ETF Trading Research 7/07/2019

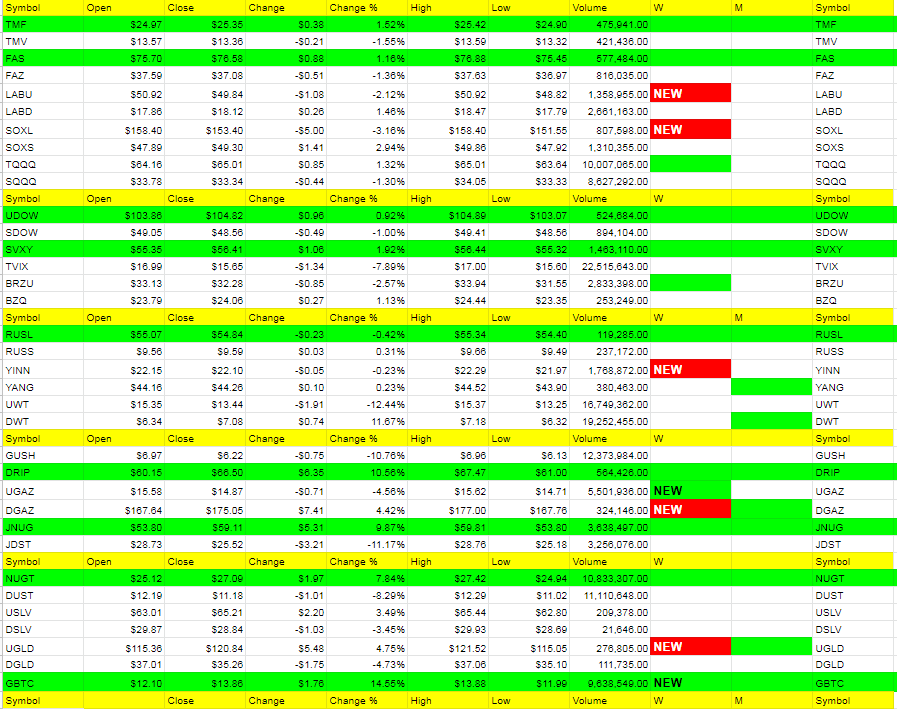

Was basically a flat day on Friday but we did have 3 long the market ETFs go to sells, giving bears some hope. We stayed short but lightened up the risk as this market is just so darn resilient despite the fact the Fed doesn’t need to lower rates. Also, SOMA holdings I posted were reduced more, having the Fed go back on what they said they were going to do. Why shouldn’t they with this nonsense of a bull run? SOXL, LABU and YINN went to sell signals.

Futures basically flat with gold down $4. Oil slightly lower. Like to see us stay under 2994 and definitely under 3003. Can go either way here but prefer a move to 2955 on any breakdown. Nat gas up decently. Love to see metals and miners fall still. Want to buy lower with confidence. If markets do fall, will scoop up shares at some point for a higher high. Bigger picture. LABD started to move up on threat of a Trump executive order on drug pricing. Powell speaking once again to dictate what market will do based on next rate move comments. More volatility expected.