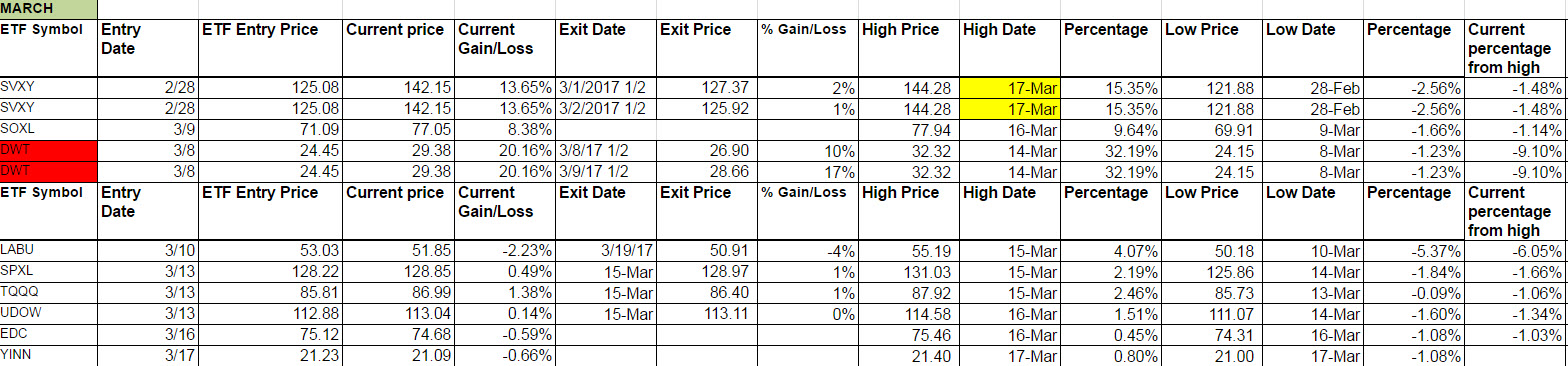

ETF Trading Research 3/19/2017

Friday’s Trades

I chickened out of what would have been a good JDST trade by just a few cents. We did get stopped out of JNUG but are back in again 1/2 shares at 6.73 and it closed at 6.74. We bought DWT over 29 and sold halv at 29.55 and a .25 on the remaining shares for profit.

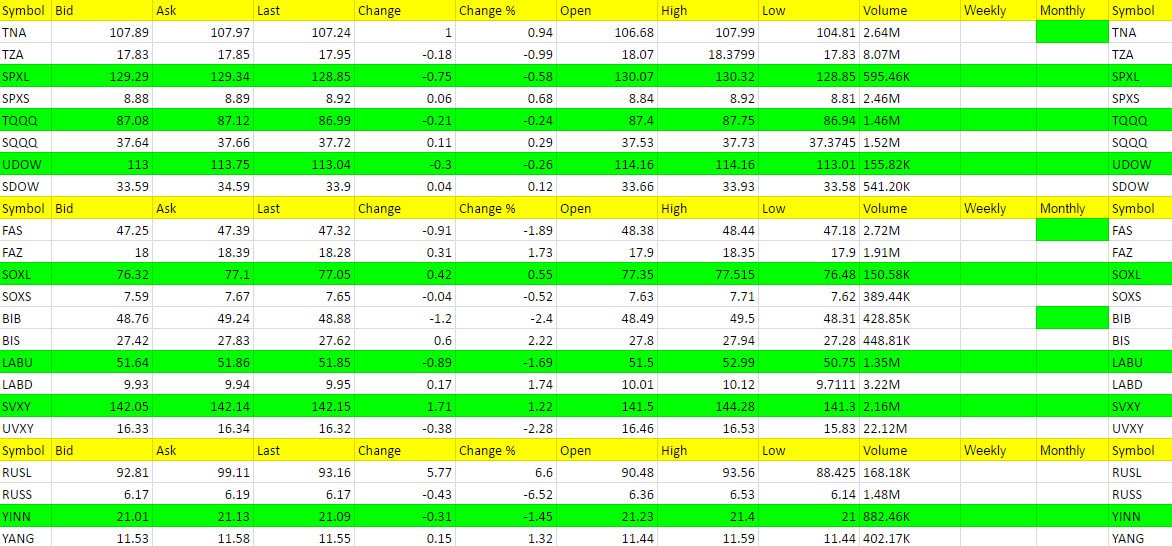

TLT were in from 116.86 and up on it. EDC and YINN down a hair. Anyone who has ridden SVXY all this time is doing well and no more UVXY calls while it is green still. It’s interesting in that on Friday we had all of the ETFs green on the nightly hit lower highs so this may be signally the reversal but SVXY hit a higher high once again.

Economic Data for Tomorrow

Nothing important for data tomorrow.

http://www.investing.com/economic-calendar/

Stock Market

With the lower highs being hit yesterday, the yellow highlighted ETFs in the 1st table below, it signals that we could be topping but I prefer to have SVXY stop rising. If they all open lower tomorrow then we’ll look to short the market. Otherwise, SVXY is the one to buy.

Foreign Markets

EDC and YINN struggling a bit out of the gate. Surprised by that. Still want to keep an eye on RUSL which had a good day on Friday.

Interest Rates

TLT I have put blue as a one to watch but we are already long.

Energy

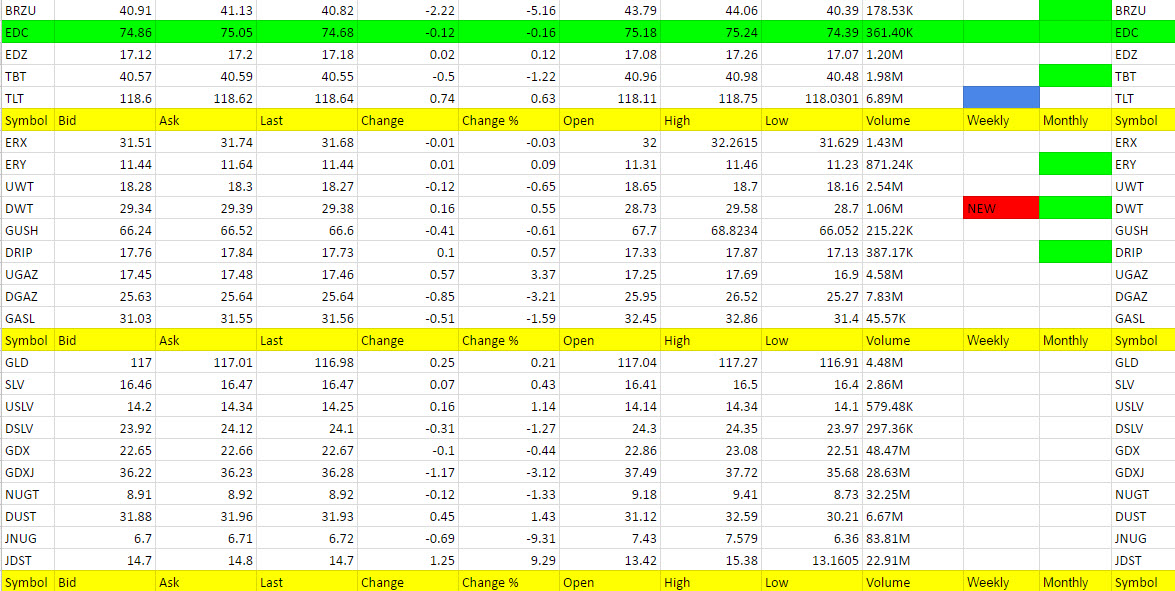

Thursday night’s report I said we “might have to look DWT’s way again” and we did, but scalped it only and now it has turned red on the weekly only because of the pullback. It did end up positive for the day.

Nat Gas still too choppy to attempt a call. Something should change here soon and get us a trade and I’ll pay closer attention to them tomorrow now that oil is a tougher call.

Precious Metals and Mining Stocks

I think the pullback in miners caught many by surprise and we kept a stop after having a great Friday and locking in profit much higher the first go around. We were only in 1/2 shares so not a big loss and we are back in 1/2 shares lower for the next leg up. Gold is up 30 cents and silver a penny in early Asian trading. Platinum and Palladium up even more.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, RUSL, UGAZ

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JNUG, RUSS, BRZU, GDXJ, DGAZ (DWT turned red on the weekly)

Green Weekly’s

No new green weekly’s. We see that ETFs are disappearing from the chart below which tells me some new trends should be coming soon for some of them. This service is not just about JNUG and JDST and gold trades. There are plenty of places to profit. The trades of late seem to be not offering the usual run up but after tracking these for awhile now, I have noticed that the ones I have labeled in the Trading Rules with the profit goals of 7% or more are the ones that tend to take off the fastest. Keep that in mind as they trigger in the weeks or months ahead. That’s where the real profit is made, but not absolute. Just what I have seen many times proven.