ETF Trading Research 3/26/2017

Friday’s Trades

The day started out to be one of the most boring trading days we’ve had in a very long time. But in the last couple of hours everything started moving in our direction and I even typed out an alert to say how nice everything was flowing. They we get completely whipsawed and I only saw one reason; House Speaker Ryan was going to speak at 4Pm EDT. Gold fell $8! On that? And markets rebounded. The good news is JNUG is a bit higher then where we bought the last round and this after moving up for us 30 cents and our re-entries into SDOW, TZA and FAZ are all higher as we timed that dip pretty good. More on gold later in the report.

Economic Data For Tomorrow

There is no real market moving economic data tomorrow. Fed member Kaplan speaks and that’s about it.

http://www.investing.com/economic-calendar/

Stock Market

Markets are moving up and down based on nonsense these days, whether it be whether or not the Fed raises rates or Congress will come to an agreement on healthcare. For rates moving higher, it is allegedly a sign of an improving economy. But since when does the higher cost associated with adjustable rate mortgages, home loans, business and personal loans initiate more growth? If anything it depletes and already beaten down GDP as consumer and business spending are the bulk of GDP. Take out government spending the last 20 years and what kind of an economy would we have? The answer to that question will eventually, as rates rise, there will be less government spending and more interest to pay on the evern increasing debt (approaching $20 trillion) and very little growth. I will continue to lean short the market because the Fed is similar to the consumer and the last to know what’s really going on.

Got back from flying 4.5 hours and market futures opened and couldn’t be happier with our short the market trades. Futures down 15. Bounce can still come in the morning with some sort of health care deal, so realize that.

Foreign Markets

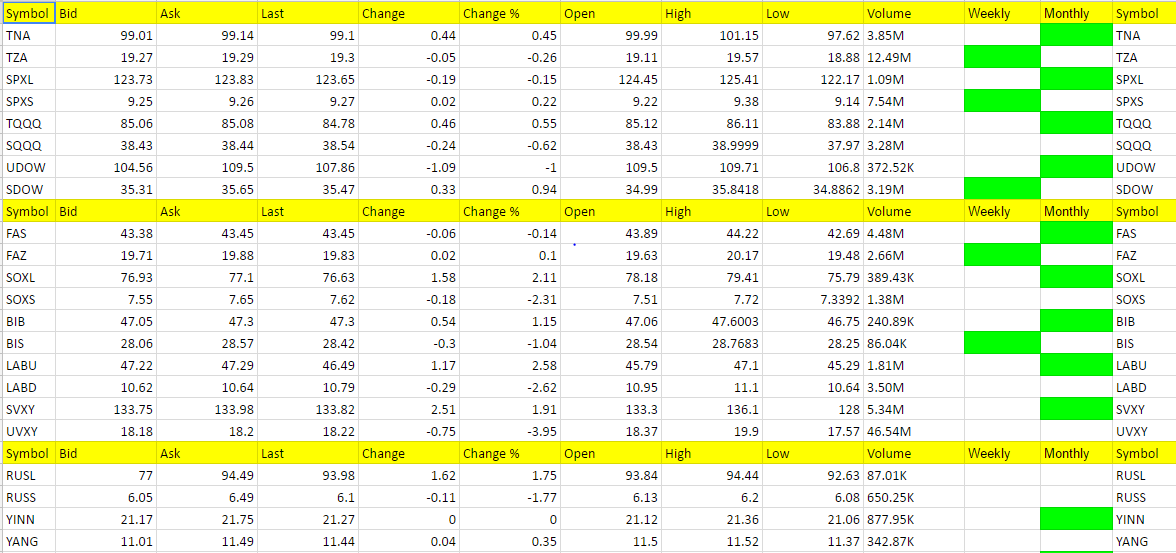

I want to make a couple points as we wait for foreign markets to really kick in with some profit for us. The calls on RUSS/RUSL – YINN/YANG – EDC/EDZ and I am going to start soon and opposite to BRZU but 2x that can still move to us because all of the sets offer some great percentage moves when they turn green on the weekly. In fact, I think they might even offer more consistent and less volatile returns once they hit green weekly but haven’t had time to confirm this. I have noticed it just from following these for so long now. If you just traded these sets and ignored everything else you could do quite well with this Service by just following the rules.

Interest Rates

I said we would be buying TLT again and we have and it still has not turned green on the weekly but we are doing well with it.

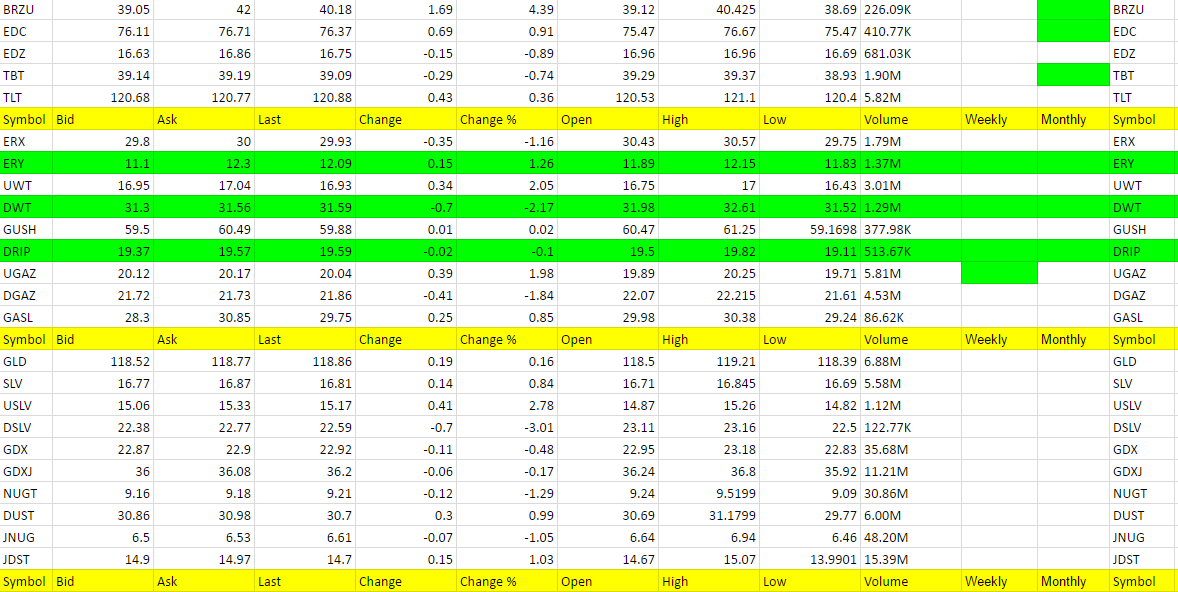

Energy

I think we might be moving to UWT as I said in the last report. This also means possibly ERX and GUSH instead of what is still green on the nightly report.

Nat Gas I think I might have actually missed the trade on it after hitting the green weekly. Perhaps because of the Thurs Nat Gas report being flat. Not sure. But I should have recognized the move up a bit better.

Precious Metals and Mining Stocks

Getting a little frustrated with gold, but the dollar is hitting fresh lows and USLV moved higher today in a decent sized move. We have to see if the dollar moving lower can trigger a gold run and also if silver can drag gold up with it.

I wrote the above while in transit on a flight back home and after settling in see that gold did move up finally and come Monday morning JNUG can finally get moving for us. Silver is already up .14 to 17.88. Great stuff. Not over yet but it was payback it seems for the false hoopla over Ryan holding a press conference on healthcare. Either way, silver is not listening to the noise and just keeps going up.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

BRZU

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

UVXY

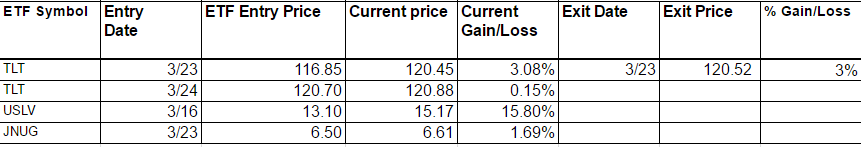

Current Non-Weekly Green Trades We Are In

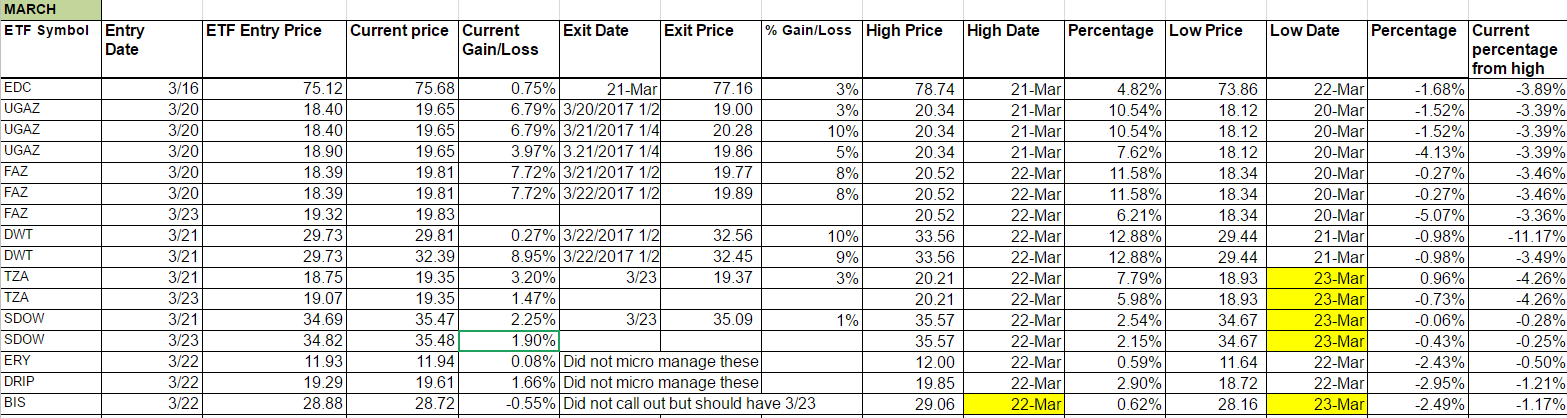

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

The following table includes the re-entry into FAZ, TZA and SDOW. I did update Thursday night’s table.