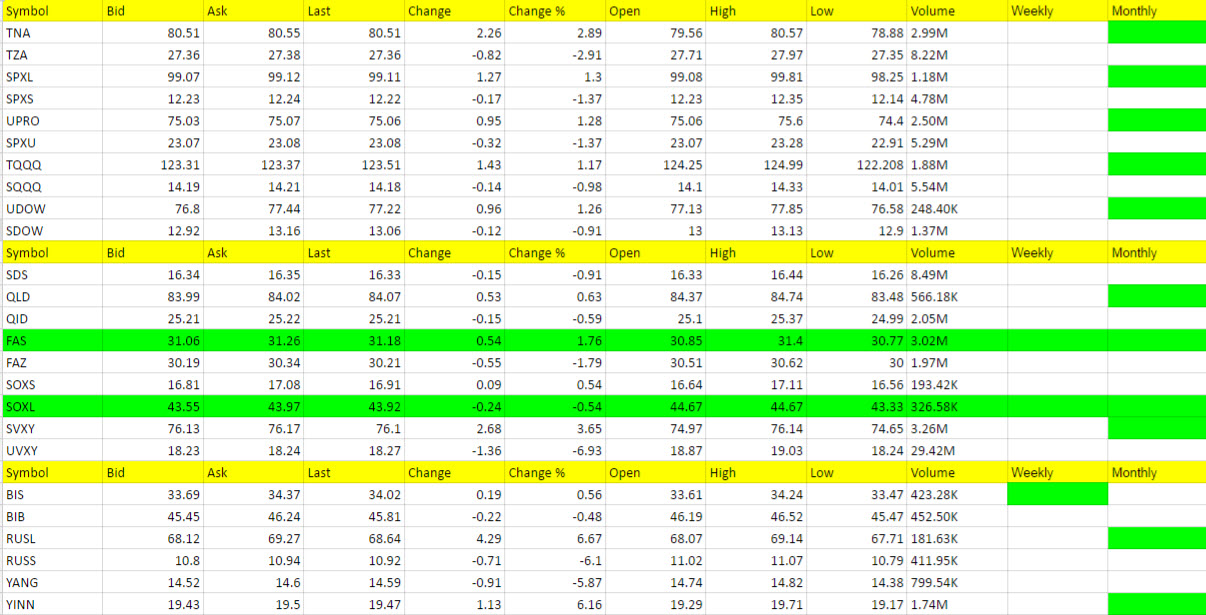

ETF Trading Research 9/5/2016

Trading Rules https://illusionsofwealth.com/etf-trading-rules/

Suggestions for Improvement

I’m always looking for ways to improve the service and will take any of them under consideration. Feel free to email info@illusionsofwealth.com A couple of you did on Friday and I appreciate it. The more I know weakness, the better the ETF Trading Service can be.

I’ll update Friday’s exits and trades a little bit later. We are presently in RUSS, SPXS and UVXY (300 shares). I will say that I didn’t follow my gut from Thursday when I said that we typically go bullish into a Holiday weekend and even with the jobs report being worse than expected, guess what? The market shot higher and stayed higher.

Below you will find the tracking of all trades we have made so far excluding Friday’s trades which we are working on a private version for Subscribers only that should be available tomorrow. It shows what a $10,000 investment into each call would have returned from Aug. 8th through Sept. 1st. Not a bad beginning to the Service!

Profit in Up or Down Markets Today with the ETF Trading Service

Market Synopsis from Friday, and preparation for tomorrow.

Right when the market starts to reverse course we had confirmation of bad data and the market goes up. We can’t ignore price action and should have simply sat on our hands, which I did try to warn to do with 3 emails on Friday morning before the jobs report. However, I will show on the report that I stuck with the trades and take the losses for my track record for the service. I will just hope that most of you did not hold going into the report. I did say then to go home flat for the weekend and that is fine. But later I did say to go long the 3 ETFs one more time, Futures are pretty much flat and have been even with the markets open in Asia and Europe yesterday. We’ll see what tomorrow brings and I’ll send out a Trading Alert Update to guide those trades if anyone took them.

If new to the service, get used to how things work and make sure you understand the Trading Rules above. Not all calls will be winners and the number one rule is to keep a stop. We look for the doubles and home runs that always seem to come based on my over a year now of doing this service in various forms. I believe the last year has taught me most my weaknesses, but at times I’ll admit that I am not perfect and some losses will come. Over trading is one thing I will keep an eye on as I feel I did it on Friday.

Stock Market

No call but yes, the market threw us for a surprise on Friday. Will wait and see what the market wants to do Tuesday morning after the Asian and European markets kick into gear. We are long SPXS and UVXY (300 shares only) and see what the open brings.

Foreign Markets

RUSS we are in but will keep a tight stop. No other call either way at present.

Interest Rates

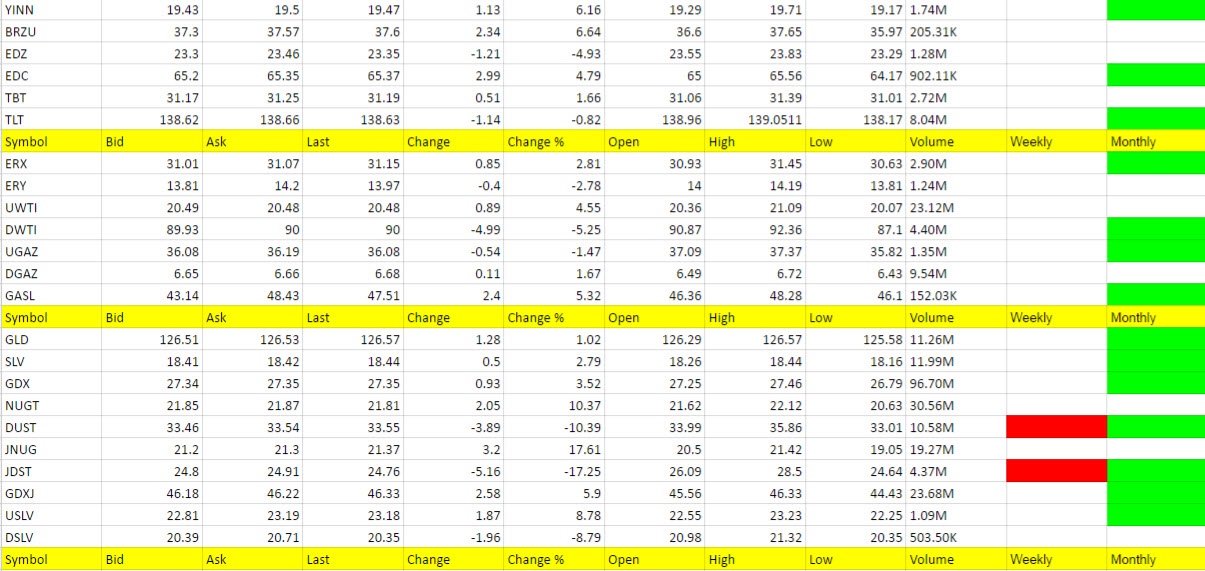

TBT and TLT still churning and no call but am leaning towards TBT although not yet ready to color it blue.

Energy

No call for oil at present. Need DWTI or UWTI to click to jump on it.

Coming back from the Holiday weekend I want to see what direction we get in natural gas before making any calls. Nothing has triggered and if anything I want to see DGAZ take charge here for a trade.

Precious Metals and Mining Stocks

I said the jobs report would trigger something for precious metals on Thursday before it was released Friday but once released it was way too fast for us to jump on and I sent out an alert to not chase it. Sure enough we got about a 9% reversal and then we bounced higher again. Volatile ETFs are not worth trading as we wait for the trend to develop. We have done the best with trades in the metals so far (along with oil) and I love trading these. But timing has to be right. The dollar is still key for direction I notice, so keep an eye on it for guidance. Little secret for you all; its been a pretty good inverse indicator. Doesn’t mean it will always be that way, but overall it has been lately. However, gold is up 3.30 and silver 25 cents with the dollar up 9 cents, so with an abnormal situation as this, we stay out for now. Price action always trumps what you think you may know

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.