ETF Trading Research 7/24/2019

Dollar positive? Check. Gold break 1417 area? Not yet. But it did have an intraday fall off the highs of 1430 and we break down from here we should be fine. We moved all the way up to 17.27 before they took it down to 16.26 and now a bounce to 16.40. Dollar will win this battle and the bottom may be in for the dollar. Thought it would get down to 97.40 but it didn’t and we are at 97.75 now, up 4 cents. TMV hung in there all day and is down just 1.15% for the day and we’re just under flat. Watch for it to move up with DUST and JDST and the dollar.

TVIX they are still pushing around a little but it’s up off the lows it just put in and I think as long as we stay under 3015 we can stay under 3033 we should head back to under 2994. The DOW will close down triple digits and not much bullish to take us higher into the Fed that I can see. Except nonsense of momentum. 3023 is next micro resistance before 3033. We may see TVIX bottom out here soon pre-Fed.

Some ramblings I think are needed at this point on what’s really happening:

More debt is a good thing right? More QE is a good thing right? No Trade deal is a good thing right? Europe imploding is a good thing right? Brexit issues is a good thing right? Everything I read from those who trade decently say 3033 next. Possibly 3079. That would really suck too. And no reason for it. But each time we get higher market calls, they come out and raise them even higher. Not bat shit crazy high like CA though. But to get this to turn south, there has to be a catalyst. Enter the Fed next week. Everyone knows a .25 is baked in. No way they give Trump .50. Market doesn’t really care it just wants to go higher no matter what data or the Fed says. Have you seen the data out of Europe? It just seems that money is flowing from there to here keeping us going. Can’t attribute the move to anything else. But consumer debt at pre-market crash levels. Auto industry in U.S. hit hard. The consumer sure as hell isn’t participating in this run higher, unless they have a 401k. If the average account value of those who have a 401k is 200k, and only 32% of Americans have a 401k overall with a balance of about $100k, how many are really going to start saving just when the market starts a multi-year sell off? Until then, party on but again, on nothingness. www.youtube.com/watch?v=EQnaRtNMGMI

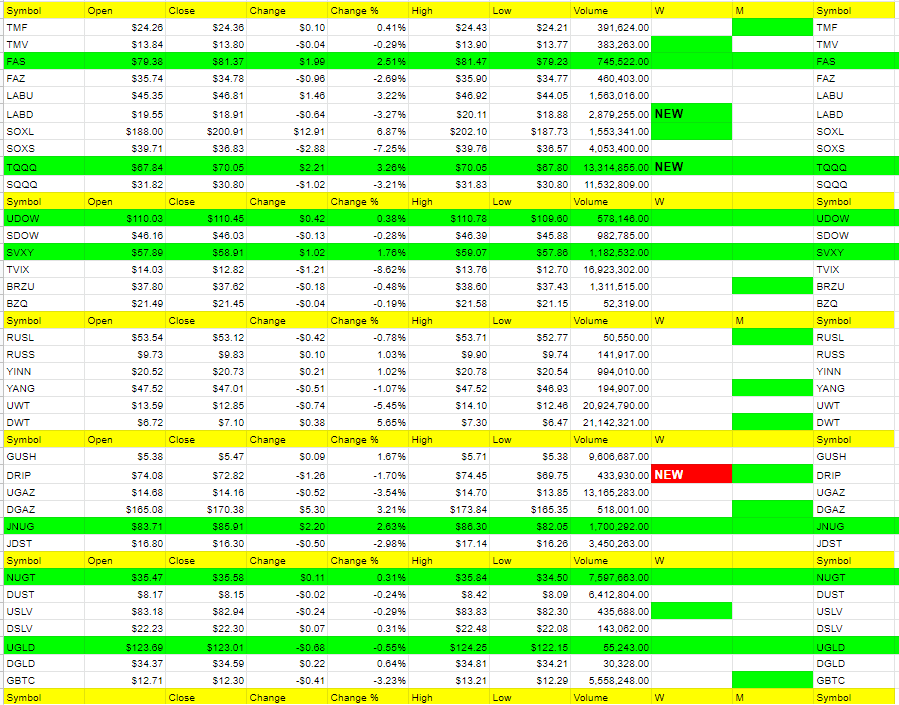

MORE: SOXL 3 days in a row in hot corner. Rarely do we see 4 or more. SOXS has lost 20.29% in the last 3 days. TVIX is up to 3 days as well at a loss of -16.18%.

I’ve been chatting with some fellow traders. We are all pretty much in agreement that a lot of what we have seen this year is unprecedented. Their will be blood at some point, but the question is when? I’m trying to play both sides and even give higher targets but yesterday I wasn’t afraid to go long and today stuck with TVIX. But I am only using 1/5 of the account for these trades while we wait out JDST and DUST and TMV should give us the move up to get JDST and DUST going. TVIX is a different animal. It has been since it was 26, twice as high, not too long ago. My guess is by the end of October, which really isn’t that far away, we will shoot for a 100% return in TVIX. I made that call the beginning of the year and it happened and we are more equipped to take advantage of it when it comes. Until then, my nightly report is smarter than I am. The green trend is paying off well for those who stick with it. When I see red again on any of those, I will go heavy the other way.

Oil falling isn’t good for the market so we’ll see if that continues or if it bounces back up tomorrow. If you see it open or go positive, it most likely is a buy. Nat gas still want to see 2.0 before going long, if it can get there. Won’t be a straight line.