Is A Recession Looming?

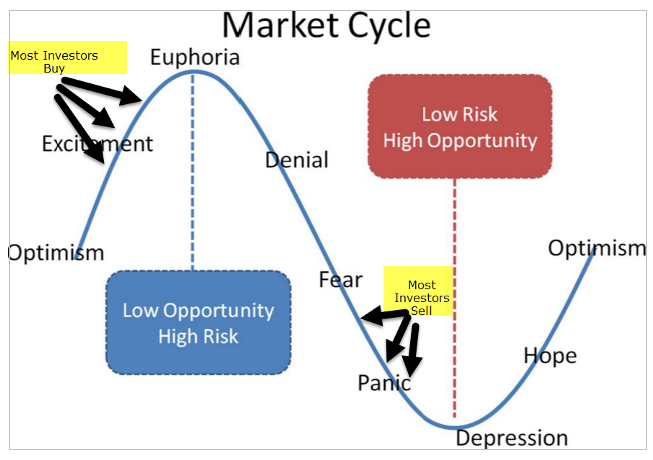

This is only going to be bits and pieces of what I am writing, but I have many pieces of the puzzle that show a recession is on the horizon. But first section is my short term thoughts on where we are today (I use this chart in the book but for different purposes).

Where Are We In the Market Cycle?

My take is we are most likely still in the Excitement stage, but some bears would probably say we are in Euphoria. To get to Euphoria, you need more bears to capitulate on some further big moves higher. We are not seeing that with a slow grind higher.

So to get more bears on board, a pullback is in order, and then a whipsaw higher. The recession wouldn’t come until we get that price action.

Jill Mislinski from Advisor Perspectives concurs with her inflation-adjusted S&P 500 index price that shows it is 112% above its long-term trend line dating back to 1871. This is 31% higher than just 3 years ago and now above the 2000 high. Just one more sign we are overvalued.

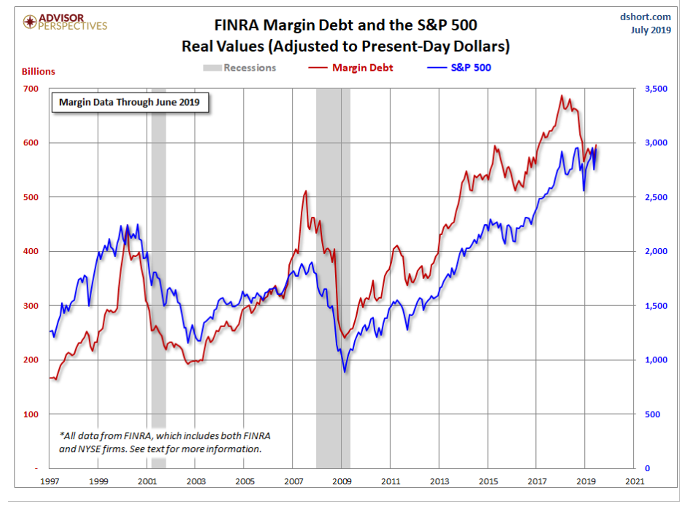

Margin Debt

In 2016 I wrote that many talk about margin debt as a reason to be worried about stock market valuations, and for good reason. In 2013 we hit record highs in margin debt, and in 2015 we were near record highs still. I wrote that while the stock market can be irrational longer than you can be solvent. Look at the chart now and see where the margin debt topped out. 40% higher than the top during the last financial crisis. This doesn’t mean we have topped out yet, but this is another area to keep an eye on if you are looking for tops and a reason to bail on the buy and hold strategy. At a minimum, it tells us to lock in profit with the assumption that we discussed already, that about every 9 years a recession looms

Market Valuations

One way to see whether today’s stock market is undervalued or overvalued is to compare the market cap to GDP. According to Gurufocus, “The Total Market Index is at $ 31,086 billion, up about10,200 billion since 2016 and the ratio of market cap to GDP is at 147% , just under the March 2000 high of 148.5% and well above the pre-2007-2009 crisis high of 110.70. This is another signal of a market potentially topping soon.

For further review;

Using History To Answer The Biggest Question

https://www.realvision.com/tv/shows/interviews/videos/using-history-to-answer-the-biggest-questions?utm_source=Organic&utm_medium=Twitter&utm_campaign=43672_RECWATCH_KA_SMT%20_RV_W3_TSNAP

What Will A Recession Do To Venture Capital?

https://www.realvision.com/tv/shows/interviews/videos/what-will-a-recession-do-to-venture-capital?utm_source=Organic&utm_medium=Twitter&utm_campaign=43670_RECWATCH_KA_SMT%20_RV_W1_TSNAP