ETF Trading Research 9/7/2016

Economic Data for Tomorrow

I want to start out by saying that if there was data on the sites I look at regarding oil, I would have called it. Unfortunately there was no oil data for aftermarket and we got hit on that trade if you took it. The first one below was the only one of the 4 to have the oil data. I will have to check all for for better accuracy in calls from now on.

http://www.fxstreet.com/economic-calendar/

http://www.investing.com/economic-calendar/

http://www.netdania.com/UI/CalendarNetDania.aspx

Overnight we have the ECB interest rate decision that should keep things just where they are. Tomorrow we have Initial Jobless claims with a 265k number expected. Natural gas storage change along with Crude oil as well along with Consumer Credit Change.

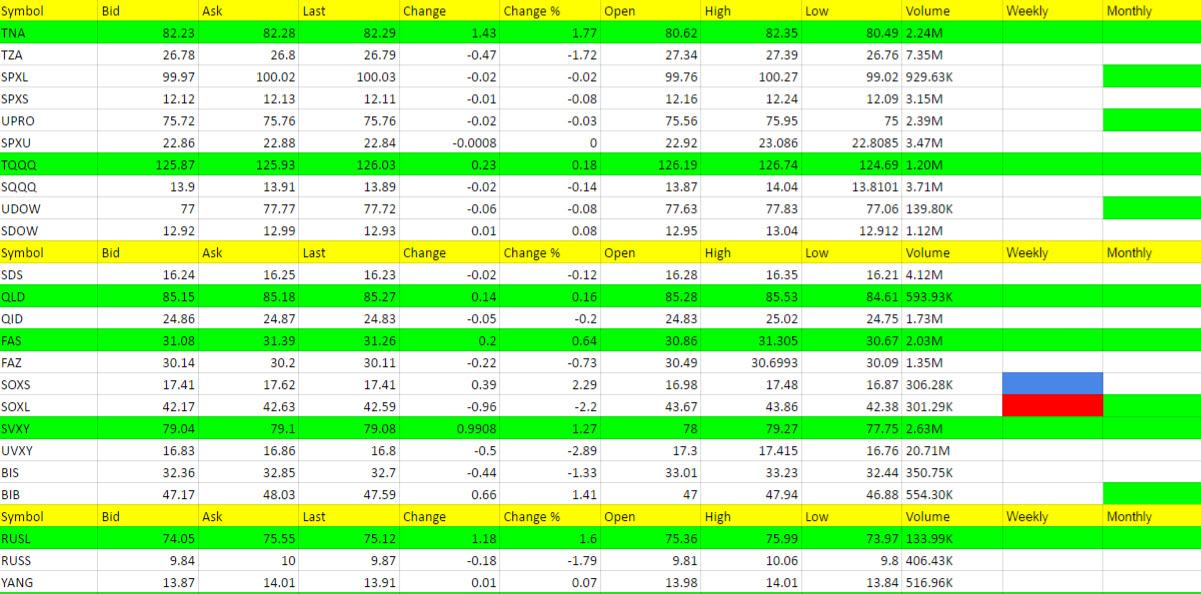

Stock Market

The last 2 days have been tough trading days because of volatility, although volatility itself isn’t rising. You can see since Sept. 1st the results of the Trading Service in trying to find trades is weaker, but eventually some of these trades will hit. Small losses on the way to big gains is what trading is all about. So far however we are seeing more green long the market ETFs popping up and we can’t ignore this price action despite the 5 shakeouts you see below. This is just market makers whipsawing us and we have to sit on our hands more or trade with smaller shares until this up and down price action subsides. We could enter some of the long the market ETFs in speculation we are moving higher, but I’m not on board yet. Even SOXL the Semiconductor Bull went red today telling us that SOXS may trigger long if we get that downturn to continue and I have put SOXS on the one to watch list. I have a new system I am utilizing based on some patterns I have seen and SOXS will be our first “one to watch” using this system and we’ll see how it does tomorrow. I would buy it if it opens green and futures are red, but scalp the open run up for now as it has not triggered long on the weekly yet. Naturally, a weaker market will benefit it. It has about a 50 cent range so that would be your target scalp. Volume has increased so we have a shot at interest now.

Foreign Markets

RUSL moved higher today in line with its trend. I said buy at the open if it was green and futures were green but futures opened lower and it did closer lower than the open price by 24 cents. We’ll keep an eye on it but I will use the same rule tomorrow; if it opens green and futures are green, it is a buy. It has a 1.2 range so use 73.94 as your stop.

YINN or YANG may come into play tomorrow with the Chinese trade data that comes out overnight.

Interest Rates

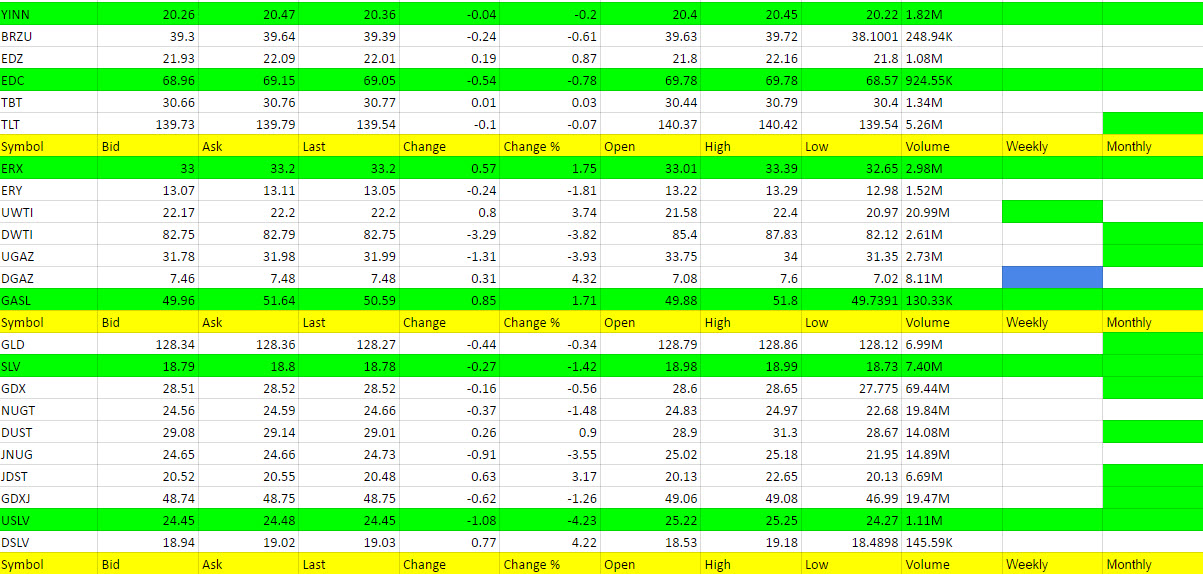

TLT and TBT flat today and no call.

Energy

Oil storage report tomorrow and I lean long oil at present after tonight’s build but no call until after the report.

DGAZ I should have given a little more of a chance this morning with a wider stop. It did move up 4% and we’ll keep an eye on it to see if it triggers green on the weekly now.

Precious Metals and Mining Stocks

We did get a good trade in JDST today and I should have sold out at an 8% gain on the last half where I told conservative traders to take profit and I know some of you did. But we still stopped out at a 5% gain on half and 3% on the other half. Depending on when you bought it your gain might have been slightly less.

Other Calls

From time to time I will be adding individual ETFs that have triggered long or short based on market trends. These may or may not be leveraged. These types of trades will be more for longer term swing trades for IRA’s where we can catch a good directional rise. I care not what the overall market is doing with these calls and will provide entry and exit strategies.