ETF Trading Research 9/6/2016

As the ETF Trading Service evolves, I will keep making tweak’s to my calls, improving on any weakness that I am missing. I know I’m not perfect (had a great first month though) but I should have called a trade in JNUG and NUGT but missed one of my indicators that should have given us that trade. While these have NOT triggered on the weekly yet, a subscriber had asked me why they hadn’t. The answer is the trend down, which we took advantage of with multiple trades on JDST and DUST, was a pretty good move and they are still green on the monthly. I’m not a bottom fisher but yes, I could have easily made that call. I missed the news this morning and didn’t see the dollar crash hard with the ISM report too so it was a double whammy. I am installing a 4th, big screen monitor to have continual screens that give me a glance of what’s going on with the main things I watch to alleviate this issue in the future. I will repeat though, only 2 of the miners I follow (out of about 30) were green on the weekly so I need some more show of strength to make a trend call. Just understand that with this service, trends take a little time to develop and I’ll be patient in calling them. If you want to trade what you see that may not agree with what I say or not do, feel free. Don’t use this service as the only thing you do, but know I try my best to give you the best calls I can and am human and will miss some. Send me an email on what you think AS IT’s HAPPENING and I will give you an opinion and it might trigger something for me. We are all in this together.

Trading Rules https://illusionsofwealth.com/etf-trading-rules/

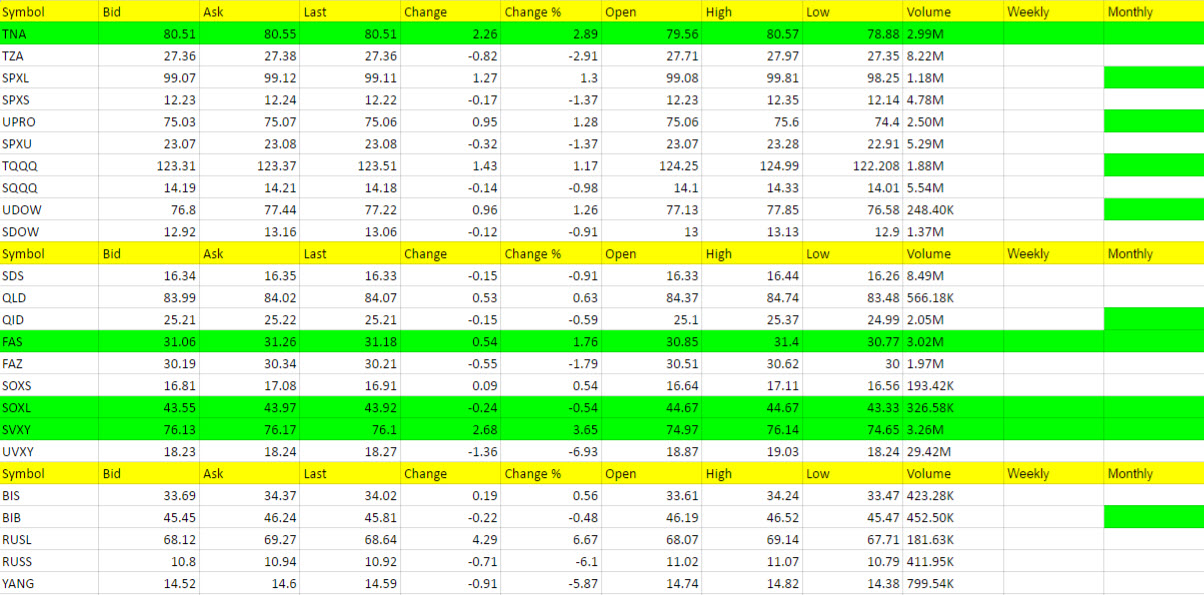

Trading Results and Current Trades

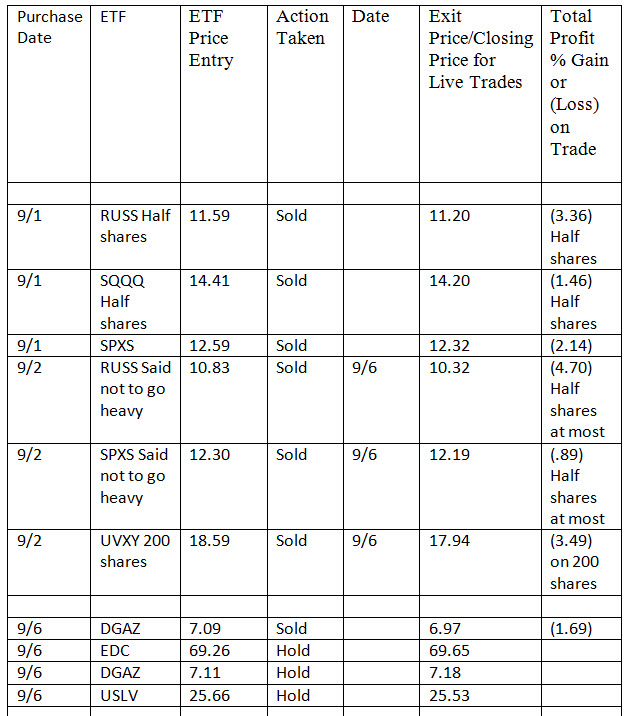

After having a good beginning of the week last week heading into Friday’s jobs numbers, I was willing to take on a little more risk. I warned about what risk I was taking and even told conservative investors pre-market 3 times on Friday to exit positions. But for my service I did not and have to live with that. Then I made even more trades that ignored the fact that the market didn’t care about the jobs numbers and true to form we headed higher into the holiday weekend. I warned of the risk carrying over the weekend but for my service, again, I was willing to take that risk. Turns out it wasn’t a good risk but conservative investors came out ok. I will always try and protect conservative investors. Perhaps I should be a little more conservative too at times. There is another thing that we as traders need to overcome within ourselves too, and that is overtrading, and I did a little bit of that on Friday.

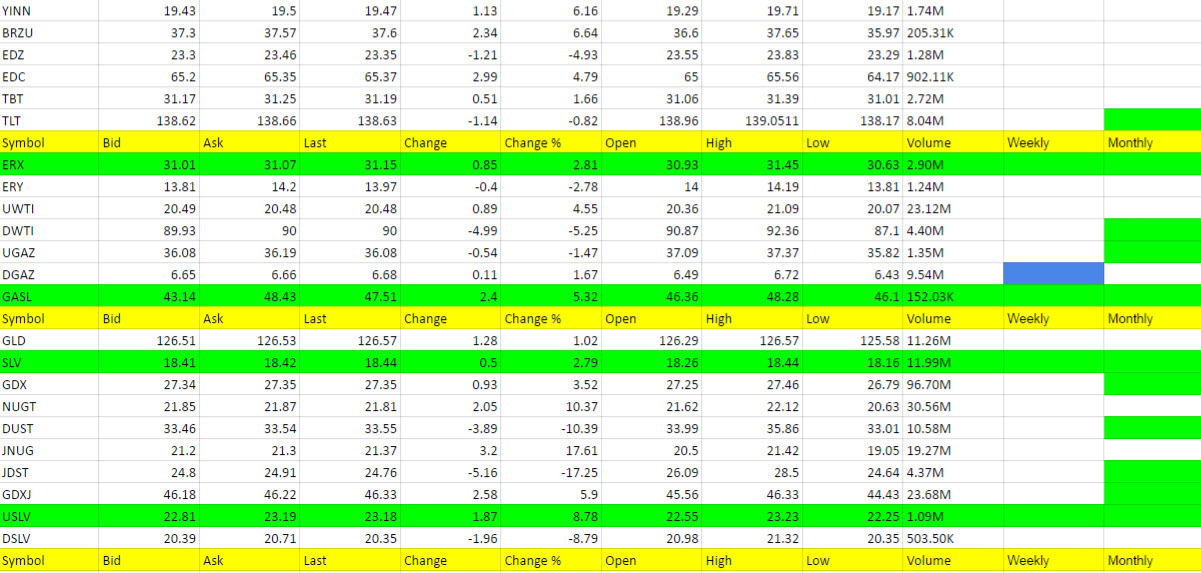

Today we tried one trade early in DGAZ and kept a tight stop which I should have lowered by a nickel, but re-entered the trade and are presently up in it. I said DGAZ is typically a scalp and sent out an alert saying that those who want to lock in profit at 7.20 could, and it closed 2 cents below that. I will lower the stop to 7 on this now, just in case we get a small gap down in the AM. We are taking the risk that we can get a run out of this as it is due for a run, but for now it is not green on the weekly and I have colored it blue only.

EDC is looking good so far and USLV is down a little but both it and SLV have triggered long on the weekly and monthly.

Economic Data for Tomorrow

There is no real big market moving data coming out tomorrow, only some lower key data with the Beige book and JOLTs Job Openings. Perhaps we drift higher.

Stock Market

We are seeing a bullish trend developing with the bad news that is coming out, which gold and the dollar reacted too with the market, but the market shot back up. We’ll play along with the market, not against it. We have to be careful of churning or whipsaw action so I am keeping the number of trades light at present. We have to have our fishing pole in the water to catch fish and sometimes we catch nothing which is why I have the stops at break even on DGAZ and EDC today, and sometimes we can catch the big fish. This service is about catching the big fish as we know they are out there.

Foreign Markets

RUSS has now turned to RUSL. RUSL has been trading with low volume and I almost called it today but wanted to wait for a better confirmation. Buy it at the open if it is green and futures are green. It is trading at 74 presently. Futures are down .50 so I prefer to see if it opens green. If it doesn’t, it is not a trade but could become one.

EDC came into play and if it weren’t for lunch I would have called it about 60 cents earlier. Sometimes you just have to ignore rules and trade.

Interest Rates

TLT took the place of TBT today and the churn continues.

Energy

No call for oil at present on oil plays. UWTI might perk up here, but nothing triggered yet.

I said in last nights report that “nothing has triggered and if anything I want to see DGAZ take charge here for a trade.” We did get in and even though it has not triggered weekly green yet, we will take a chance with it.

Precious Metals and Mining Stocks

See above. Still plenty of profit to make in these.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.