ETF Trading Research 1/20 /2019

Most of Friday was trying to figure out where the top would come in after the China rumors of resolving tariff issues. We broke 2652, and that would normally have got me all in on the long side, but just had a feeling, being options expiration day, to not chase the longs with too much capital. We did get short end of day and took a little profit from TVIX, but small in comparison to what I think is coming.

We could have also bought at the open and scalped some profit with the move up, but wanted to see if we had legs and we topped out at 2677 and closed 2671. I am still in that camp and want to use 2700 /ES as the target or top to go short. Most of the times I pick a target higher, we get there and normally I’ll try some trades in the opposite direction (resistance areas) once there. But the moves that originally you think we will reverse from are extended and that’s what we are seeing now. While I did have us short end of day, once again I got us out after hours because of Trumps big announcement that he was going to speak Saturday.

Futures opened up flat on Sunday and then fell with the bad Chinese data. Now on the MLK Holiday, futures have opened even lower by 3 points to 2657.62 and it tells us that we should look for signs to short any moves up minimum.

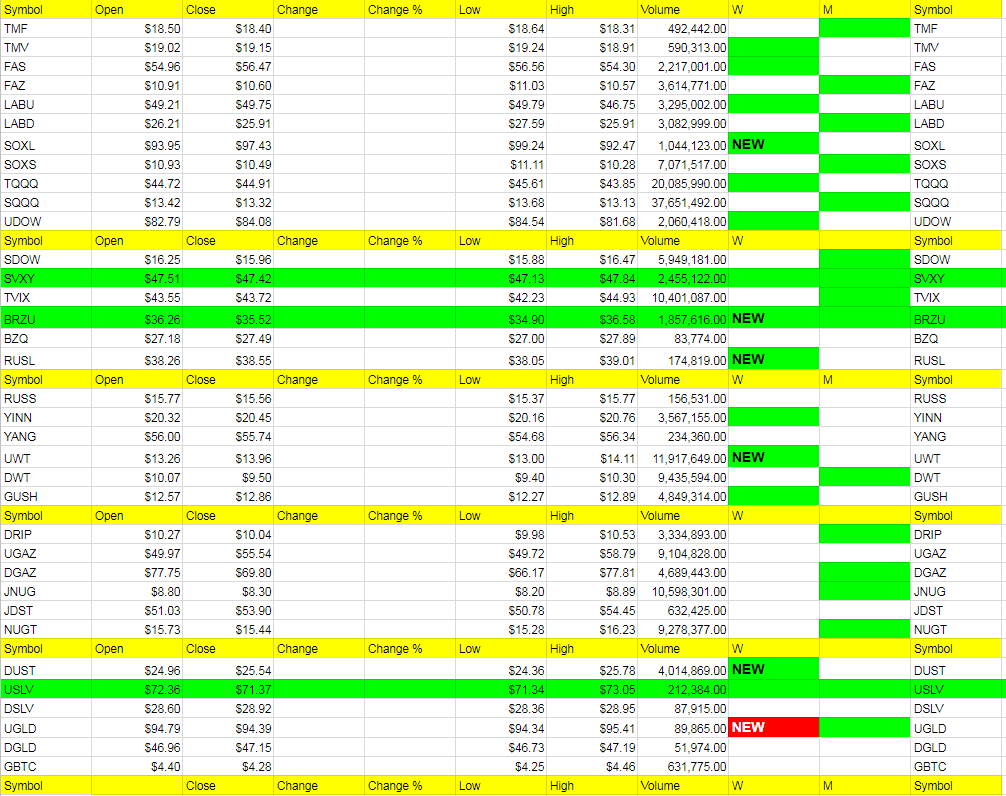

The dollar is flat and we see gold futures down to 1278.55 and silver to 15.27 and we may be in for a bounce soon there with any move up in the dollar. Look for that possibility on Tuesday. I am however neutral right now with DUST turning to a buy, so I have to wait and see and I would trade what is positive at the open with a trailing stop if you want to trade metals. A little bit of a tougher trade right now.

Natural gas took a big hit on Sunday and has since rebounded in today’s session, up 7 cents but still down from Friday a decent amount. Remember all the weather was reporting a big storm to hit the NE but it fizzled out. Have to be neutral here right now too, but the closer to spring we get, the more I think we fall.

Oil down a hair with the markets and I expect DWT and DRIP to be on the watch to trade long on Tuesday as long as we keep moving south in the futures. Should get that move south before a larger move up to 60.

Would love to get one last move up to 2700 to start the week with any resolving of the government shutdown, but Trump’s speech fell on deaf Democratic ears. It’s all about principal now, not about the $5.7 Billion. It’s Trump vs Pelosi and two ego’s that aren’t backing down on their side. This can still go on a long time and has me leaning short more than long, and if we hit 2700 we are going 100% short with a 2500 target although I will micromanage us on the way down. TVIX could be a home run for a bit on any weakness. 2500 first would be great and then we can look to 2800 next. Big picture stuff.