ETF Trading Research 4/6/2017

Today’s Trades

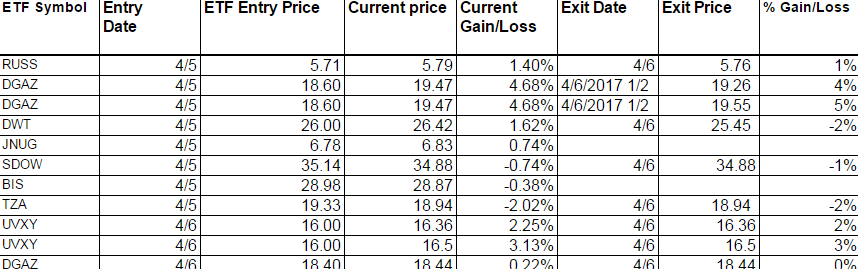

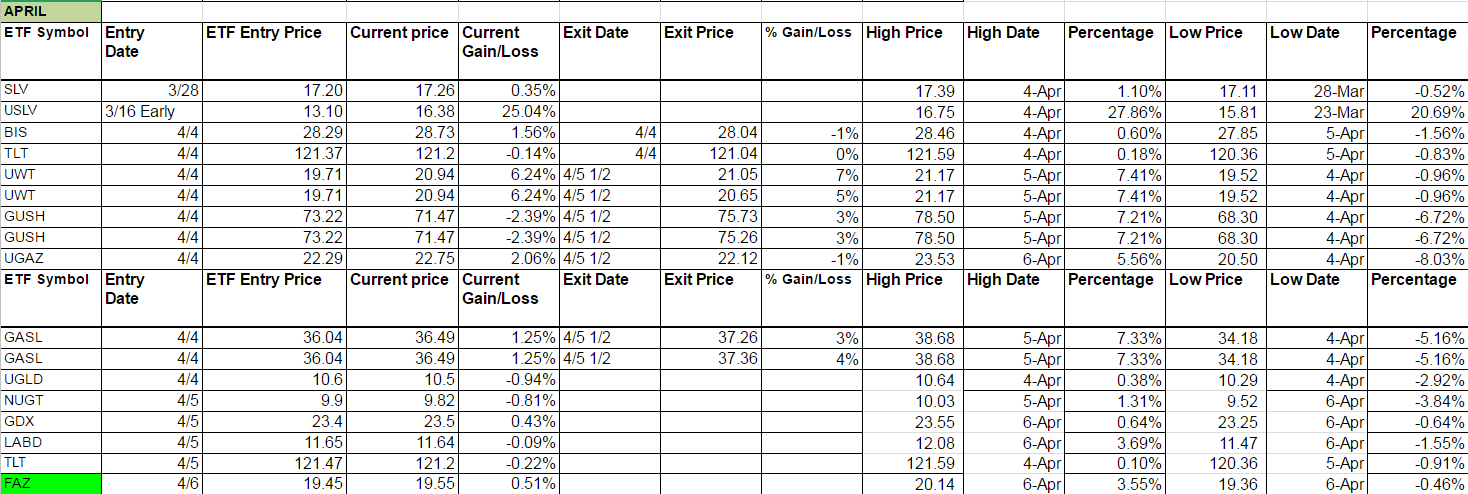

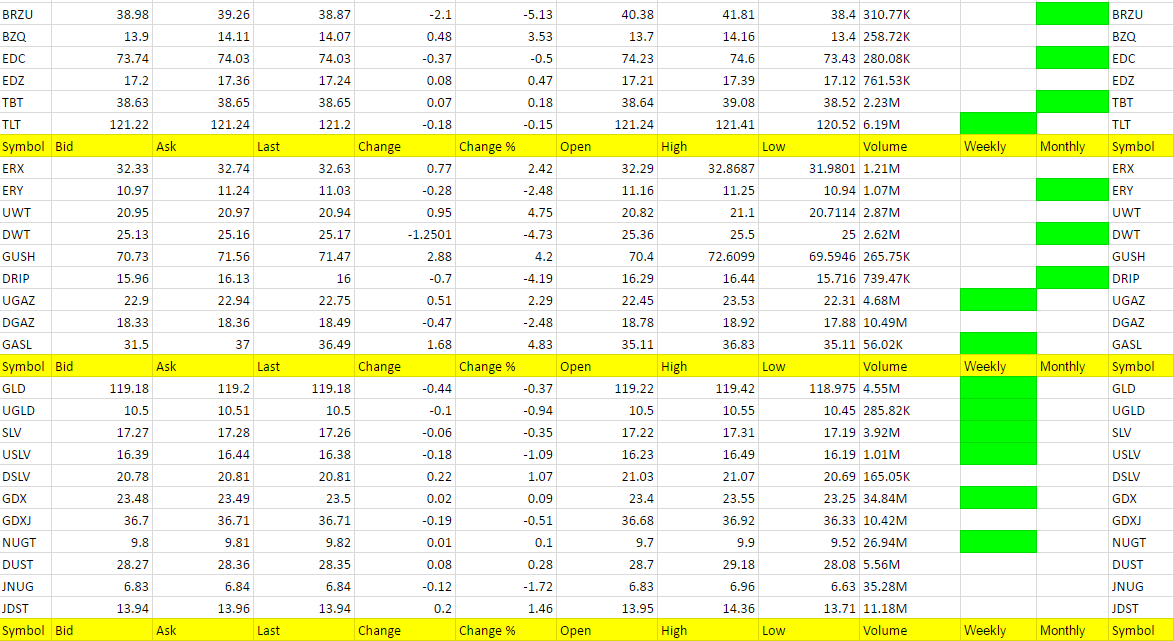

You can see the recap of today’s trades below. I am trying to incorporate all trades, day trades and swing trades into better tracking for us. I want you to all track for yourselves too as you may notice some patterns. For example, one trader wrote me they made money on every trade they made that was listed green on the weekly, but didn’t do as well with ones that were not green. In other words, the day trades they made that were in the direction of the green weekly they profited.

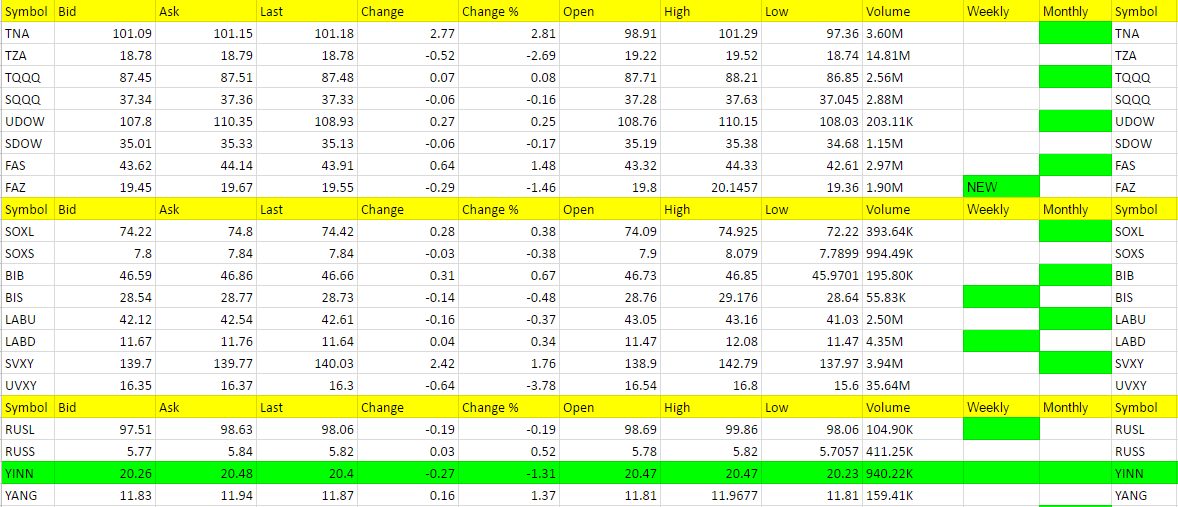

I should have given UWT and GUSH a little more credit today because they were green on the weekly and were up for the day. Just because we already scalped profit from them doesn’t mean we can’t get more. I sure wouldn’t forget about JNUG if we were long, so I shouldn’t be forgetting about others that have turned green on the weekly.

We carried over DGAZ for some nice profit and stopped out of DWT. From there it was a pretty choppy day but UVXY ended up being a good end of day trade. I lightened up the load on short the market ETFs as I don’t know what we have coming out of the Trump meeting with the Chinese President and also what the unemployment data will be tomorrow. Plenty of time to jump on a move after the data.

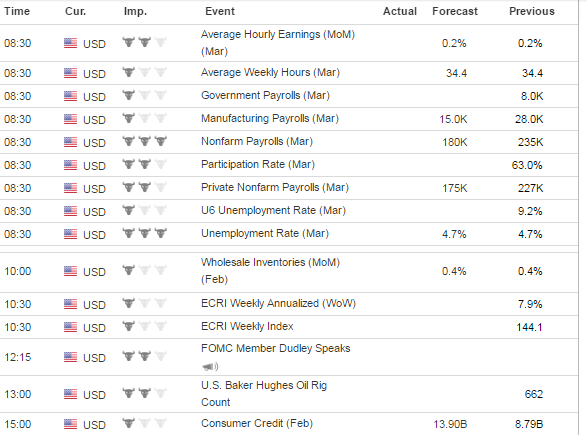

Economic Data For Tomorrow

Tomorrow we have Nonfarm Payrolls which looks to be a low forecast, and one FOMC member speaking along with the US Baker Hughes Oil Rig count.

http://www.investing.com/economic-calendar/

Stock Market

Was an up and down market again today but still wreaks of weakness I think. No healthcare bill passed. No tax reform yet. Sooner or later the market gives up on the hype.

Foreign Markets

Got out of RUSS with a little profit but no calls at present.

Interest Rates

Still in TLT.

Energy

UWT took back over today but we ignored them for the most part. Anytime an ETF that is green on the weekly opens the day positive is worth trading long.

Precious Metals and Mining Stocks

At some point we will have blastoff in JNUG and I since we are not getting the best trades in JNUG or JDST right now, I want to emphasize again that profit can be made from the other 43 ETFs that we follow. Make sure you diversify into these other ETFs and look for profit there too. At least until we get going in JNUG.

The dollar is still the culprit for keeping JNUG and gold from taking off. It needs to trade below 100.32 and then 100 for a bigger move. And gold needs to move over $1,260. Silver still holding steady though.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

UWT, GASL, GUSH, BZQ (FAZ new green on the weekly’s)

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

BRZU, DWT, DRIP, UVXY

Current Trades (Non-Green – Bought/Sold/Hold)

Today’s trades and carry over’s from yesterday.

Green Weekly’s

These are the ETFs that have turned green on the weekly and the dates they turned green. This is used for tracking your percentage gains so you know when to take profit for each ETF per the Trading Rules profit taking guidelines. It is also used for tracking the percentage from high to keep a stop on remaining shares. These green weekly’s work as you can see from the %Gain/Loss tables. You won’t get the exact high with your trade but you will also be out before typically well before they start to fall again. Your best way to profit with the service is stick with the green weekly trend and take profit while using a trailing stop on remaining shares. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities too. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.