST traded higher with the market weakness that trumped what the price of gold did. We can somewhat ignore the price of gold with the miners of late and trade the direction of the market and should do well for scalps as we wait for a trend to develop.