ETF Trading Research 4/8/2019

For bears, we were able to get out of some ETFs with less damage but a couple hit us, so took some profits in UGAZ and JNUG/NUGT to offset that as we wait for the bigger move down. We are positioned for it once again and my main reasoning is the fact /VX and VX were up today and held steady all day except into the close where they brought us lower. But also because we stayed under 2900 into the close. Now we have to see where we go, over 2900 for some short squeeze minutes or hours or below and the top is in. That’s the risk we take at a round number and willing to take. Prefer a small gap up in morning and retreat, or overnight a bigger move down and selling commences. Still looking down into Easter. And I really don’t think there is enough life left in the Trump tariff news. It’s priced in too. And so is the Fed nonsense. Couple that “news” and the fact data has literally sucked with GDP and we are do for a retreat.

Price action still dictates and we can’t get going lower till oil falls. That’s where Trump comes in too as he has been reltentless on higher oil prices and doing something about it. But if he wants the Fed to stop raising, then he admits economy is weaker and sorry Donald, you can’t have your cake and eat it too.

Either way, a top out is coming but still not a bigger move down to 2200 that will eventually come. A move lower yes, but another pop higher. However, at 2900, we seem to be just moving up to that 3000 market now, don’t we. On fluff for reasoning.

Meanwhile we will look to commodities for some easier trades like with metals, miners and UGAZ today. A lot to be said for diversifying and leaving some cash available for other trades and scalps that come.

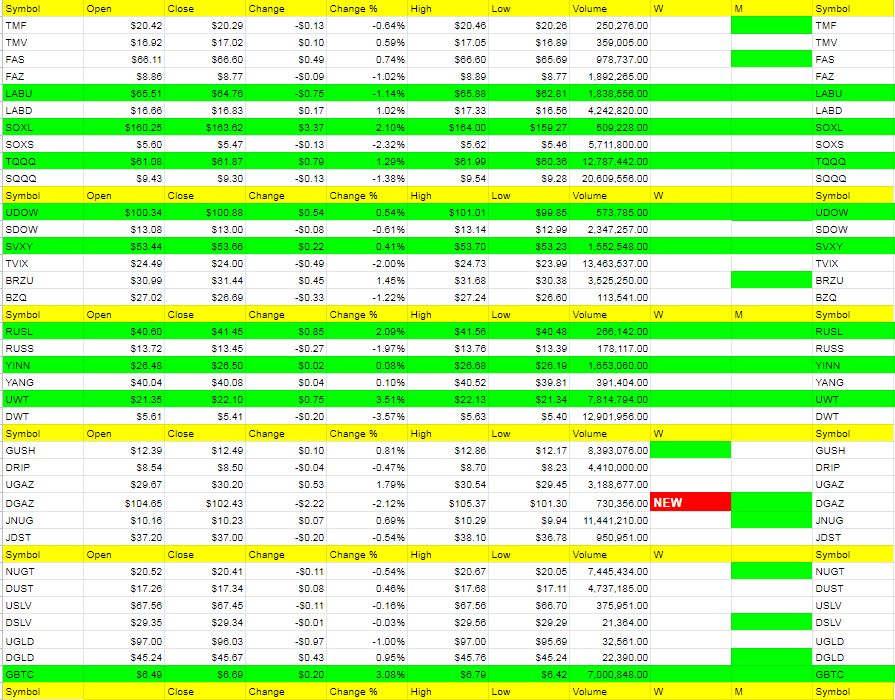

No new signals today except for a DGAZ sell that we caught a little of.