For those of you new here, I most of the time have the ETF Trading Research report out by 8PM PDT, and it comes by an RSS feed, but you can look at the report here sometimes before you get it in your mailbox; https://illusionsofwealth.com/category/etf-blogs/ This is also the same link if there are any technical difficulties.

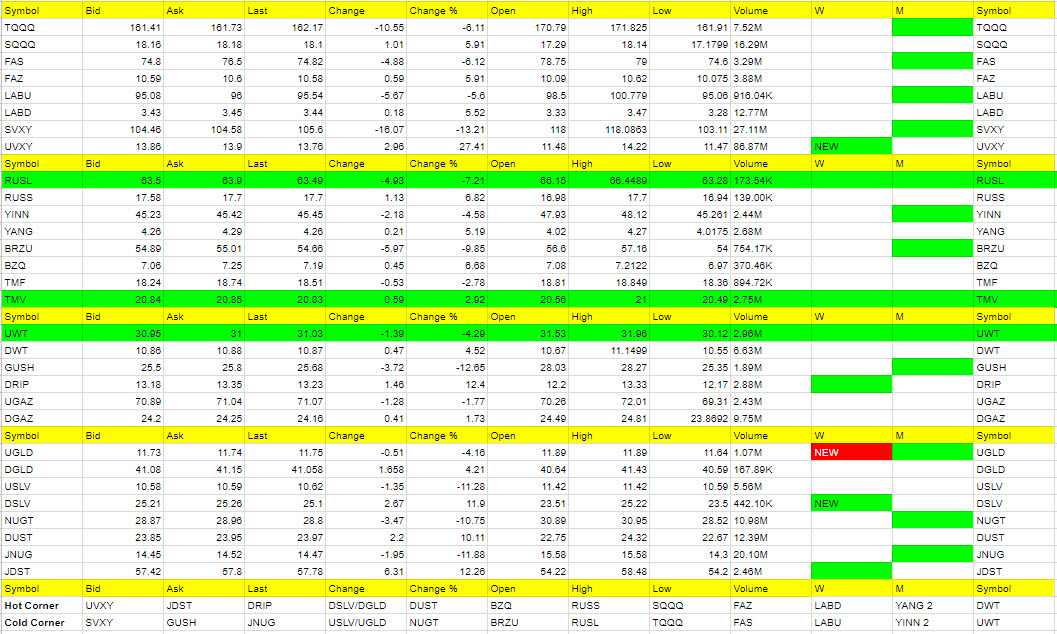

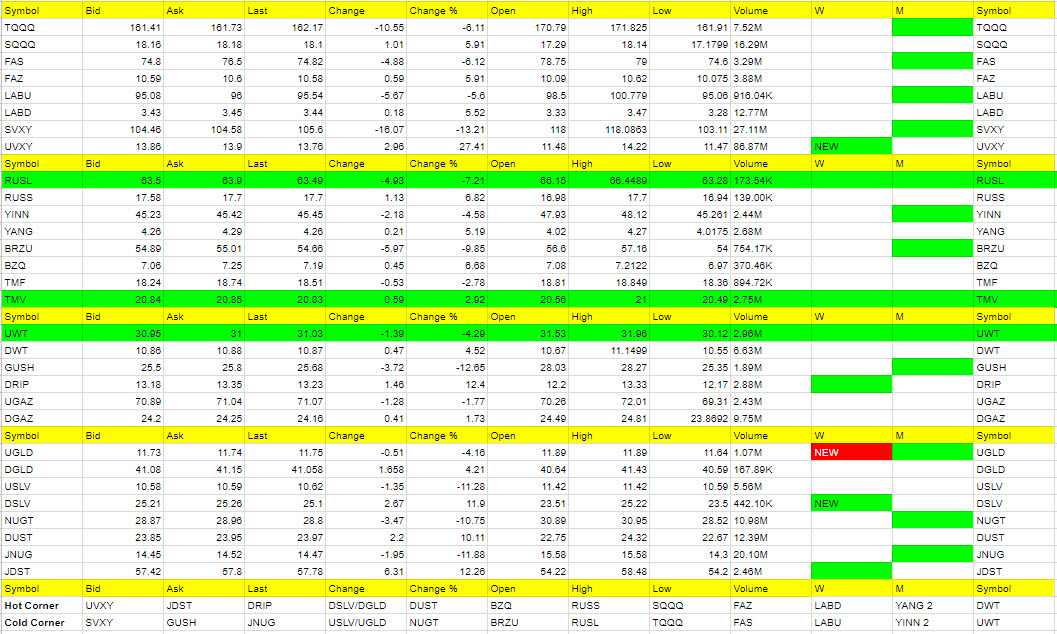

Today’s Trades and Current Positions (highlighted in yellow):

Getting the report out early so you can enjoy the Super Bowl. When trading opens up overseas, we’ll see where we are with the dollar and watch for reversals next week. Very tough time to make trades, so your risk is higher with any calls. Stops should be tighter and if we get runs, they will more than likely be in the green weekly ETFs. The JNUG (half shares @15 entry) and TMF (18.50 entry) trades we are both long and will pull the plug on JNUG if the dollar goes higher and buy lower. If positive, more than likely use a trailing stop if we see dollar do any reversal action. Look for an oil bounce.

Lot more action for a Friday than I expected. Was a mixed day of trading with good results in JDST, flat in oil, down in GUSH and end of day attempt at SVXY (never trade a falling knife unless you are open to the risk). I’m trying to get some more Conservative trades coming and on Monday, trade what is green on the weekly as your best trades. This means buy them at the open if positive or buy them when they go positive. Best advice for Monday’s where I usually start out the day a little slow and wait for the trades to develop. But after Friday’s move, there may be some continuation or a reversal. The dollar is key to everything. I would read the gold section first to understand what I mean. We can literally go either way in almost all the ETFs right now based on what the dollar does, as well as rates (watch the 10 year).

Economic Data For Tomorrow

Important ISM Non-Manufacturing PMI data tomorrow. Everything happening during market hours so we can see if the data even means anything. Friday’s data was all good and the market fell -665.75 points.

http://www.investing.com/economic-calendar/

See the gold analysis below to help you decipher your next stock trades. Was quite the sell-off on Friday and went much further down that I anticipated. It was all about the rates moving higher and that is what the market finally caught up to. We’ll look to SVXY on any potential market bounce. TVIX and UVXY really made their moves on late Thursday and Friday.

A move up in BZQ and YANG, and down in RUSS with the oil reversal. If the U.S. stock market does move up next week, look for a bounce in these as they seem to be trading with U.S. markets. The problem is, most of the time they make their moves overnight.

Interest Rates

I do think we get a reversal in rates soon and thought TMF the best place for it. It’s a little hedge against our half share JNUG trade.

Energy

Despite the Friday turnaround, I am still bullish oil and although we got stopped out of UWT, we got back in it and came out ok with the trade by taking the profit before it fell again. We’ll still look to get long and get the loss in GUSH back as well.

DGAZ got us a flat trade unless you scalped it. I see a small bounce in UGAZ at this point and don’t think it will last and we fall a bit further. Being that sentiment is mid-range, it is more difficult to trade right now. We will look for some lower prices to go long UGAZ, and buy DGAZ anytime it is positive since that is the direction we are heading. Those long UGAZ should hedge with some DGAZ should it go positive. We will bottom out and jump on UGAZ again, more than likely back to the 100+ mark. Been some warm weather around so you may need a cold spell to come short term. Still 2 more months of winter. You can map out some historic data for your trades and do some correlations to today’s pricing of Nat Gas here;

http://americanoilman.homestead.com/GasStorage.htmlPrecious Metals and Mining Stocks

I may be a tad early on the JNUG entry. We’ll find out when the market opens overseas where we stand with the dollar which will dictate everything. I know we are in 1/2 shares and gold and miners were beaten down on Friday, so I thought that spot to also get us a little short term pop too. It tried a few times at that 15 mark but ended the day falling a bit lower with JNUG to the 14.47 range and gold right at that support level of 1335 (although intraday it did go to 1330). The key here is bond yields have moved up and with the passage of Trump’s tax plan and the 1.5 trillion to be spent on infrastructure, and the last 2 data points on average earnings increasing, this has been inflationary and priced into the market. But with this dollar move up on Friday, I have to rethink what all this means after such a beat down in stocks and the quick gold decline. We may have a temporary situation where we are seeing wages rise meeting Fed inflation goals and a move the other way as those expectations diminish, lower yields (good for TMF), resulting in a stronger dollar. However, if rates continue to rise, and the dollar fall more with the stock market falling more, then gold can and will move higher. It’s really a catch 22 right now and can go either way.

We’ll have to let price action dictate our move on Friday, whether to sell on a bounce and try and profit or just sell and take a loss and buy JDST. If the dollar rises, I have to let go of my own expectations and jump ship to the other side which we did profit from on Friday. Friday I really thought the market would reverse and take gold up with it, but it just didn’t. So now have to speculate the “what if’s” and analyze things a bit further, which I did above, but look to the dollar as the key still. The dollar seems to hold all the cards right now. Let’s just be on our toes. I would sell any sign of weakness Monday morning, and if we are higher ni JNUG, keep moving the stop up (.25 trailing stop) and see what the dollar is doing and if we can get more out of it. As much as I want be “all in” right now for the bigger move and not care about the potential of any leg down in gold, it just makes sense for right now to see what the dollar does and possibly hold of a hair longer. Believe me when I say, the next leg up is going to be awesome for us. And remember this 15 level no matter what. If we stop out here, and fall to 12 or 13, I’ll look to go long there or below, depending on the strength of this move in the dollar, if it wants to move.

To wrap up the above; if bond yields continue to fall and the stock market fall, the dollar should decline and gold rise and vice versa. This analysis can help with your other trades too.

Friday Night Price

Wednesday Afternoon Price

Tuesday Afternoon Price

Green Weekly’s

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

Wait for the sign of a positive day to go long anything beaten down, I think the odds swing to your favor.

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again. Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.