ETF Trading Research 9/27/2016

I notice some of you with Yahoo email have not switched to Gmail yet. I wrote this yesterday; Please note: Yahoo users for some reason seem to be getting delayed alerts from our email distribution company. I do suggest a switch to gmail. Notify us of the new email address and we’ll switch you over so you can receive the quotes faster.

Please review the Trading Rules

Trades Today

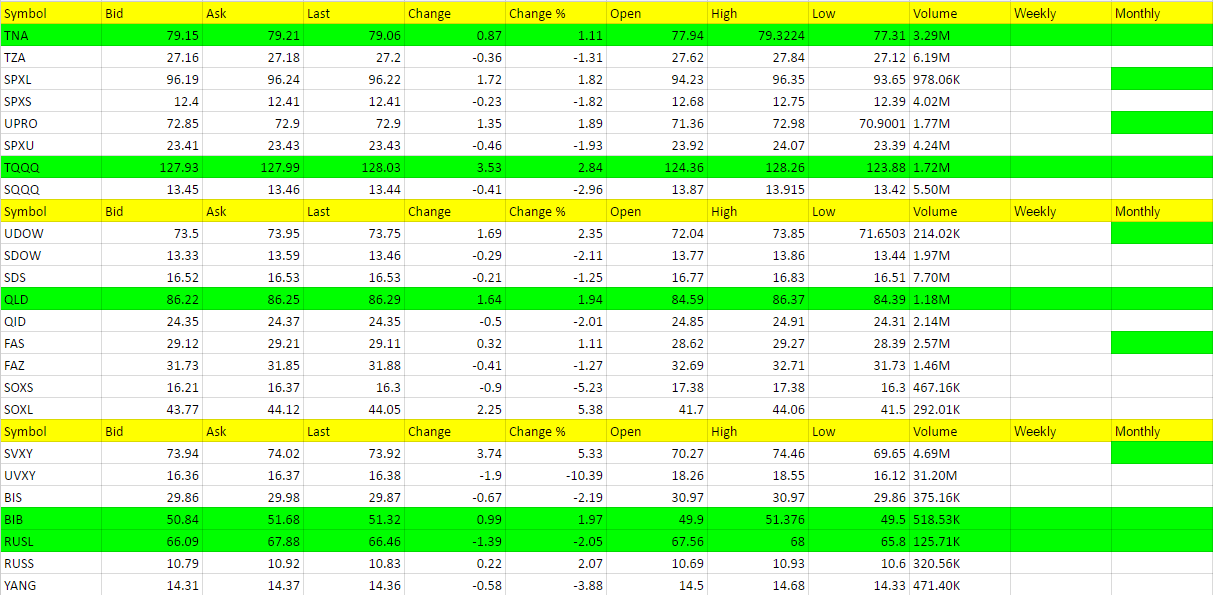

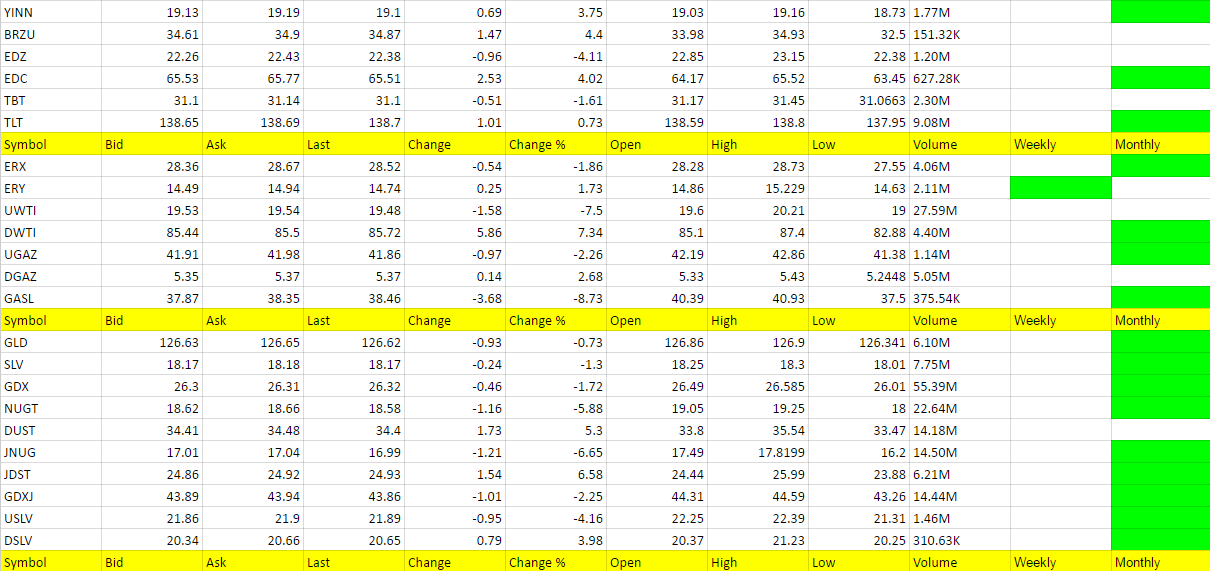

After the debate yesterday I wrote my thoughts which were a little bullish on the markets and to look for SVXY as a possible good trade. We fell back down to earth for a bit with Europe’s downturn, but then carried forward to give us a trade in SVXY. This is not a trend and we’ll be looking to get short on a sign of any weakness. Still waiting though on a good SWING trade opportunity. It may come in JDST and DUST soon if we can break down in metals with a dollar bounce.

Economic Data for Tomorrow

Consumer Confidence came out better than expected today to help the market move higher. We could possibly see some more of a move higher tomorrow morning, depending on any news out of Asia or some more misgivings in Europe. Tomorrow we have a market mover pre-market with Core Durable Goods orders, which the forecast is -0.4%, down from last months 1.3%. MoM is expecte do be -1.4% down from a robust 4.4% last month. Understand this is NEGATIVE, but a beat will have the markets move HIGHER. Next we have Fed Chair Yellen testifying at 10AM EDT and OPEC will come to their conclusions in the 10:00 hour and 10:30 Crude Oil Inventories. We then have Draghi speaking again at 10:30. Looking ahead to Thursday we have a few market movers, GDP QoQ for Q2 expected to grow to 1.3% at 8:30am EDT, Initial Jobless Claims expected to be 260k at the same time and at 10am Pending Home Sales expected to be 0.3%.

It’s always important to look for market moving data that may come out the next morning pre-market that can possibly effect any overnight holds and the liquidity that they normally have pre-market. You don’t want to be in a thinly traded ETF pre-market that goes against you because of some data. Of course the data could be in your favor too, if the trend is working in your favor. I typically prefer only called SWING trades on overnight holds.

Stock Market

We had a good day for the stock market and we now have to see if it wants to continue higher on a momentum change again, or if we can get back to selling. I prefer to sell these tops or resistance levels right now and we’ll have to look for a good setup there.

Foreign Markets

Yesterday before the European markets opened up I called them a mess and despite the good showing in Asia, Europe was down sharply. But that didn’t rollover to the U.S. where I joked today in a Market Update that maybe democrats were buying the market as the media deemed Hillary Clinton the winner of last nights debate. Even Fox News was praising Hillary from what I could tell. But foreign markets will trade on their own issues and Europe is still a mess and could get bigger and I think China is next.

Interest Rates

TLT continued higher again today. I will say again that TBT goes green tomorrow, play it long. If it opens green I would jump on it at the open. Just see a reversal possibility.

Energy DWTI you may have got a little out of it today, but I warned that it’s a tough trade when OPEC is discussing what’s going to happen next. We saw that in the chart of UWTI that I sent. Will probably wait to hear the final results along with the storage data before jumping on a trend. http://www.reuters.com/article/us-opec-meeting-saudi-idUSKCN11X0LL

DGAZ came close today, but hanging in there as a potential. Leaning this way for now.

Precious Metals and Mining Stocks

Gold was down with the dollar up and JDST joined the move lower and JNUG and NUGT didn’t follow the market higher today. I don’t even think I gave them a second look with the dollar up. But I did keep an eye on them. Still waiting and wanting gold to break $1,300. Silver is by far weaker and DSLV may trigger tomorrow with anymore selling.