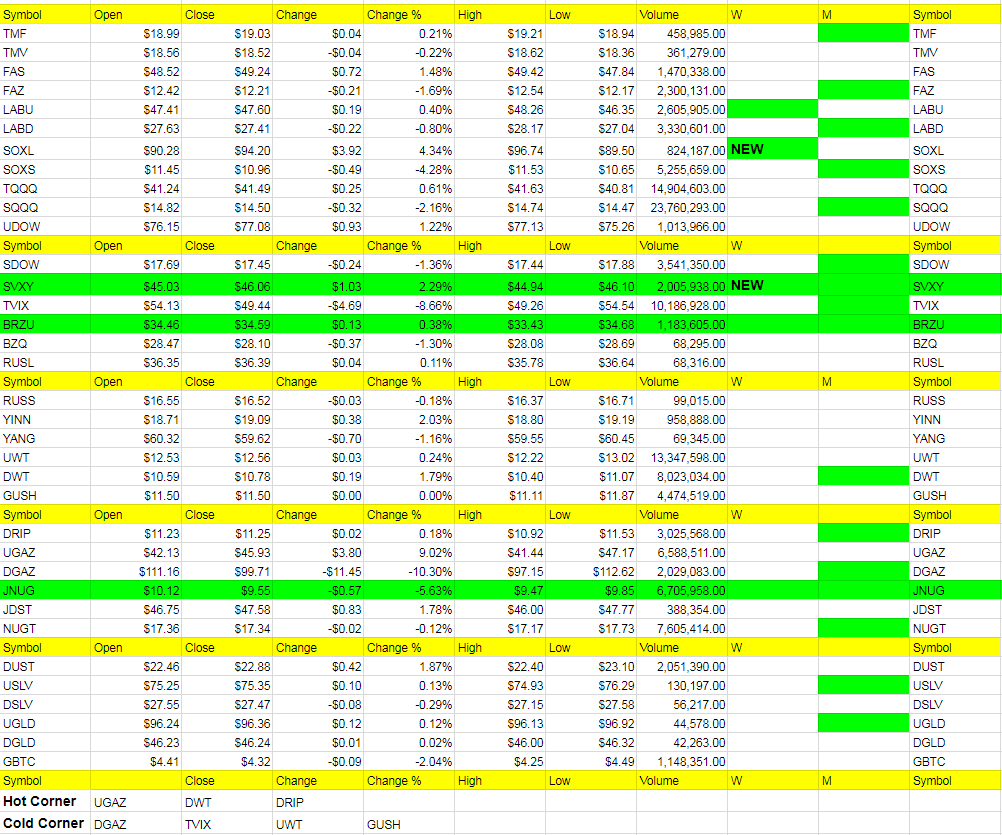

ETF Trading Research 1/13/2019

We had a new bullish signal with SOXL but with the government shutdown lingering, and futures brushing up against resistance, we need to most likely begin looking south versus north. We should find out this afternoon if we head south into Monday and our pick up in TVIX was well timed. TVIX was beaten down extra hard for no real reason with the small moves in the markets. In fact, everything was red overall and the VIX down over -6.7%. Any sign of weakness and TVIX will fly and we’ll be on it. Time to concentrate on it even if we do get a stop out early Monday.

Gold may/should move up to the 1300 to 1315 range before we start looking south. I did however get a late signal on Friday to turn JNUG red on the weekly so that end of day sell off got the job done. Will be neutral on metals now.

Got out of UGAZ a little early. Even though we got 8% plus from it we could have got more with a trailing stop. The closer to 3.30, if we get there, the more we look south. 3.30/3.50 is the topping area for nat gas. The goal then would be 2.50’s and we will concentrate on shorting then, but for now have to look up still. Cold weather reports abound as I posted. Just didn’t stick around along enough but happy with the overall returns last week in UGAZ.

UWT may still be on break for a bit longer as the market retreats, assuming it does. Oil still following the markets. Same with DRIP and GUSH. Trade accordingly.

In cutting down the number of ETFs I have been following, I have more time to look at charts closer. And while I may not get all of every trade, and because we have these dang reversals all the time in the markets now, whipsawing us around, we have to be on our toes at all times and do what the charts tell us to do. I’ll continue to do that with my system while concentrating on one or two ETFs each week that can get us some daily swings like we did with UGAZ last few weeks. We have to be patient for those setups. They always come.

You’ll also notice my stop outs are much tighter and our taking of profit and not asking questions about could we get more. I’ll continue to do this and keep us out of trouble. And I’ll be using the buy of certain ETFs for the next day too at the open if they fit my criteria. I’ll do that Tuesday through Friday trading to start. Never know what you’re going to get on Monday’s so like to approach Monday’s with some caution.

I also have noticed pre-market trading is a little volatile too and for now will cut that down to one new ETF tops until we get some trends going that make sense. Markets have moved up for a long time now without much downside at all and like to see a good move south commence for a bit. We’ll see if the 2599.50 mark from Thursday holds or if we get that last move up to 2620 or not. But either way, 20 points up is a small move compared to the next leg down which I think may break 2500. We will get the most we can of that move from wherever we top out.

The only thing that concerns me is the creeping up of more green weeklies with the addition of SOXL and SVXY. So will keep tight stop on TVIX if it doesn’t cooperate on Monday and possibly flip sides. It’s not necessarily toss a coin at this point but I will say that Congress is not helping the bull case at present and the fight against Trump with Russian collusion allegations just seems to drag on.

EDIT: 6:09PM Eastern Time; Futures are opening lower at 2586.50. We’ll see if we can progressively move lower now or if we move higher into Monday’s open. So far, futures are not liking the Russia news and government shutdown. Meanwhile, cold weather is gripping the nation and nat gas has hit that 3.30 market and moved above. We can now once we get a signal look to DGAZ to trade long here soon enough. 3.50 is the topping area so the closer we get to that we can wait for some signs, assuming we get there. OIl slightly up and gold and silver about flat with the dollar.