ETF Trading Research 4/7/2019

We’are all waiting for this market to turn, but before it can we need a sign that it will with a sell signal in the chart below. The fact that FAS and BRZU have not gone to full buys gives a chance for the bears and the round number of 2900 to stick and at least offer a pullback to take advantage of. From that pullback we’ll have to see what we can get though as this market has no desire to give up its strength, even with data that says it should from retail to housing to GDP. It is kept alive by the Fed only from what I see and there will be payback for that at some point. Even now we have Trump and Kudlow saying to lower rates and into a so called strong economy. Talk about greed.

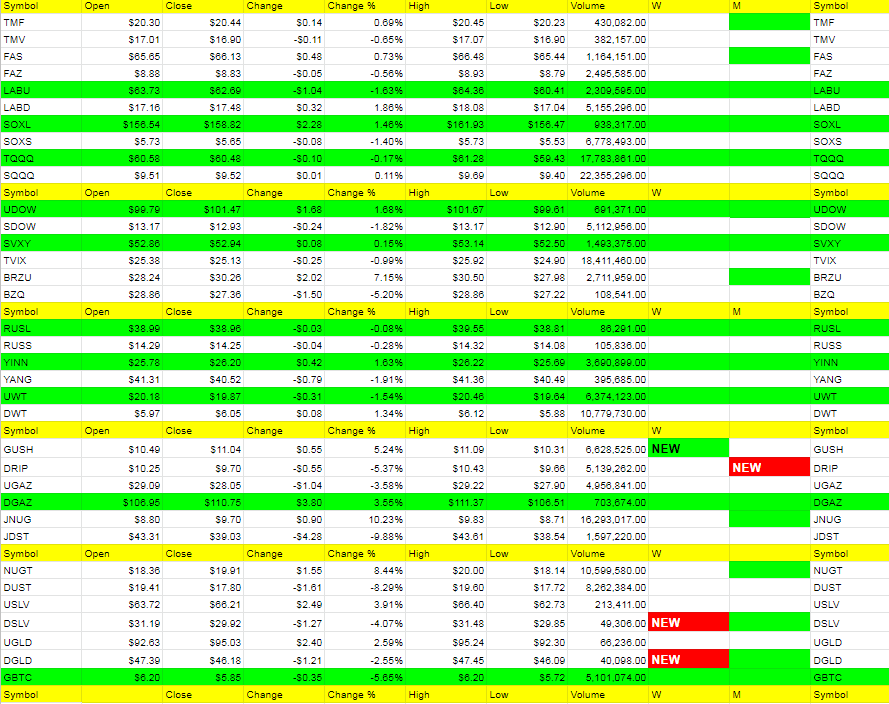

Personally I am somewhat shocked on what I see with this strength but should have followed the data in the table below more than anything.

Metals and miners should fall with the market so hard to be fully bullish. They may pop up initially now though with the sell signals on DSLV and DGLX.

Nat gas is still in the heading lower category but has been beaten down a bit.

Futures are somewhat flat here on Sunday afternoon and I really would like to see 2900 hold.