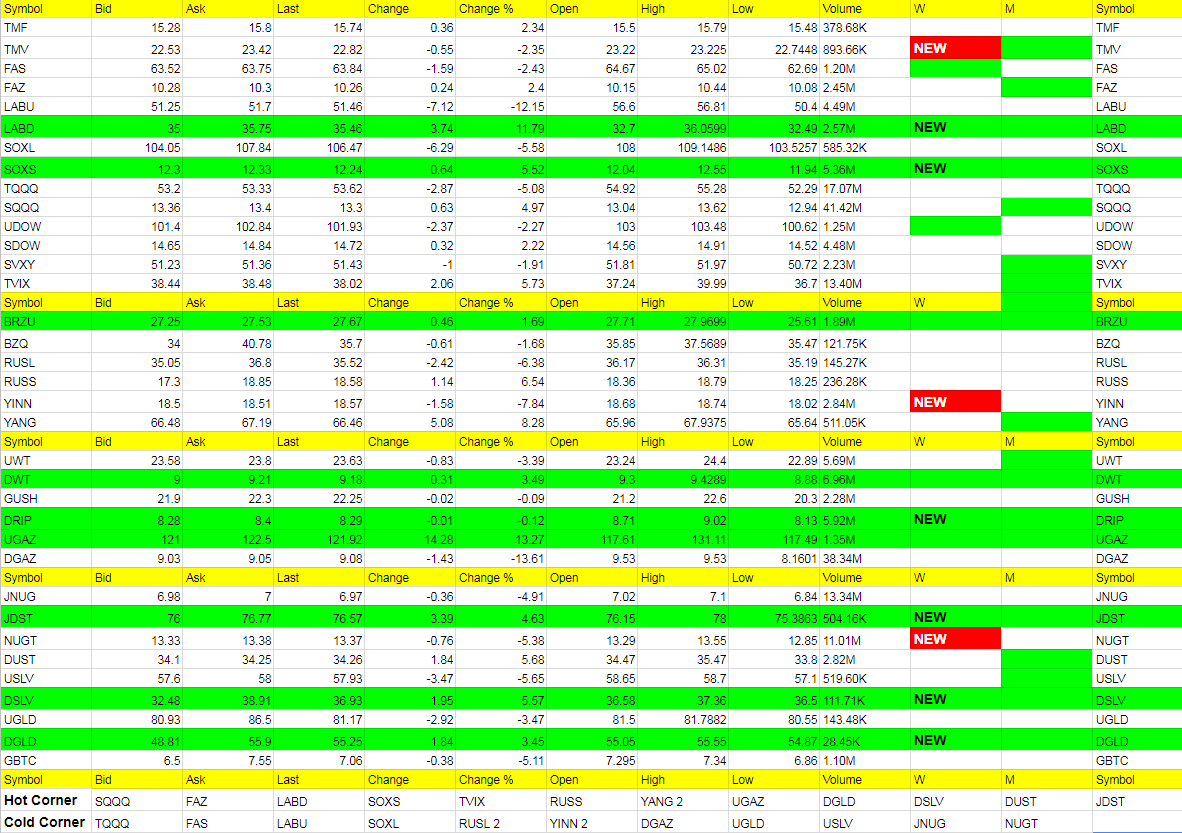

We were leaning short heading into Friday but went conservative Thursday night or we could have got more out of the trades. Did fine with what we had and could have got more there too when TVIX hit that resistance at 40 and we were up 2% on it and up more on the other shorts. We did take profit in LABD early though and locked in the higher profit. /ES futures did bounce and I said one could go long if they wanted but chose to stay flat and sell the DUST and JDST by end of day as they were not attempting to take off. We might see a little reversal in metals and miners so will keep an eye on them.

Economic Data For Tomorrow

No real important data tomorrow.

http://www.investing.com/economic-calendar/

With midterm elections out of the way and the Fed out of the way, we get to see what this market is made of. Will Trump go on the warpath with Chinha and tariff’s? Will he go on the warpath with Democrats? Will he go to war with migrants at the border? What will move the market up at this point? In one sense, the more I trade, the more I have to stop asking these questions and just trade price action. It is thinking one thing that gets a trader in trouble and that cost me a bit last week. I am confident we will be on the right track this week. If we see some swing trades enter the picture, I may take some risk in ETFs that have been beaten down if they show signs of life. These include; UWT, JNUG and DGAZ. But I will not buy unless I get some signals. I spent a lot of time backtracking my system this last week and I do expect good things this week.

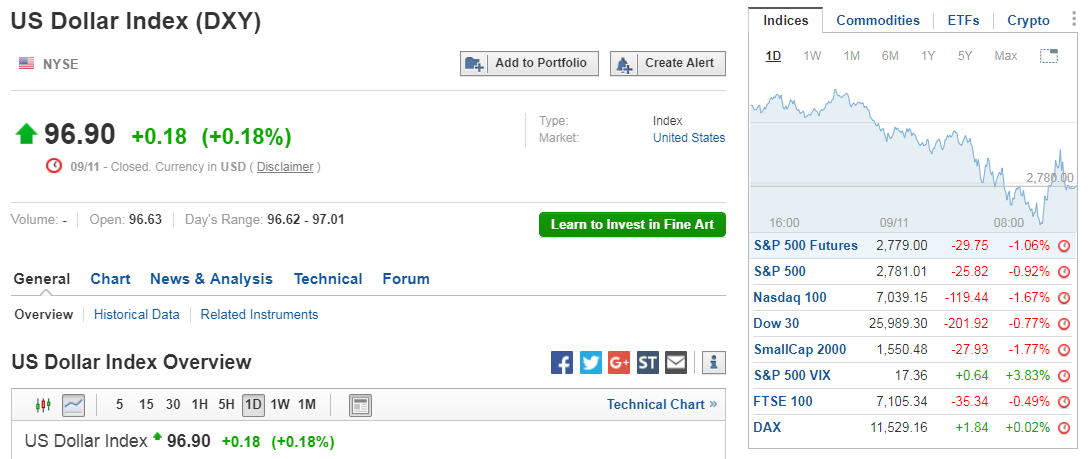

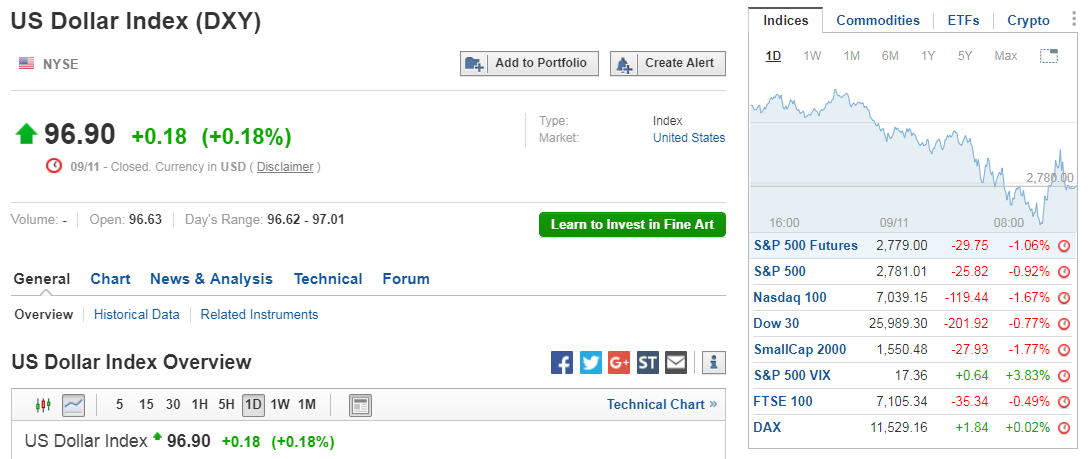

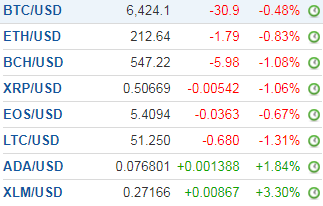

We have to see if the new signals in going short get us more signals, so a slight lean short right now still, depending on how futures react to market opens in Asia and then Europe.

Foreign Markets

These ETFs once again outperformed their U.S. counterparts on the way down. They will most likely on the way up too. They are following U.S. markets at this point and I’ll look for some entries soon. Like I said above, don’t care which way, as there is a trade there somewhere for decent profit. I will warn that holding overnight carries additional risk as sometimes these will move -5% to -8% quickly on a reversal overnight. Most of the time, up or down in the trade, best to go home flat these until we get some momentum in the trend after some extreme moves.

Interest Rates

TMV red on the weekly as Friday everyone went to the safety trade. TMF would continue higher if the markets do want to head south.

DGAZ did move lower but had a nice comeback off the low it hit. We’ll see what Monday brings with the weekend weather and trade accordingly.

OIl may finally get back to a buy if and when the market resumes a trend back higher.

Precious Metals and Mining

While we have more signals that have had us concentrate short metals and miners, notice that DUST never did get us a buy, but overall we did well with it. When we do bounce, I think NUGT will perform better than JNUG.

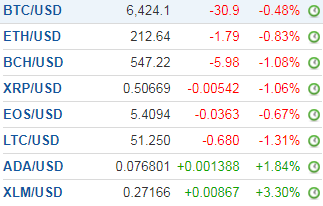

I’m still open to a move down to 1180’s so we’ll have to see if there is any follow through higher in the dollar and lower in metals and miners with all the recent signals. Love the fact JNUG broke 7 for a bit. I do see miners possibly moving up with the market when the time comes that the market wants to start a leg higher.